Outcome

Consistent with the labour market data, the June quarter national accounts confirmed that prior to the current lockdowns the economic recovery was continuing at a solid pace – any drag from the end of the JobKeeper scheme and other COVID-supports was more than offset by positive momentum in both public and private domestic demand.

The ongoing lockdowns in NSW, Victoria and Canberra will clearly put a significant drag on employment and activity in the near term. Assuming vaccination rates continue at their current pace, restrictions in NSW and Victoria should begin to ease in mid-Q4, which will enable the economic recovery. But the vaccination program is necessary not sufficient. The policy environment will need to remain supportive, and households and businesses will have to adjust to a new COVID-normal, where cases are endemic within the community (with the worst health outcomes largely prevented by the vaccination program) and some restrictions are still needed. Given this, the initial phase of the recovery is likely to be bumpy, and this will delay the return to full employment and the 2-3% inflation target, and the time for rate lift-off (to late 2023).

Q2 real GDP numbers were very good and showed an economy that had almost completely recovered to its pre-Covid trend. However, we can expect the economic fallout from the Delta variant to be significant in Q3. The previous experience suggests that the Australian economy will recover again given widespread vaccination and a seeing through of plans for persistent fiscal stimulus. In terms of monetary policy, then, the RBA should stay the course of forward guidance to keep the policy rate at 0.10% until early/mid 2024 at the earliest. Indeed, the RBA should signal that it may need to keep rates lower into late 2024 to ensure inflation expectations persistently move into the top half of its target range. The recent low wages growth and the economic fallout from the Delta variant make the gains in inflation expectations from the RBA’s previous forward guidance somewhat fragile.

The economy will clearly struggle severely for months due to the continued shocking mismanagement of the public health crisis. Barring something much worse than the current covid variants, the economy should recover in 2022, likely quite strongly, which will eventually cause a need to increase rates. We will also have to consider the implications of seemingly endless fiscal deficits since all major political parties appear to have abdicated any sense of responsibility regarding those.

Updated: 21 November 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Absolutely No Doubt: Cash Rate Must Stay Put

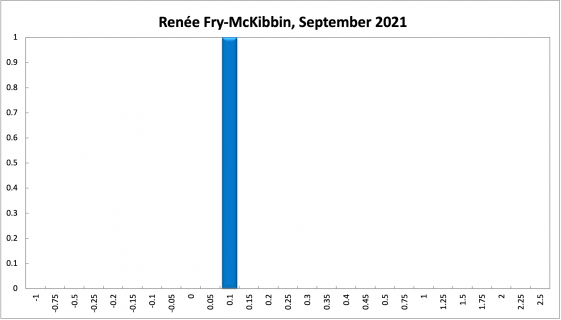

The most recent data on Australian GDP – an increase of 0.7% (quarter-on-quarter) in the June quarter – looks promising but does not reflect the current situation in the two most populous states, NSW and VIC. It is clear that the Delta strain is exceedingly difficult to contain and that a zero Covid strategy is untenable. Thus, these states’ lockdowns will likely persist until they have reached vaccination rates of 70 or 80%, before restrictions are significantly relaxed. There is no new data on inflation which, measured by the growth rate of the CPI, surged by 3.8% (year-on-year) in the June quarter, above the RBA’s official target band of 2-3%. With two thirds of the country’s population in lockdown, the RBA Shadow Board has come to an unprecedented verdict: it is certain (100% confident) that keeping the cash rate at the historically low rate of 0.1% is the appropriate policy for the September round.

The most recent data from the labour market showed yet another surprise drop in the official ABS unemployment rate, coming in at 4.6% in July, 0.3 percentage points below the June figure. Youth unemployment steadied at 10.2%. Total employment edged up by a little over 2,000. The low unemployment rate is misleading, however, flattering even, as the labour force participation rate dropped to 66% and the underemployment rate increased to 8.3%, an increase of 0.4 percentage points. Thus, monthly hours worked decreased by 3 million hours. Job advertisements declined by half a percent. Importantly, nominal wages, as measured by the Wage Price Index (WPI), grew by a meagre 1.7% year-on-year in the June quarter. Whilst an increase of 0.2 percentage points compared to the previous quarter, given an increase in the CPI of 3.8% in the same quarter, this means real wages are currently falling in Australia and will probably continue to fall, as forecasted in the 2021 Budget’s forward estimates provided by the government.

The Aussie dollar continued its recent decline, finding support just above the 71 US¢ mark and bouncing back to around 74 US¢. Yields on Australian 10-year government bonds dipped to below 1.06%, before recovering; they are now hovering around 1.2%. The broad shapes of the yield curves are unchanged: the yield curve in short-term maturities (2-year versus 1-year) remains flat as intended; in mid-term versus short-term maturities (5-year versus 2-year) and in higher-term maturities (10-year versus 2-year) the yield curves continue to display normal convexity. The spread between the 10-year rate and the 2-year rate widened slightly, from 116 basis points to 119 basis points. The Australian stock market continued its unprecedented bull run; the S&P/ASX 200 stock index breached 7,600 in mid-August and only retreated slightly to close the month above 7,500.

According to the Economist magazine, the Delta variant is likely to slow the global economy down more than expected. Global supply chains are being disrupted, which poses a particular problem for manufacturing intensive economies such as Germany, but also affects consumers worldwide. The risk is that these supply chain problems will persist, creating uncertainty for producers and pushing up inflation. Any economic fallout from recent geopolitical events such as the crisis in Afghanistan is highly speculative but will likely be small in the short-term. Mirroring the situation in Australia, it is evident that the key to a normalisation of the world economy is mass vaccination and while developed economies are likely to achieve vaccination rates of around 80% by the end of the year, developing economies are lagging far behind.

Unsurprisingly, given the protracted lockdowns in NSW and VIC, Australian consumer confidence weakened: the Melbourne Institute and Westpac Bank Consumer Sentiment Index fell from 109 in July to 104 in August. Retail sales contracted by 2.5% month-on-month and by 3.1% year-on-year in July. Business indicators plummeted in the past few weeks. NAB’s index of business confidence dropped from 11 in June to -8 in July, with confidence hit most severely in transport & utilities, manufacturing and finance, and property. The services PMI fell from 57.8 in June to 51.7 in July; the manufacturing PMI fell from 60.8 in July to 51.6 in August, the lowest in 11 months. Capacity utilisation also continued to diminish, from 85.1% in May to 83.9% in June and now to 81.2% in July. The Westpac-Melbourne Institute Leading Economic Index contracted for the third month in a row, by 0.12% month-over-month in July. The six-month annualised growth rate in the Leading Index equals 1.3% in July, slightly down from June. These numbers will remain relatively weak as the lockdowns in NSW and Victoria persist.

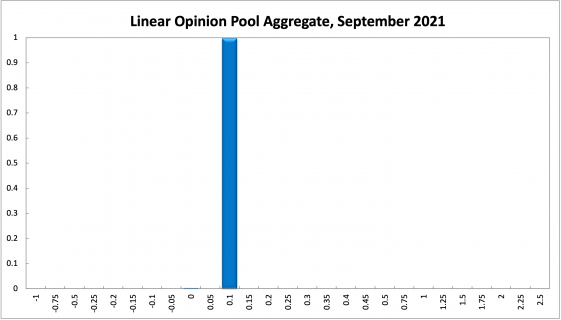

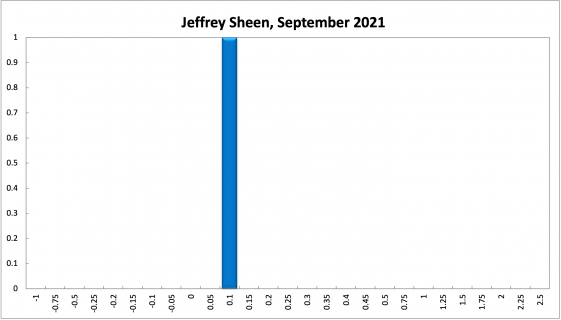

The official cash rate target has been at the unprecedented level of 0.1% for ten months. The Shadow Board’s already strong conviction to keep the overnight interest rate at 0.1% strengthened further and reached unprecedented unanimity: it is 100% certain that the overnight interest rate should remain steady (98% in August), attaching 0% probability that either an increase is appropriate (6% in July) or a further rate cut to below 0.1% (unchanged from August).

