Aggregate

Interest Rates to Remain on Hold over the Summer

Australia’s growth rate still stands at 0.9 percent for the June quarter while CPI inflation fell to 1.9% in the September quarter, just below the Reserve Bank of Australia’s official target band of 2-3%. The official unemployment rate remained at 5%. The RBA Shadow Board rules out any likelihood that a reduction in interest rates could be called for. It attaches an unchanged 53% probability that holding interest rates steady at 1.5% is the appropriate setting, while the confidence in a required rate hike equals 47%.

According to the ABS, the seasonally adjusted unemployment rate in Australia remains low, at 5%, with a marginal increase in the labour force participation rate, from 65.5% to 65.6%. Nominal wage growth has finally ticked up, albeit modestly, equalling, annualised, 2.3% in the September quarter, or 0.4% in real terms. This wage growth will need to be sustained in the future to ease household budget constraints.

The Aussie dollar, relative to the US dollar, has bounced back from the recent lows and is currently trading around 73 US¢. Yields on Australian 10-year government bonds have fallen to below 2.6%. After a short-lived rally the Australian stock market has retreated to where it was a month ago. The S&P/ASX 200 stock index is currently trading around 5,700, well below the recent high of 6,370.

Global stock markets have quietened down again, as witnessed in lower volatility measures, such as the VIX. Uncertainty about the future of the world economy remains high, however. The Chairman of the Federal Reserve in the US, Jerome Powell, signalled a reprieve from further increases in the federal funds rate, at least for the immediate future, which duly fed optimism in global share and bond markets. Powell had come under severe criticism by President Trump who argued there was no need for interest rate increases in the current climate.

The picture elsewhere is mixed. Recent economic figures coming out of Germany point to a slowdown, while Italy continues to pose a threat for the region. The Bank of England highlighted the risks of a deep recession following a Brexit without a deal. Emerging market economies, especially in Latin America, remain fragile, suffering from high sovereign debt and weak economic growth. Turkey, too, has yet to find a way to stabilize its flagging economy. While there appears to be no imminent threat to Australia’s economy from overseas, this could change swiftly and a careful monitoring of global events, political and economic, is warranted.

Consumer confidence, as measured by the Westpac Melbourne Institute Consumer Sentiment Index, has improved slightly, while business confidence, according to the NAB business confidence index, have softened a little. The manufacturing PMI and services PMI have weakened slightly, as did capacity utilisation. The construction PMI, along with other housing related indicators, has weakened, sustaining the recent decline in real estate prices across much of Australia.

