Outcome

The inflation report for the September quarter revealed upside inflation risks are materialising. Indeed, inflation could take longer to come down as a result. Headline inflation showed growth of 1.2% in the quarter, much faster than the 0.9% growth rate that the current forecasts from the RBA imply. In a recent speech, Bullock emphasised that the RBA would not tolerate a later return to the target band, which means the higher-than-expected inflation result has implications for the next policy decision on 7 November.

Bullock, the recently appointed Governor of the RBA, also took to the stand today before the Senate Legislative Committee. Bullock said services prices were still higher than the RBA was “comfortable with”.

The inflation report followed a recent update on the jobs market, which revealed a tick down in the national unemployment rate to close to a 50-year low of 3.6% in September. Whilst job vacancies are off their post-covid peaks, they are still elevated and some businesses are still struggling with shortages. It’s hard to find strong evidence that the unemployment rate is set to move above the rate consistent with full employment over the coming six months at least.

The low unemployment rate reflects the resilience of the economy. Households are tightening their belts and consumer spending growth is slowing, leading the weaker activity in the economy. However, strong population growth is injecting a layer of resilience.

These mix of factors and data leaves the November board meeting as a live decision. In fact, we are left in no doubt that the Board will need to discuss a rate hike at the meeting. The discussion will boil down to whether they leave the cash rate unchanged or tap the brakes by 25 basis points to fine tune policy settings and ensure that inflation returns to the band in a timely manner.

The RBA will need to weigh up the slowdown in consumer spending growth against ongoing resilience from businesses and determine how much of the surprise outcome in inflation was due to temporary factors versus permanent drivers. In our opinion, there were more permanent drivers at play. For example, around 75% of prices economy-wide are growing at an annual rate that is faster than the midpoint of the RBA’s inflation target band. This share has come down from the peak, but remains high and progress lower appears to have stalled.

Since the rate-hike cycle began in May of last year, one variable has ranked consistently high on the RBA’s watch list. That variable is inflation expectations, especially over the medium term. The RBA wants to ensure that inflation expectations do not become de-anchored. Higher than expected prints on inflation can contribute to a flare up in inflation expectations. There is some evidence in recent weeks that medium-term inflation expectations have begun to tick up, suggesting the RBA may need to lean in to arrest the trend.

Reflecting the changing balance of risks, we believe the odds have shortened considerably for a rate hike on Melbourne Cup Day. Is this one hike and done? Quite possibly, but the high uncertainty attached to forecasts in the current environment means further tightening in the next six months cannot be fully ruled out. The incoming data remains key.

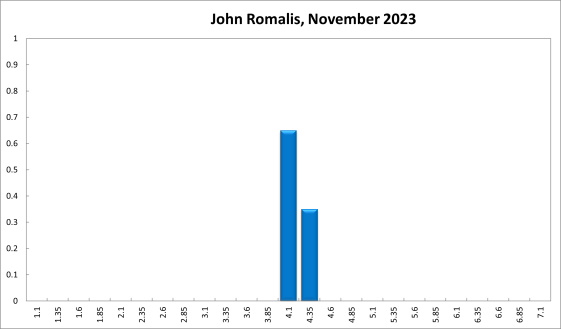

The RBA should increase the cash rate at its next meeting. As I said in August 2023, monetary policy, while less expansionary than before, remains expansionary. This remains true today. With underlying inflation running above 5 per cent, the real cash rate remains negative. Real rates for households and businesses are at historically low levels as well. The labour market continues to be tight. The exchange rate remains weak as expectations of future monetary policy in the United States incorporated the higher-for-longer message of the Federal Reserve. A weak exchange rate add to the ability of foreign inflation to turn into domestic inflation. The RBA should put more weight on the risks associated with doing too little, in particular the risk of inflation taking a long time to return to its target. At the moment, giving current inflation, low productivity growth, a weak exchange rate, very high services inflation and historically low real rates, increasing the cash rate, in my view, is required.

The latest inflation report confirms that we are past the peak and inflation looks like it will gradually return to the RBA’s 2-3% target range. However, there are enough components of inflation that surprised on the upside in the report and the RBA will want to ensure longer-term inflation expectations remain anchored at low levels despite another spike in volatile energy prices that is hopefully less persistent than with the War in Ukraine. Also, more robust global economic conditions and domestic financial conditions both suggest the risk of recession is receding. Thus, the RBA has room to raise rates at the next meeting in response to inflationary pressures while still likely achieving a soft landing.