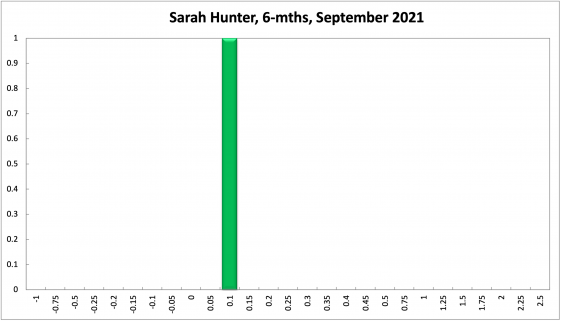

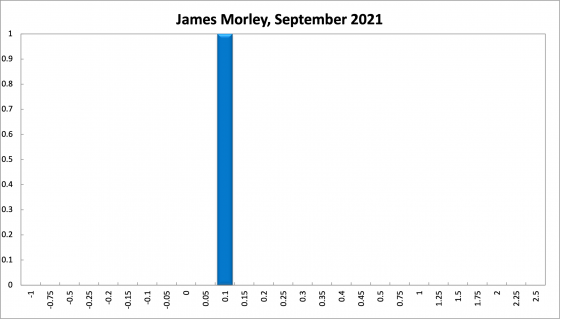

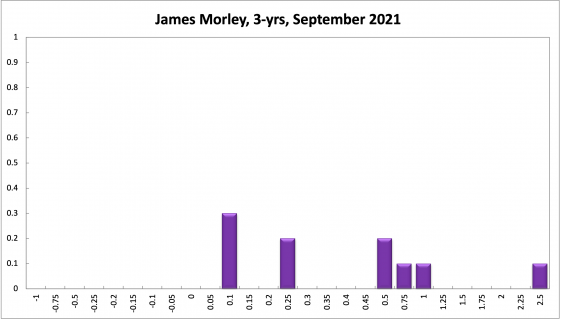

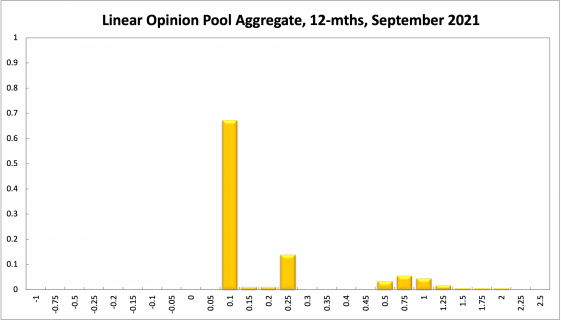

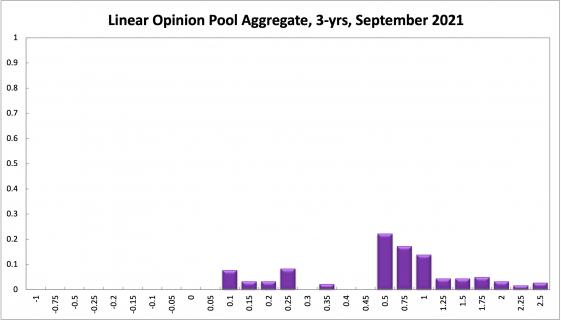

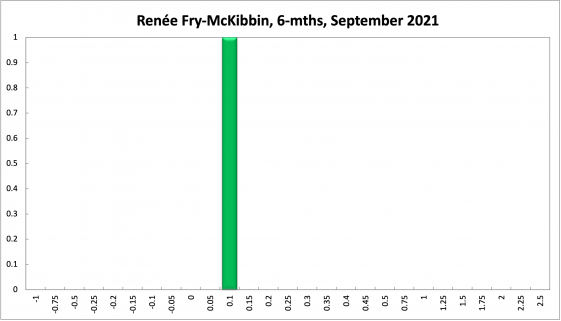

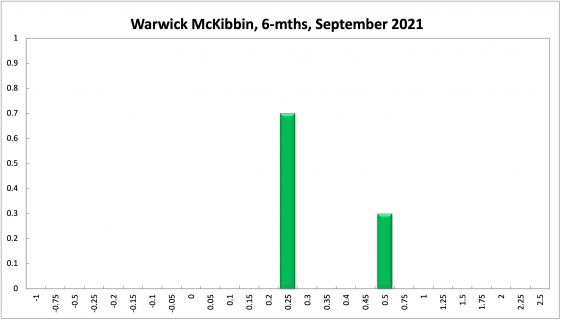

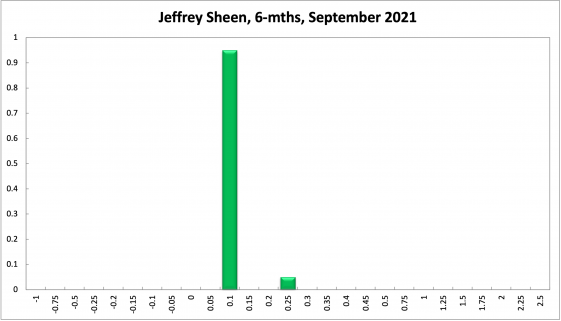

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at 0.1% has actually weakened, from 87% in August to 83%, the probability attached to the appropriateness for an interest rate decrease remains exactly 0%, while the probability attached to a required increase rose from 13% to 18%. One year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 67% (68% in August). The confidence in a required cash rate decrease, to below 0.1%, is 0% (unchanged) and in a required cash rate increase 33% (32% in August). Three years out, the Shadow Board attaches an unchanged 8% probability that the overnight rate should equal 0.1%, a 0% probability that a rate lower than 0.1% is appropriate, and a 92% (93% in August) probability that a rate higher than 0.1% is optimal. The range of the probability distributions over the 6 month and 12 month horizons has widened considerably, from 0.1-1% in the previous month to 0.1-2% in this round, whereas the range of the probability distribution for the 3-year recommendation remains unchanged, extending from 0.1% to 2.5%.