Outcome-April 2013

Return Gradually to a Neutral Stance

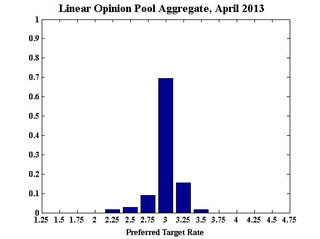

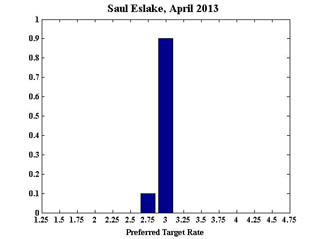

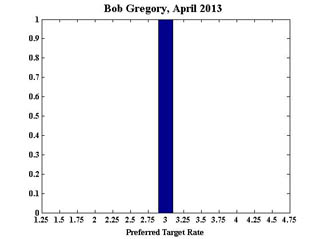

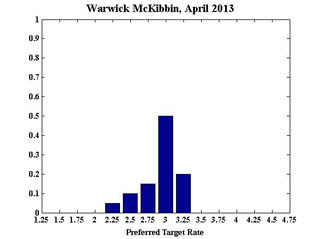

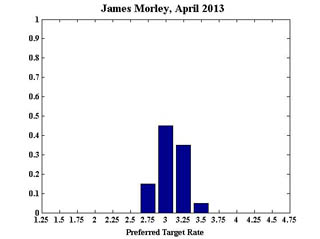

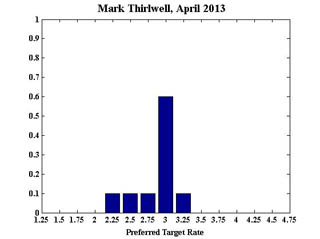

The consensus of the nine members of the Shadow Board is that the Reserve Bank of Australia should leave interest rates unchanged from March at 3.00%. But the balance of risks implies that rates should rise within the next 12 months to return monetary policy to a neutral stance.

The probability that rates should rise in the next 12 months remains at around 1/2, exceeding the risk that rates should be lower, which is under 1/3.

Although domestic conditions have been relatively stable, political and fiscal turmoil in Europe continues. Recent US data indicate more promise of sustained economic growth. Gradual tightening to a more neutral policy stance, following the recent period of monetary accommodation, would be the prudent path for Australia, although not risk free.