My recommendation puts a bit more weight on raising than holding steady, but the rise in geopolitical uncertainty means that risks of a global recession have not completely evaporated. Also, domestic demand is likely to continue to weaken given the past increases in interest rates. It is just that an upside surprise in the level of inflation should be met with a response to ensure real interest rates have their effects in cooling inflation and to help bring the level back to the target range. It will be important to monitor global inflation and demand conditions as well going forward as these appear to have an influence on Australia’s inflation. The RBA should not ignore components of inflation that are beyond their immediate control, but should offset them in whatever way necessary to ensure total headline inflation returns to the target range.

With underlying inflation accelerating, despite large fiscal subsidies, the economy appears to be operating beyond its sustainable capacity. The outlook for inflation, under unchanged policy, would be for a prolonged return towards the target. If the RBA signals acquiescence with that, inflation expectations will increase, leading to more unemployment in future. So further tightening is needed.

Updated: 27 July 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Shadow Board Recommends Rate Hike to Contain Inflation

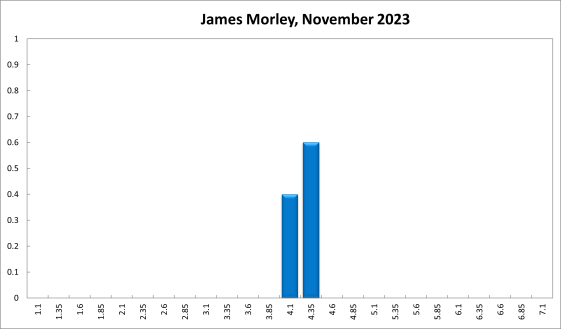

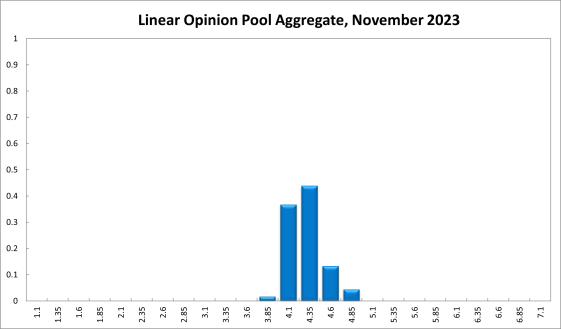

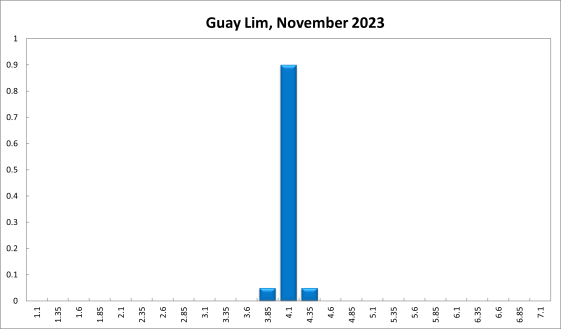

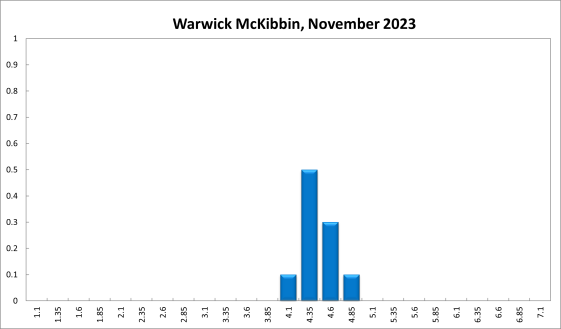

Most recently, the monthly consumer price index (CPI) rose 5.6% in the twelve months to September 2023, while the quarterly inflation rate fell to 5.4% year-on-year in Q3, the lowest since the first quarter of 2022. The RBA’s Trimmed Mean CPI, which excludes the most volatile items, grew by 5.2% year-on-year, still well above the RBA’s target band of 2-3%. The labour market remains remarkably resilient but business confidence is softening further and the global economy, while surprising on the upside, faces considerable challenges, especially geopolitical. On balance, the RBA Shadow Board recommends increasing the cash rate in November. It attaches a 62% probability that the overnight rate should increase to a level above 4.10%, a 37% probability that the overnight rate should remain on hold, and a 2% probability that the overnight rate should be lower.

The official Australian seasonally adjusted unemployment rate, at 3.6% in September, was lower than expected, coinciding with a slight drop in the labour force participation rate, from 67% to 66.7%. Job vacancies fell for the fifth consecutive month; job advertisements, too, contracted, albeit only slightly, by 0.1% month-over-month. Youth unemployment and underemployment have both fallen recently. The labour market is continuing to prove remarkably resilient, despite recent monetary tightening. Of key interest to the RBA will be the latest figures on wage growth, to be released in mid-November. In Q2, the wage price index grew by 3.6% year-on-year, less than the official forecast and well below inflation, but there are signs this number will be higher in Q3.

The Australian dollar traded in a relatively narrow corridor between 63 and 64.5 US¢. Yields on Australian 10-year government bonds continued to rise, finishing this week slightly above 4.7%. The shapes of the yield curves have changed somewhat over the past few weeks. While the yield curve in short-term maturities (2y vs 1yr) remains inverted, the yield curve in medium-term vs short-term maturities (5y vs 2y) is now flat and the one in long-term vs short-term maturities is displaying normal convexity. This rotation of yield curves points to the markets’ expectation that interest rates are unlikely to return to the historic lows any time soon. The Australian share market ended the month of October slightly lower, with the S&P/ASX 200 stock index finding support above 6,800.

Consumer confidence, while still in “pessimistic territory” hit a six-month high, with the Westpac-Melbourne Institute Consumer Sentiment Index rising 2.9% in October, to 82. Retail sales expanded 0.9% month-over-month in September, or 2.0% year-on-year, which is still less than half the long-run average. Business confidence in October took a further hit: the Judo Bank Manufacturing PMI, the Composite PMI and the Services PMI all dropped, from 48.7 to 48.2, from 51.5 to 47.6, and from 51.8 to 47.9, respectively. The capacity utilisation rate dropped from 85.07% to 84.16% in September. The Composite Leading Indicator edged down, to 98.54 points (also in September), the lowest in more than three years. All these numbers are suggestive of a business sector that is gradually softening.

The world economy has been outperforming most forecasts. Rather than slipping into recession in 2023, as widely predicted, the US economy, for example, grew by an annualised rate of 4.9%. China’s economy has weakened on the back of a bursting property bubble, and some European economies, foremost Germany, are flagging but the outlook for emerging market and developing economies is significantly more positive. In its October World Economic Outlook, the International Monetary Fund stated that the baseline forecast for global growth is 3.0% in 2023 and 2.9% in 2024, still below the 2000-19 average of 3.8%. Global inflation is projected to decline steadily, from 8.7% in 2022 to 6.9% in 2023 and 5.8% in 2024. Whilst the global economy appears to be avoiding a major downturn and the threat from inflation is limited, the Fund highlights the risk of “growing regional divergences” and “little margin for policy error”. Clearly, the Middle East conflict, in addition to the Ukraine-Russia war and Chinese-US tensions, are making the global economy more vulnerable and thus the outlook more uncertain.

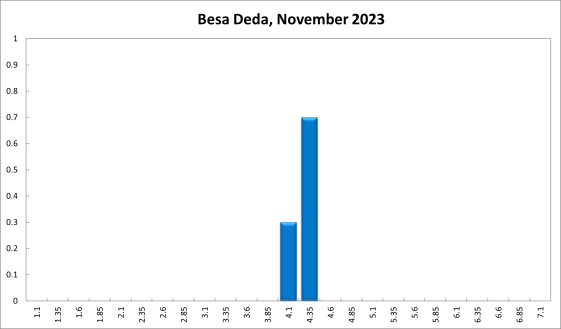

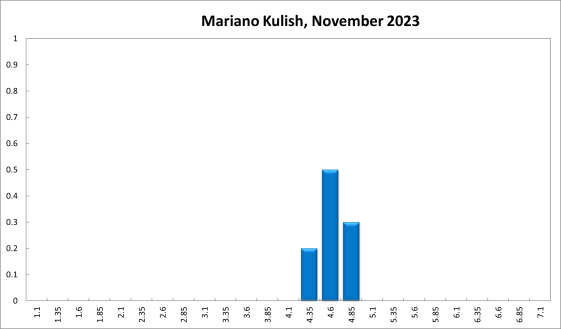

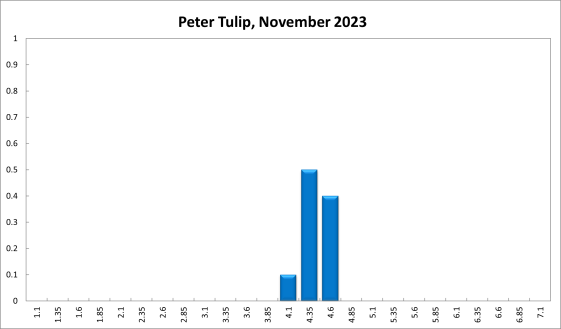

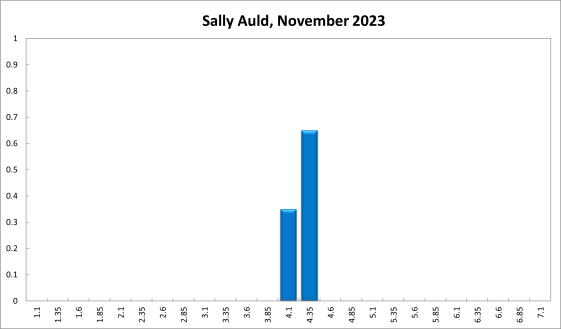

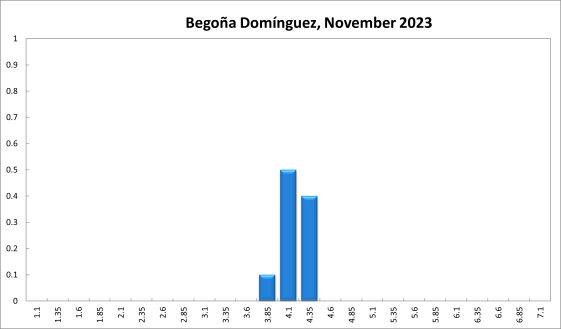

The Shadow Board’s assessment of monetary policy clearly shifted in favour of an interest rate increase. The Board attaches a 62% probability that this is the appropriate policy, while only attaching a 37% probability to keeping the overnight rate on hold and a mere 2% to a rate reduction.

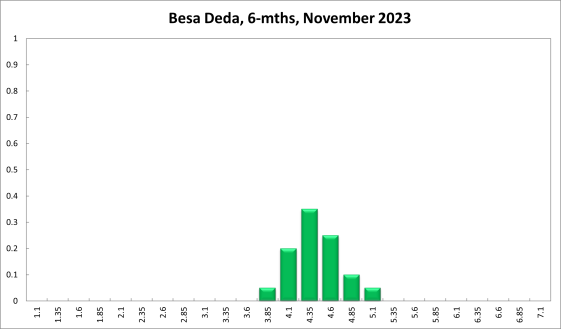

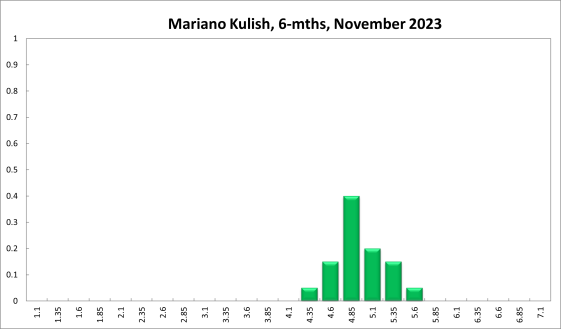

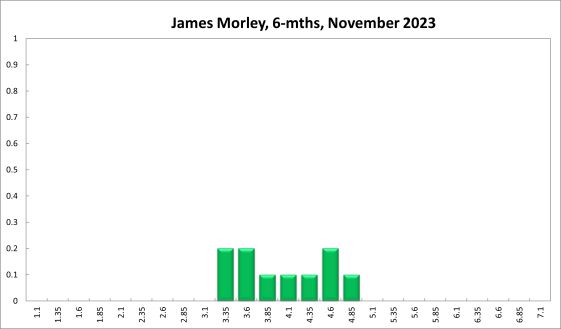

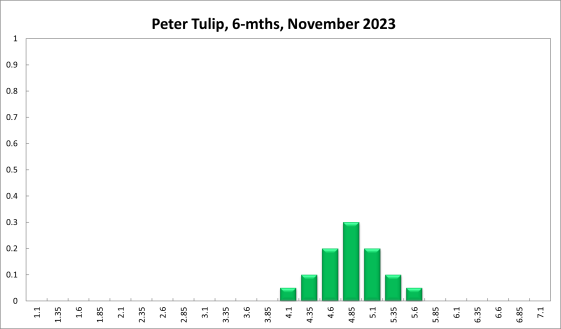

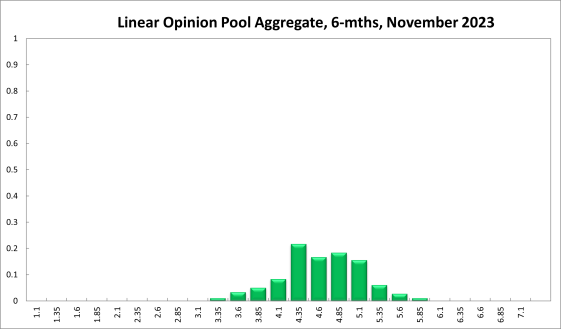

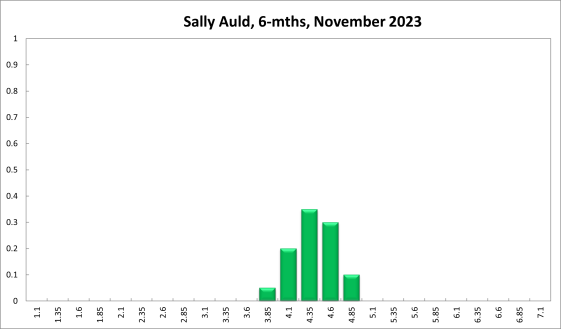

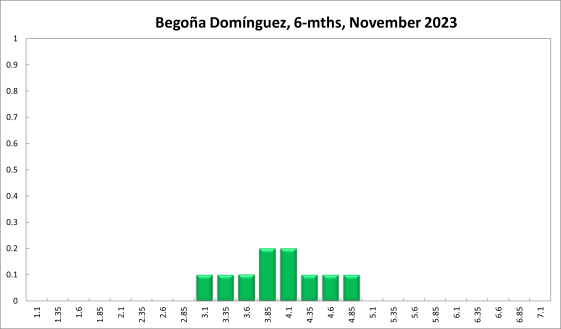

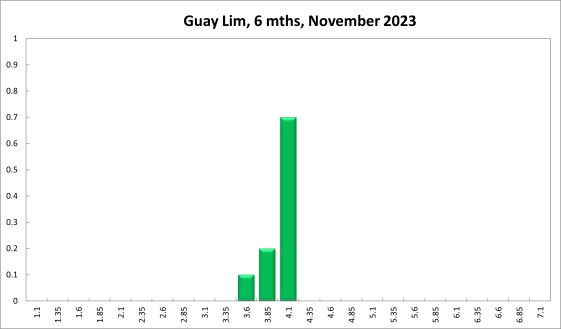

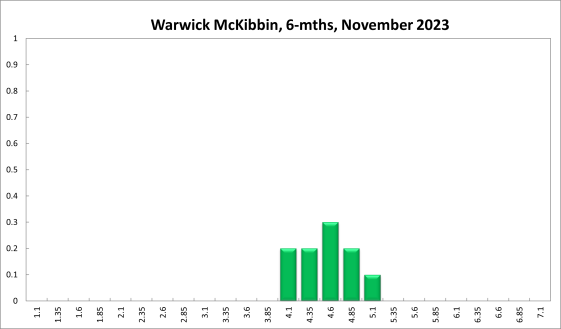

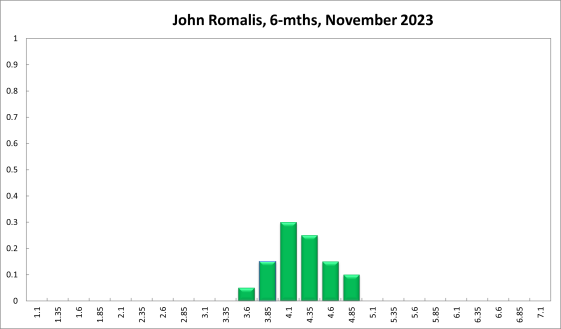

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 4.10% equals 22%; the probability attached to the appropriateness of an interest rate decrease equals 18%, while the probability attached to a required increase equals 61%. The mode recommendation at this horizon is 4.35%.

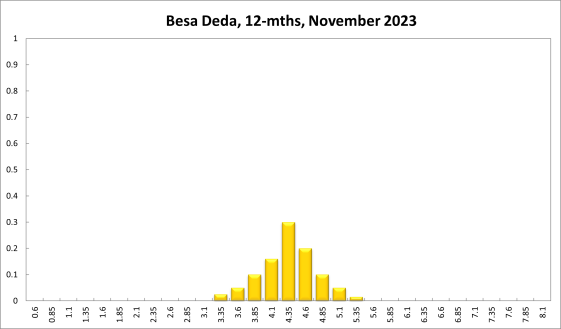

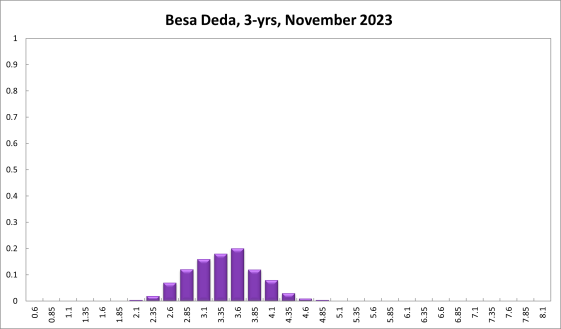

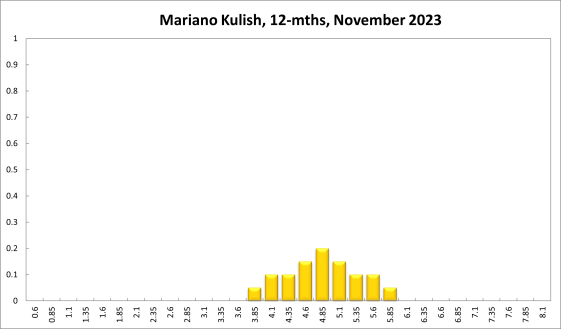

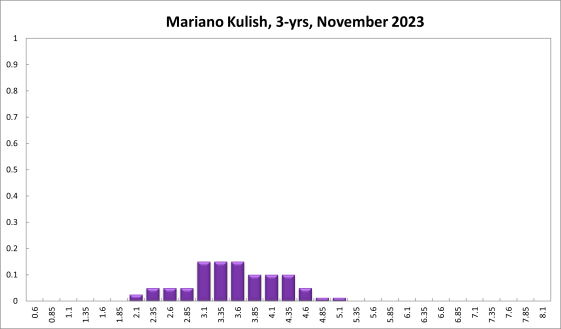

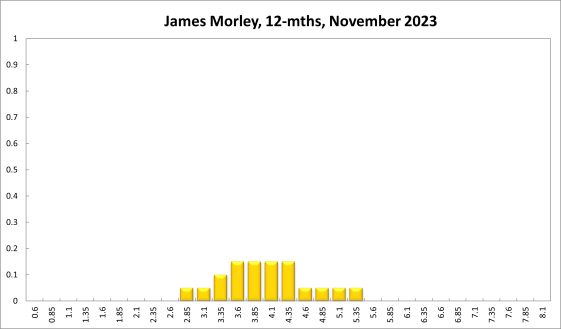

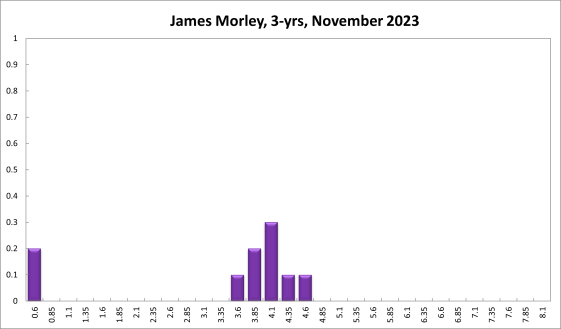

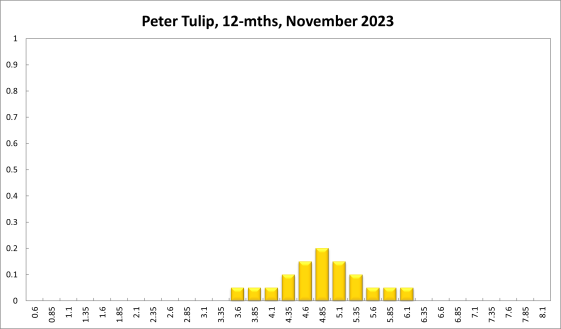

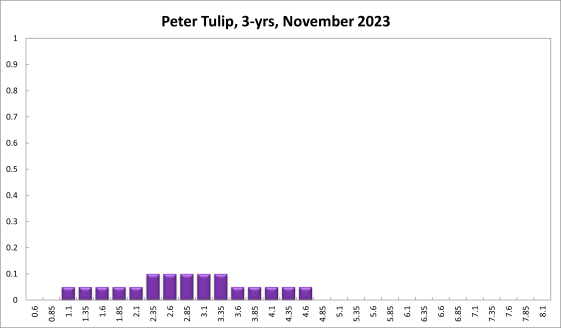

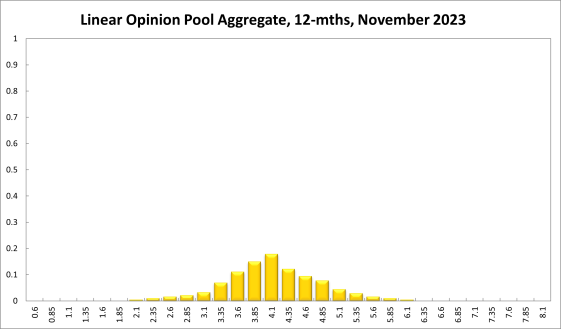

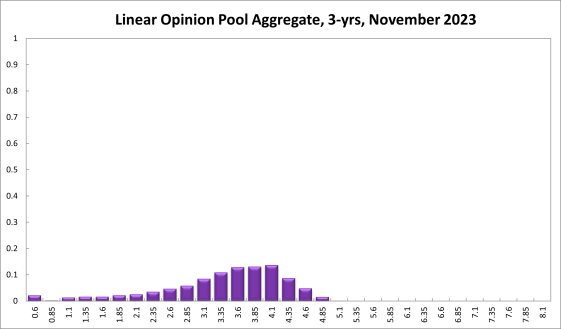

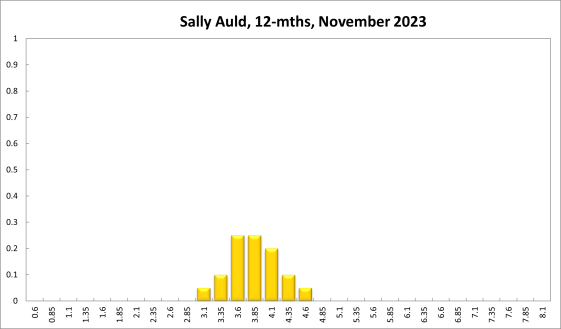

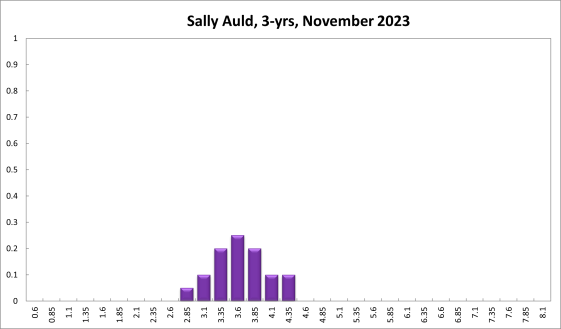

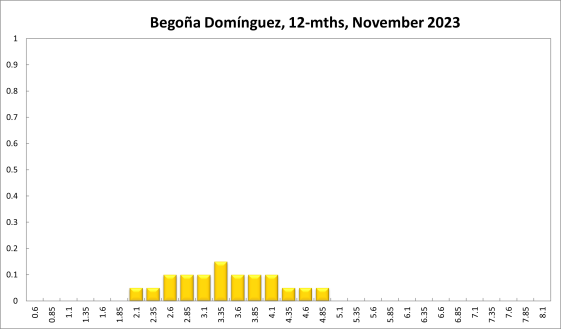

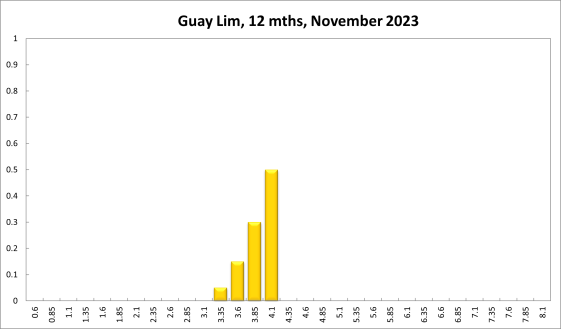

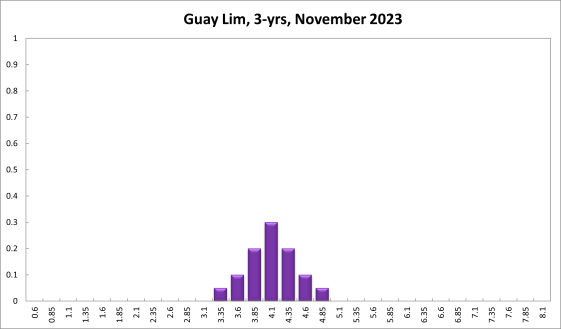

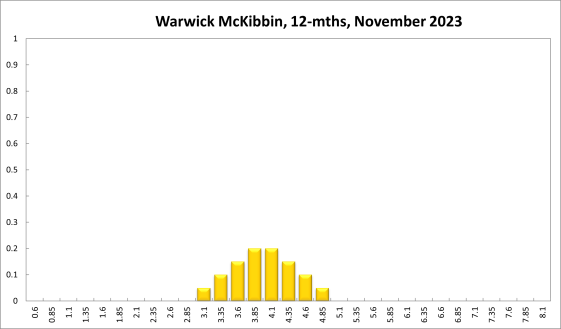

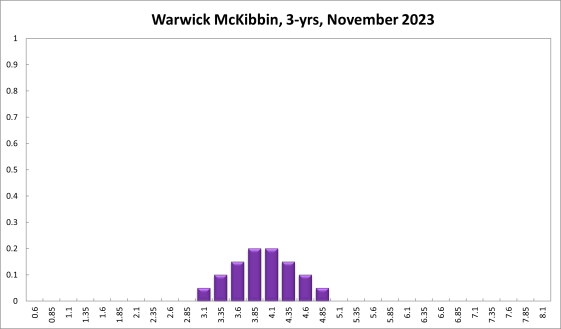

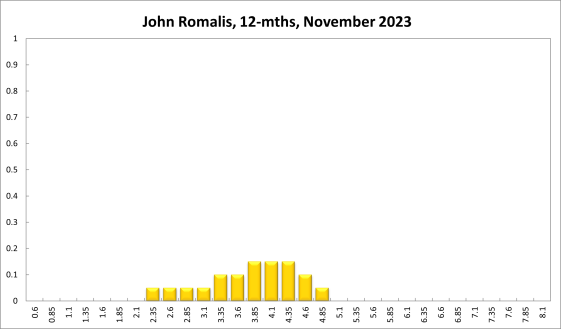

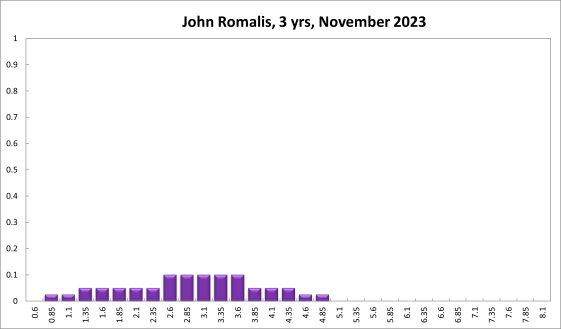

One year out, the Shadow Board members’ confidence that the appropriate cash rate should remain at the current level of 4.10%, equals 18%. The confidence in a required cash rate decrease, to below 4.10% equals 42%, and its confidence in a required cash rate increase, to above 4.10%, is 40%. Three years out, the Shadow Board attaches a 14% probability that the overnight rate should equal 4.10%, a 71% probability that a lower overnight rate is optimal and a 15% probability that a rate higher than 4.10% is optimal.

The range of the probability distribution for the current recommendation remains relatively narrow, extending from 3.85% to 4.85%. For the 6-month horizon the range, extending from 3.35% to 5.85%, simply shifted up 25 bps. The range for the 12-month horizon, at 2.10%-6.10%, widened by 25bps, whereas the range of the 3-year horizon remained unchanged at 0.60%-4.85%.