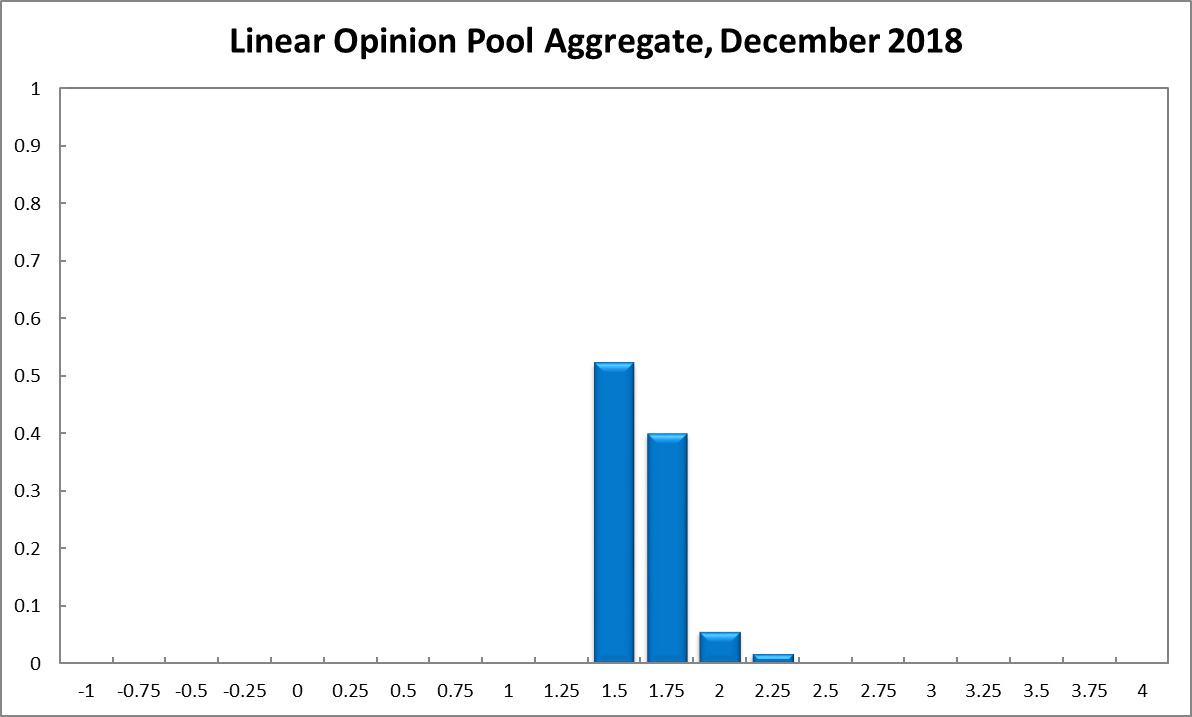

The distribution of the Shadow Board’s policy preferences continues to favour holding the interest rate constant. The Shadow Board is 53% confident that keeping interest rates on hold is the appropriate policy, unchanged from the previous month. It attaches zero probability that a rate cut is appropriate (unchanged) and a 47% probability (unchanged) that a rate rise, to 1.75% or higher, is appropriate.

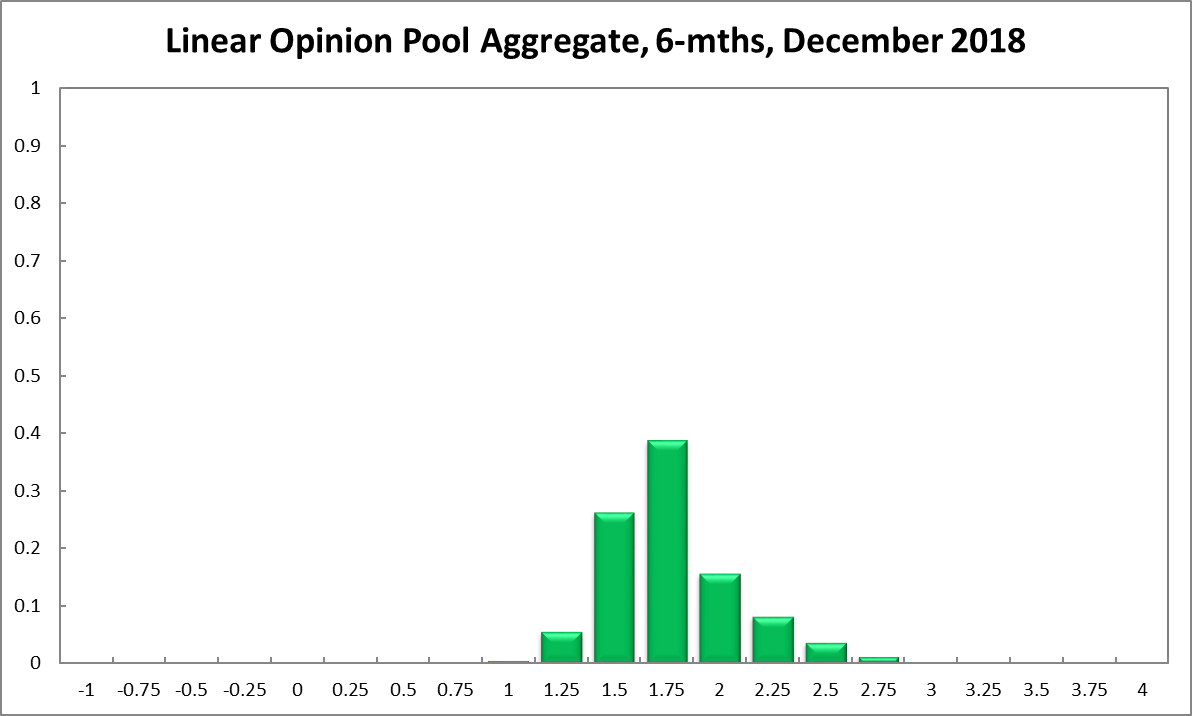

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 1.50% equals 26%, four percentage points down from the previous month. The estimated need for an interest rate decrease is unchanged at 6%, while the probability attached to a required increase has increased 64% to 68%. The numbers for the recommendations a year out paint a similar picture. The Shadow Board members’ confidence that the cash rate should be held steady equals 16% (14% in November), while the confidence in a required cash rate decrease equals 7% (unchanged), and in a required cash rate increase 78% (79% in November). The width of the probability distributions over the 6 month and 12 month horizons remains unchanged, extending from 0.75 to 3.5.

Updated: 22 November 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin