Outcome

Today (29 Sept 2022) Australian Bureau of Statistics (A.B.S.) released the monthly CPI indicator for Australia. This is a very welcome innovation from the A.B.S. that will facilitate the work of the Reserve Bank of Australia (R.B.A.) as well as many academics, public and private sector economists, and policymakers. Dr David Gruen AO said that “The monthly CPI indicator saw annual inflation of 6.8 per cent in August compared to 7.0 per cent in July and 6.8 per cent in June”. Dr Gruen also indicates that the slight fall from July to August was mainly due to a decrease in fuel prices. These numbers clearly show that annual CPI is well above target. However, inflation has slowed down in August. In my opinion, at this point, this is just one observation rather than an established trend. Global factors and in particular the war in Ukraine could lead to further increases in energy prices over the coming months and even years (due to the need for transition to greener energy).

Dr Gruen also states that inflation of food and non-alcoholic beverages increased to 9.3 %, with very large increases particularly in the fruit and vegetables category. This is very concerning as these are essential products that will particularly affect families in modest income brackets.

In the last few days A.B.S. has also released additional data that shows that retail trade remains strong (rose 19.2% from August 2021 to August 2022), but job vacancies have started to decrease (2.1 % from May to August 2022) particularly in the private sector (3.1 % fall in the same period). So the economy remains strong but there are signs that it could start cooling down.

The R.B.A. has the difficult task of bringing down this inflation to its target while maintaining full employment. With inflation at 6.8 % and the cash rate target at 2.35%, I believe the R.B.A. should continue with its monetary policy tightening, respond strongly, and increase the cash rate in this monthly meeting. However, over the following coming months, it should start considering a more gradual approach to minimise the risk of recession (i.e. to engineer a soft-landing). That will involve paying close attention to the distribution and trends of inflation and expectations of inflation (to ensure these are well anchored) as well as to indicators of the real economic activity.

Australia’s economy continues to look more resilient to the current headwinds facing the global economy, with household spending and construction activity holding up better than in other developed economies. But there are now clear signs that the economy is running into capacity constraints, with employment total hours worked holding broadly steady since May (after a sustained period of strong growth post-Delta lockdown).

With demand still running stronger than supply, further domestic inflationary pressures are likely to be generated through wages and price setting behaviour, and it is appropriate that the RBA board continue to raise the cash rate to contain these. But given the extent of monetary tightening that has already been implemented, now is the time for the Board to slow the pace and assess the impact of what has already been put in place. Furthermore, the deterioration in the global environment will weigh on external demand.

A potential complication through the next twelve months will be developments in global currency markets, particularly the AUD:USD bilateral rate. While the AUD has outperformed most developed economy currencies this year (against the USD), import contracts are typically priced in USD, and a further sharp depreciation of the AUD would lead to further upward pressure on prices via imported inflation. But elevated prices for key commodities (particularly coal and natural gas) will provide support for the AUD, and a further normalisation of supply chains and shipping costs will also help to cool import prices. Overall then, inflation in Australia is still likely to peak at around 7.5%, well below other developed economies.

The RBA finds itself in a difficult position given domestic and international circumstances are contradictory. Over the coming months, major economies will likely be in recession (Europe probably already is in recession). A significant global economic slowdown implies that the RBA will likely not have to continue quite so aggressively with the current tightening cycle as slow global growth due to tight monetary policy and the energy crisis coincide with falling global inflation. Given current information, interest rates in Australia need to rise above a neutral nominal rate of 3.5% to bring inflation back to target. However, inflation is likely already falling due to adjustments in the global economy. Thus there is considerable uncertainty about the appropriate policy rate over the next year, but it is probably significantly higher than at the end of September.

The consensus outlook is for underlying inflation to remain above the RBA’s target range and unemployment to remain below the NAIRU throughout the forecast horizon. Policy tightening is being offset by foreign developments, so the exchange rate is not appreciating as desired. A higher path of interest rates than currently anticipated would move both inflation and unemployment closer to their targets, so is unambiguously preferable.

Updated: 27 July 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Another 50 bps Rise Called For

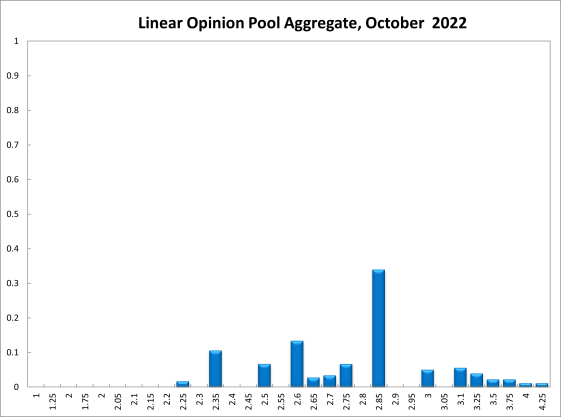

Domestically, many economic indicators remain quite strong: the labour market is tight, the capacity utilisation rate is high, business confidence is mostly sanguine. But there are clear headwinds on the horizon, as recent interest rate rises start restraining spending and global risks reduce external demand. With the most recent print of the inflation rate (6.1% in Q2 of 2022 for headline CPI and 4.9% for core inflation) well above the RBA’s target band of 2-3%, the broad consensus calls for further monetary tightening. The RBA Shadow Board strongly advocates in favour of further interest rate increases. It is 88% confident that the overnight rate should be raised to above the current setting of 2.35%, with a mode recommendation of a 50 bps increase, whilst only attaching an 11% probability that keeping the overnight rate on hold this round is the appropriate policy.

Australia’s seasonally adjusted unemployment rate ticked up, from 3.4% in July 2022, to 3.5% in August. Total employment increased by 33,500, and the labour participation rate, increased also, to 66.6%. Total monthly hours worked in all jobs rose by 14 million, or 0.8%. The underemployment rate fell to 5.9%, and job vacancies and job advertisements remain strong. Overall, the Australian labour market continues to perform. There has been no new data on wage price growth.

Throughout September, the Australian dollar continued to weaken, trading below 65 US¢, a new two-year low. This is the result of the US Federal Reserve increasing the interbank rate more aggressively than the RBA and other central banks. Yields on Australian 10-year government bonds continued to rise, pausing just below 4% at the end of September. Yield curves retain their normal convexity. The spread between 10-year versus 2-year bonds narrowed a little, to 44 bps. Australian stock prices rebounded briefly at the beginning of the month, only to fall sharply, testing the low made in June. The S&P/ASX 200 stock index looks to have found some support around the 6,500 mark.

Consumer confidence arrested its nine-month decline: the Melbourne Institute and Westpac Bank Consumer Sentiment Index recovered slightly, from 81.2 to 84.4. Private sector credit remained steady, whereas August retail sales softened. Business confidence remains positive; NAB’s index of business confidence improved from 8 to 10, as did the services PMI (from 51.7 to 53.3, August); the S&P Global Australia Composite PMI improved slightly (from 50.2 to 50.8, September). The capacity utilisation rate remains just shy of its all-time high of 86.68%. On the downside, the six-month annualised growth rate of the Westpac-Melbourne Institute Leading Economic Index, which is interpreted as the likely pace of economic activity relative to the trend in six to nine months, fell to -0.36% in August. This is the first time since the big lockdown in 2021 that the number is negative.

Risks to the global economy remain elevated and are unlikely to go away any time soon. Inflation is uncomfortably high everywhere, leading most central banks, led by the Federal Reserve, to tighten monetary policy sharply. Widespread downturns are likely, with a recession in Europe seen as a near certainty, especially as demand for natural gas going into winter increases. The Ukraine war is likely to cause further disruptions, as are other geopolitical tensions, gumming up supply chains and raising risk premia. International capital, which Australian financial markets rely on, will become more expensive as a consequence.

