Outcome-October 2012

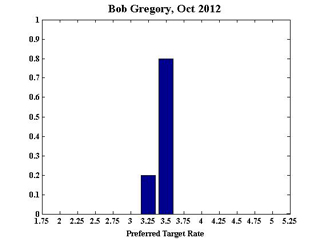

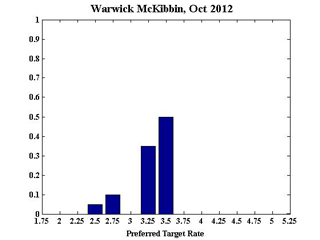

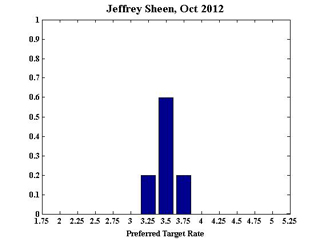

CAMA's Shadow Board, which gave its views ahead of the decision by the Reserve Bank of Australia on Tuesday October 2, continued to support the current setting of the cash rate at 3.5 percent. The Shadow Board comprises influential economists from the private sector and academia. They were asked to rank their preferred settings for the cash rate.

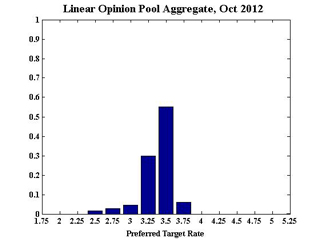

Keeping the interest rate unchanged at 3.5 percent received nearly 60 percent weight, considerably above the next most popular setting, a decrease to 3.25 percent, with 30 percent weight.

The Shadow Board saw evidence of weakening inflationary pressures, and a risk that the current rate should be lower. Support for a decrease in the October cash rate (of 25 basis points or more) received a weight of approximately 40 percent. In contrast, the support for an increase (of 25 basis points or more) was just over 5 percent. The corresponding figures for September suggested both more upside risk, and less downside risk.

With some evidence that inflationary pressures will continue to abate in the coming months, there is more scope for lower rates in the medium term. Support for a decrease in the cash rate over the next six months was just over 50 percent.