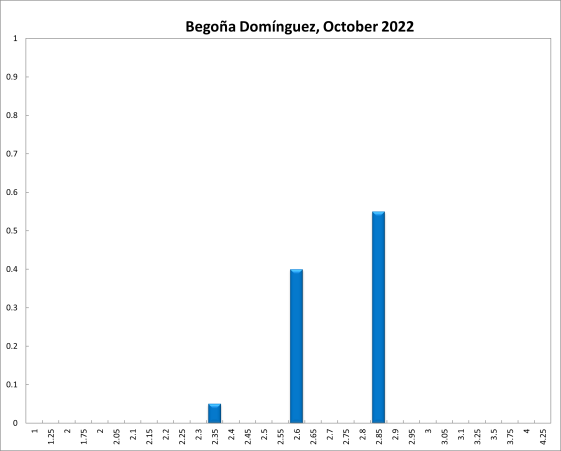

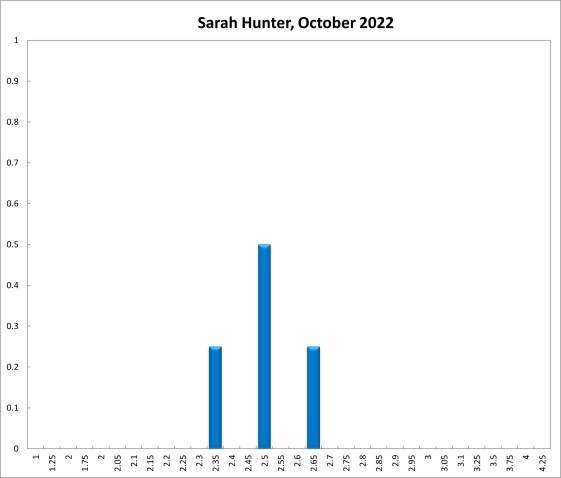

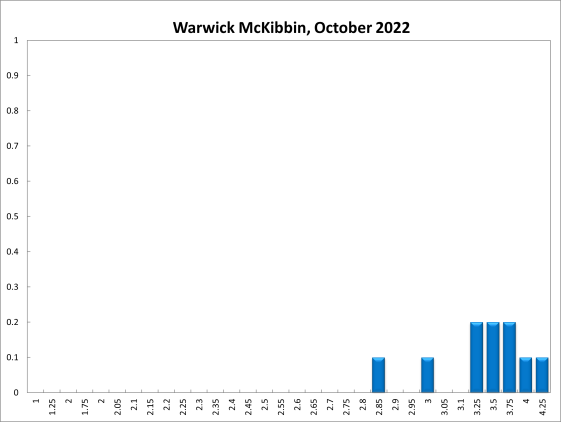

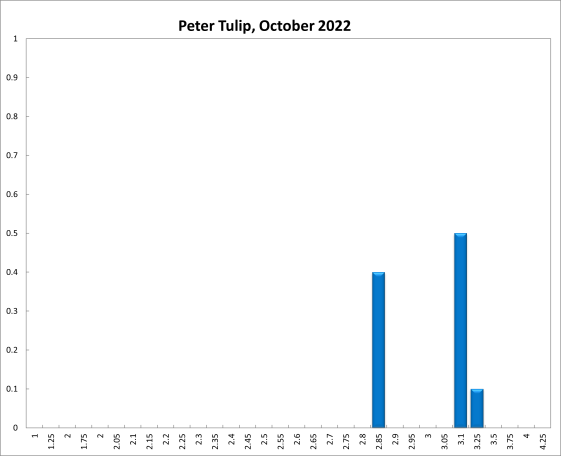

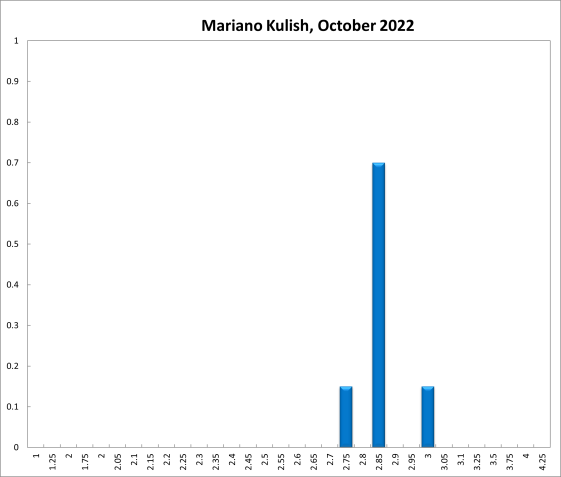

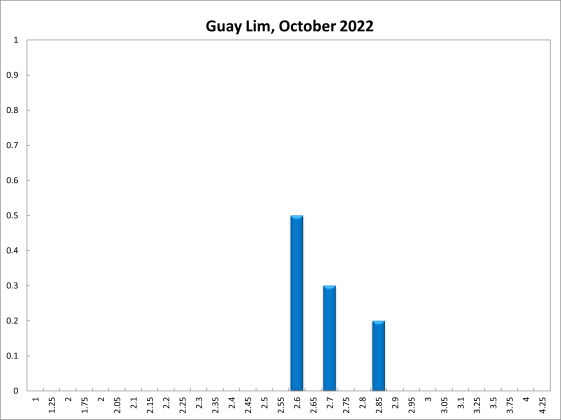

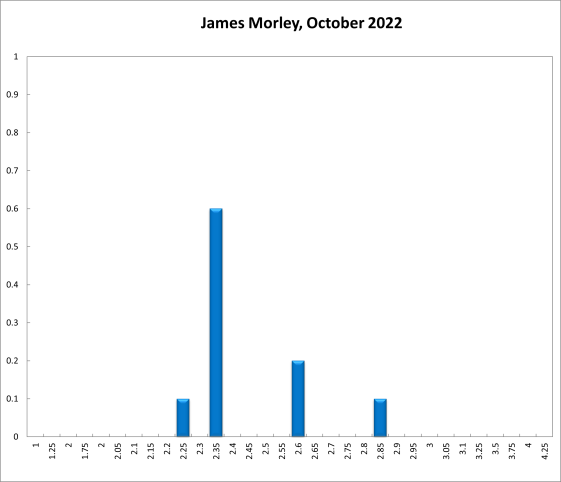

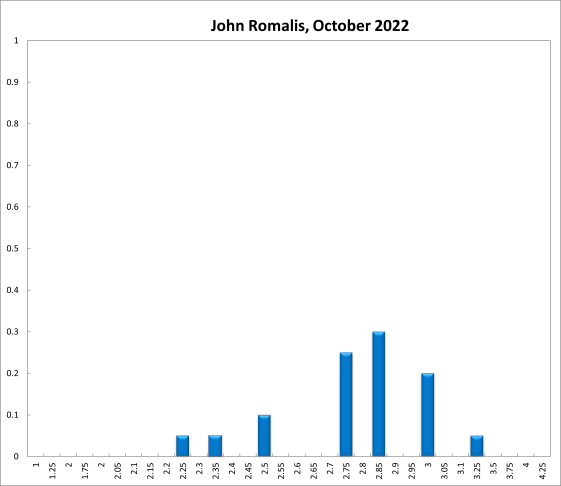

Five months ago, the Reserve Bank of Australia embarked on a tightening cycle after the official cash rate target stood at the historically low level of 0.1% for one-and-a-half years. For the current (October) round, the Shadow Board is advocating that the overnight interest rate be raised further, above the current level of 2.35%, attaching an 88% probability that this is the appropriate policy stance. It attaches an 11% probability that keeping the overnight rate on hold is the appropriate policy and a mere 2% probability that a decrease is appropriate.

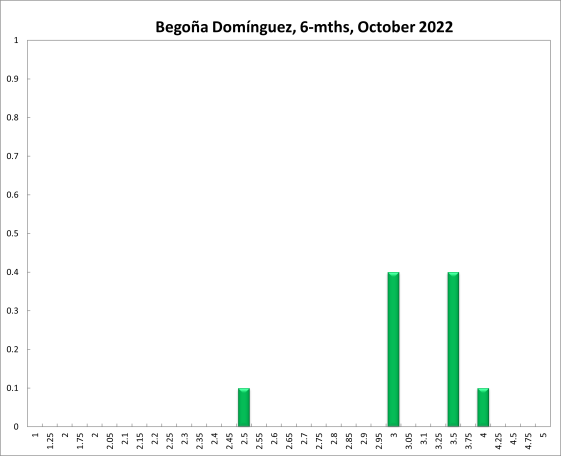

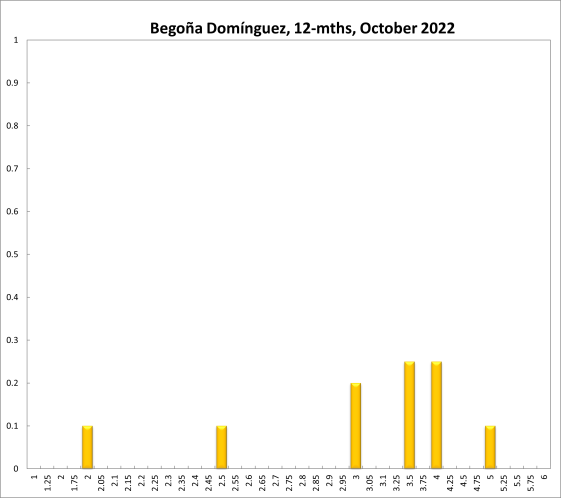

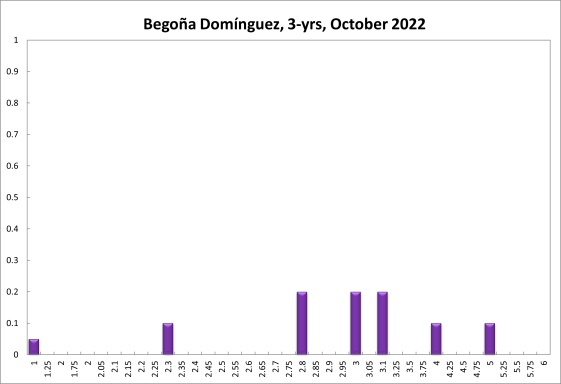

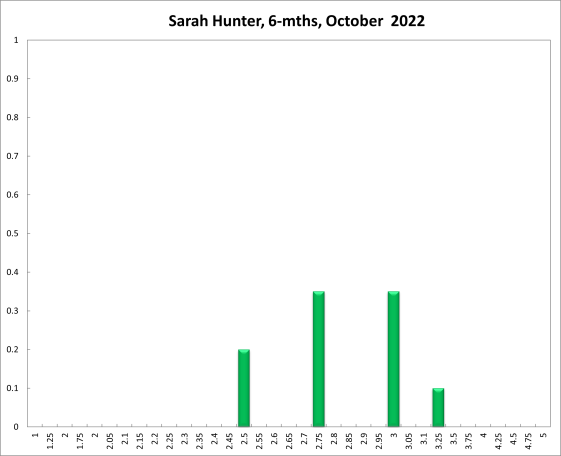

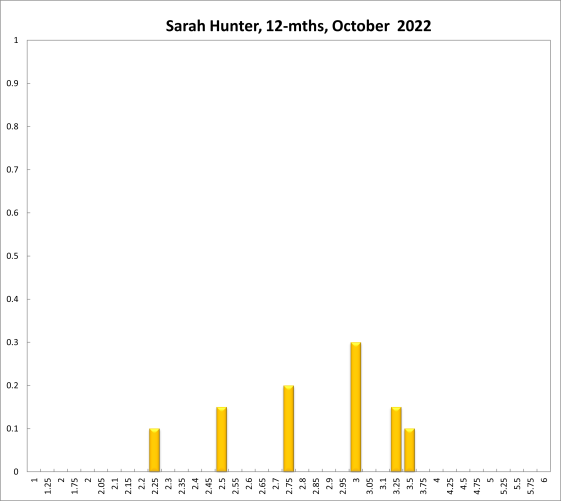

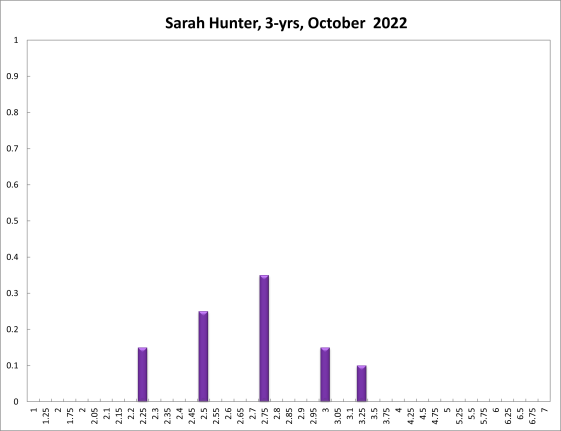

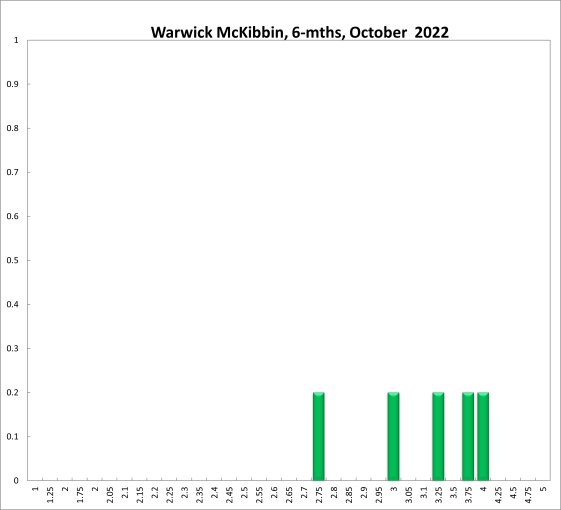

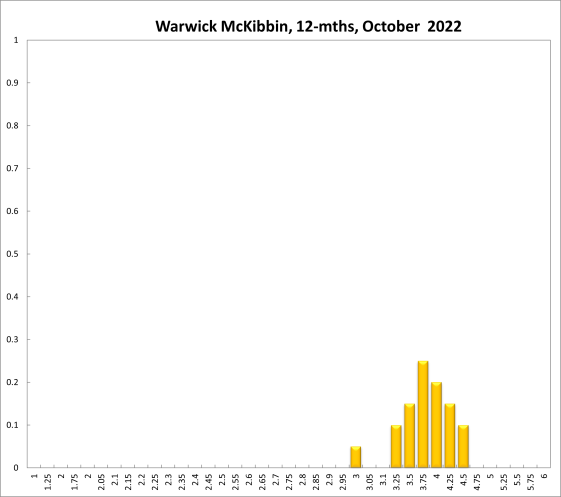

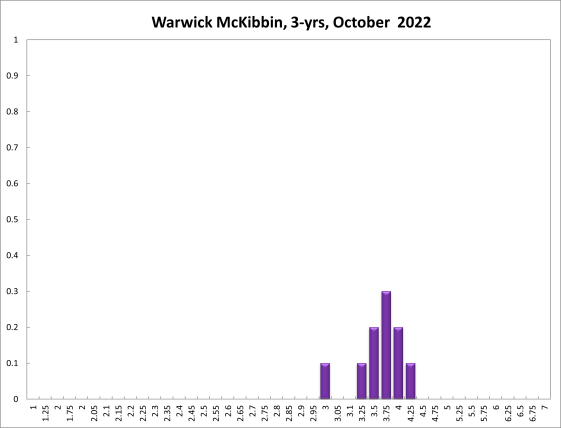

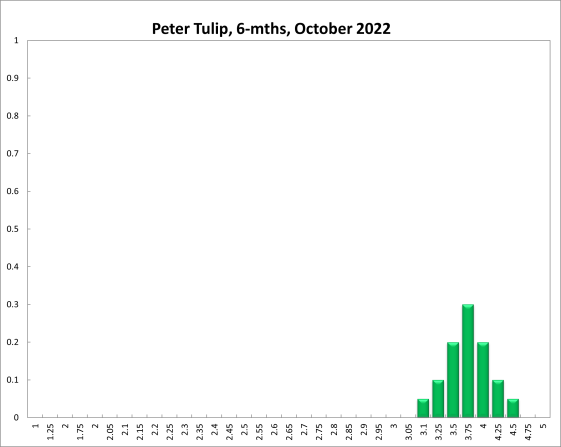

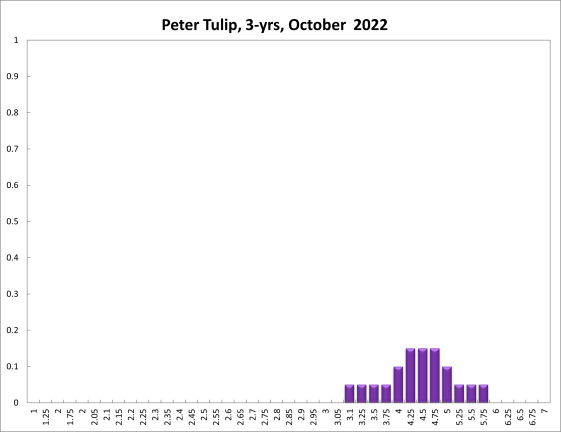

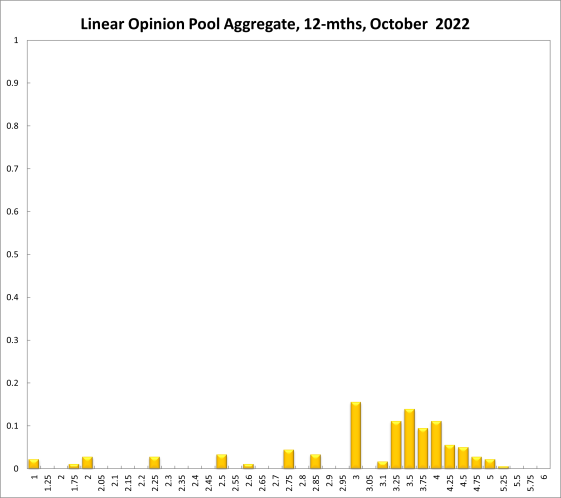

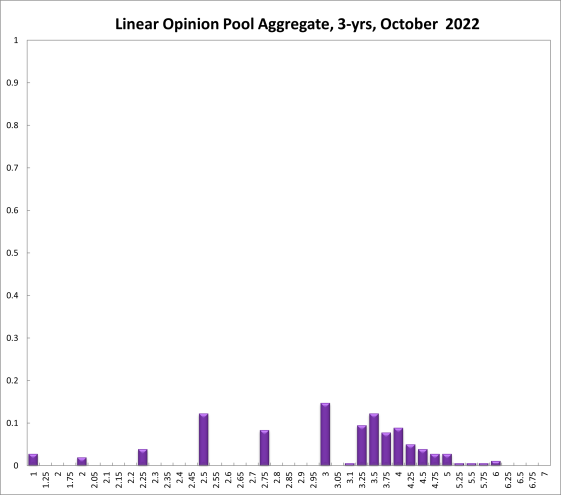

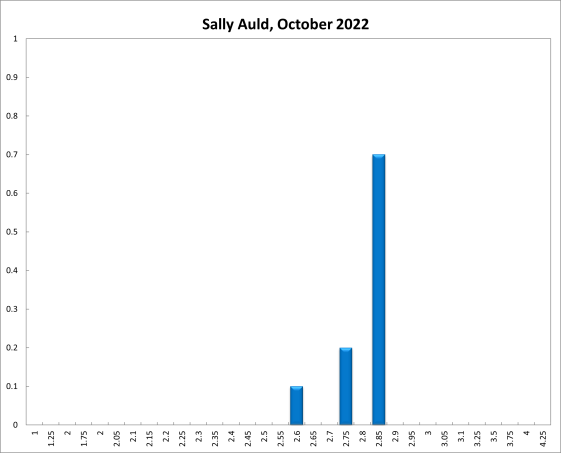

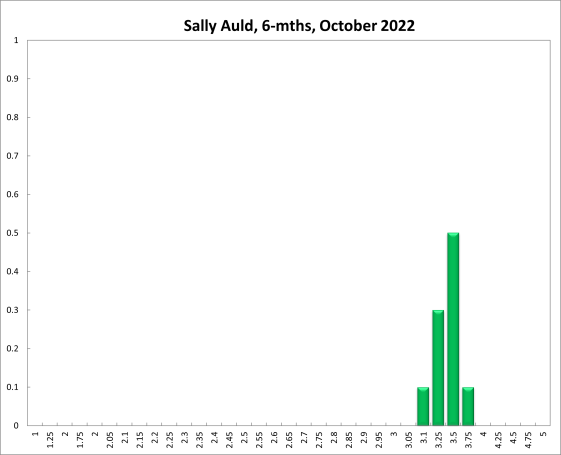

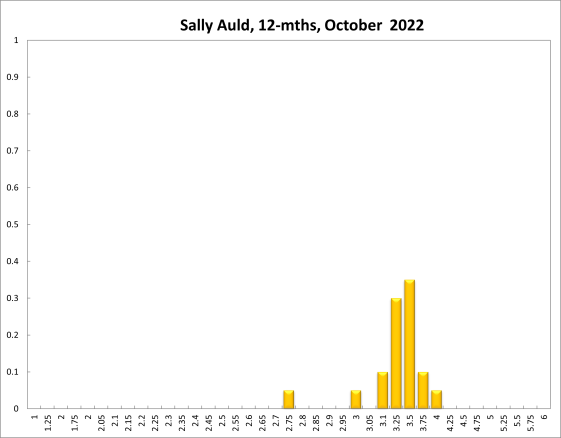

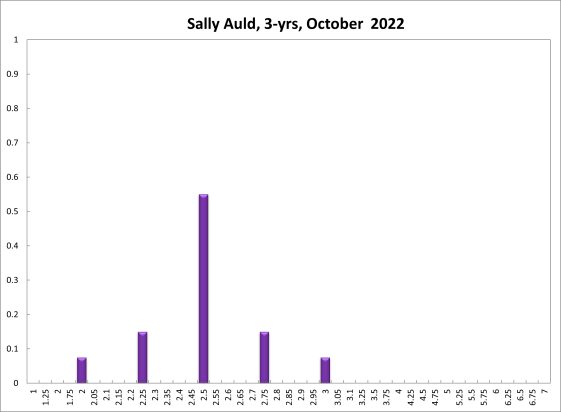

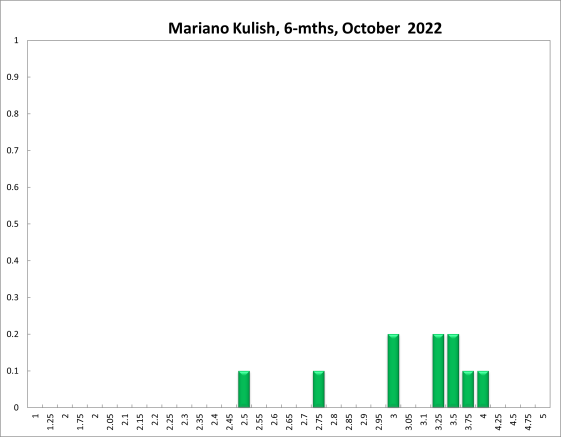

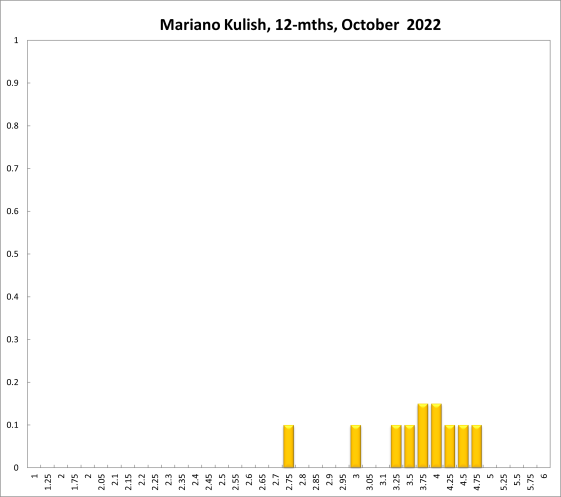

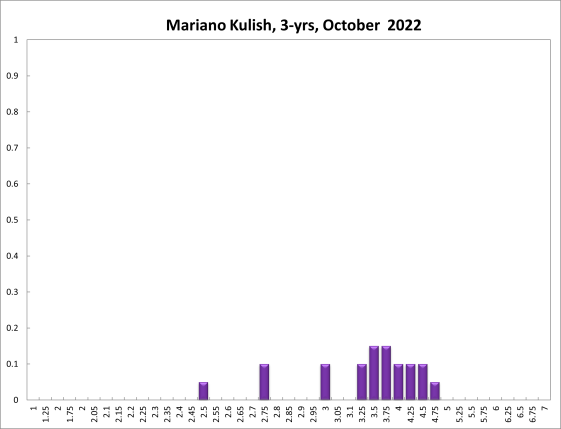

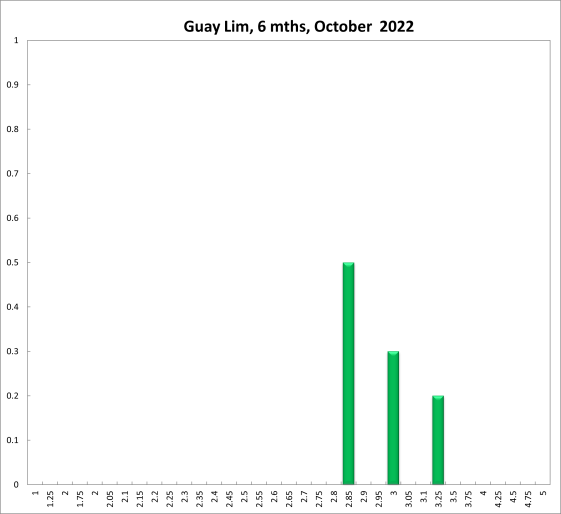

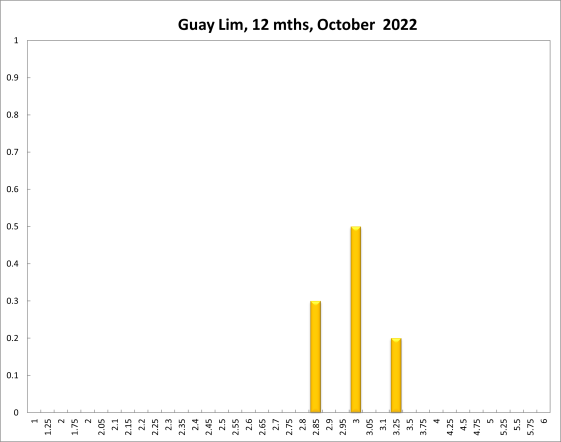

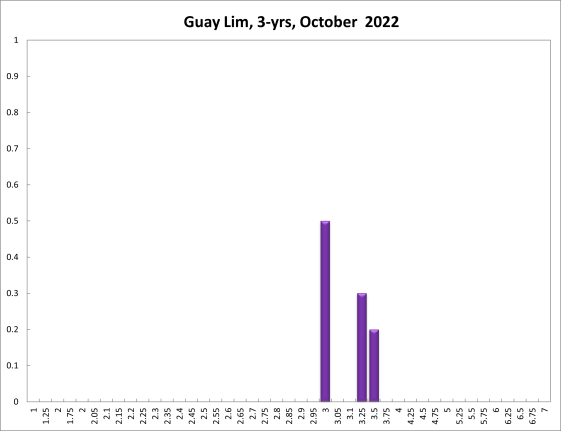

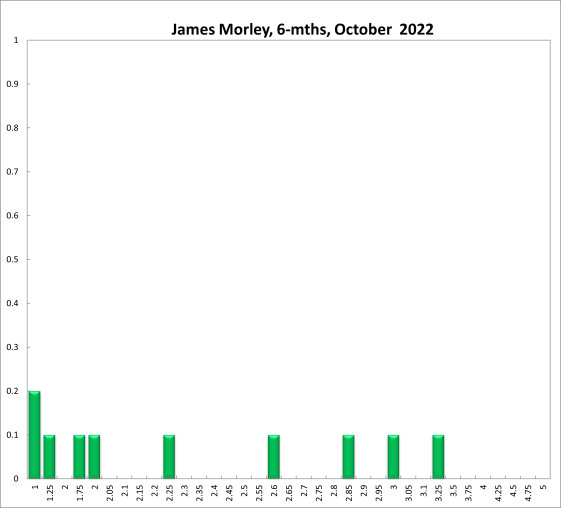

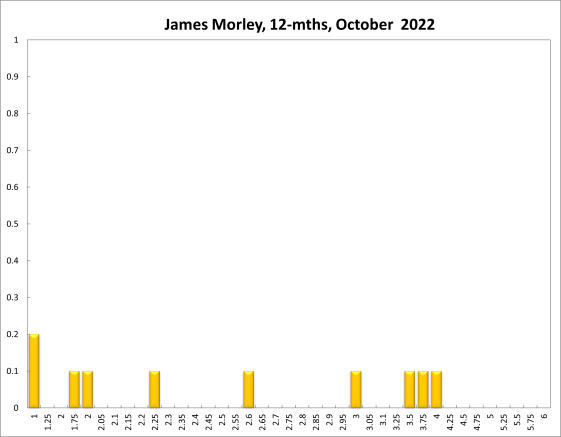

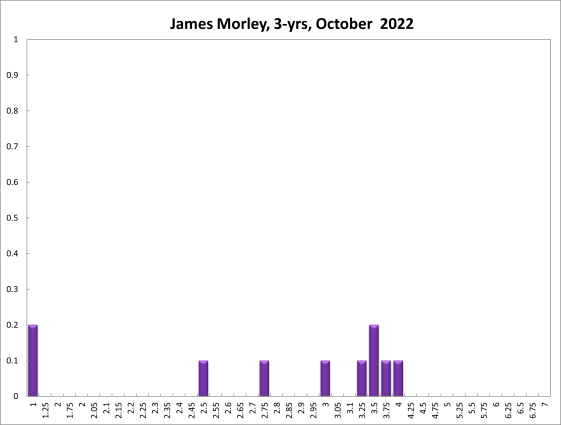

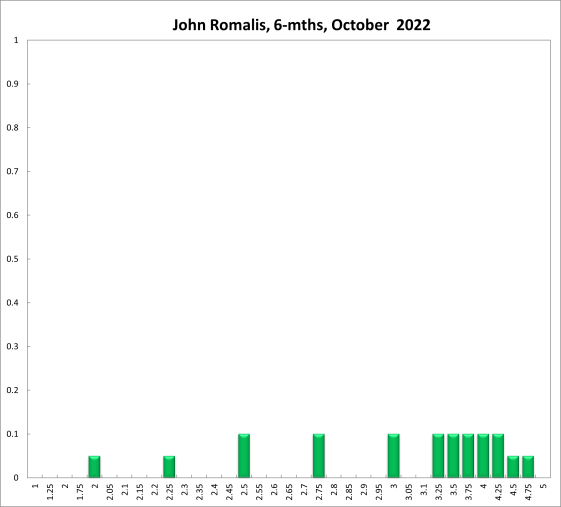

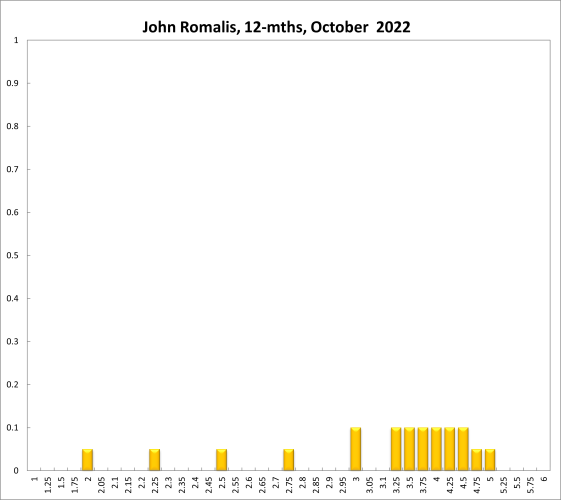

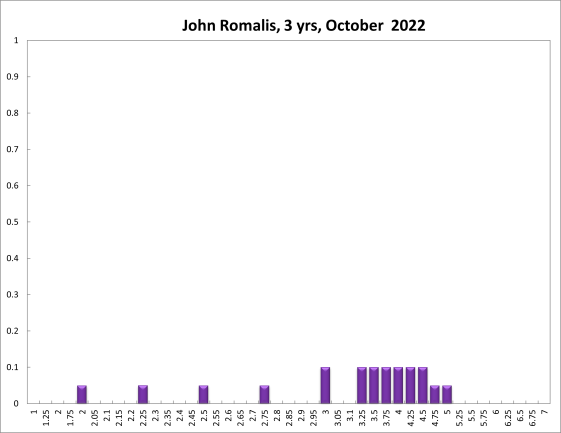

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 2.35% equals 0%; the probability attached to the appropriateness of an interest rate decrease equals 8%, while the probability attached to a required increase equals 92%. One year out, the recommendations are similar. The Shadow Board members’ confidence that the appropriate cash rate is 2.35% equals 0%. The confidence in a required cash rate decrease, to below 2.35%, is 9% and in a required cash rate increase, to above 2.35%, equals 91%. Three years out, the Shadow Board attaches a 0% probability that the overnight rate should equal 2.35%, a 9% probability that a lower overnight rate is optimal and a 91% probability that a rate higher than 2.35% is optimal.

The range of the probability distributions for the current and 6-month recommendations has widened considerably: for the current setting, it extends from 2.25% to 4.25% (compared to a range of 1.85% and 3.00% in the previous round) and for the 6-month horizon it extends from 1.25% to 5.00% (compared to a range of 1.5% to 4.25% in the previous round). The range for the 12-month horizon extends from 1.0% to 5.25%. For the 3-year horizon the range, now extending from 1.0% to 6.0%, actually narrowed slightly.