Aggregate

Inflation Down but RBA Shadow Board Wants Overnight Rate on Hold

Australia’s annual inflation rate (based on the quarterly consumer price index) fell a full percentage point in Q3, to 2.8%, the lowest since 2021Q1 and, importantly, within the Reserve Bank of Australia’s official target range of 2-3%. The drop was mainly due to declines in energy prices. The RBA’s trimmed mean CPI, a measure of core inflation, increased by 3.5% year-on-year, down from 4% in the previous quarter. The unemployment rate is holding firm on the back of a record-high labour force participation rate, consumer sentiment is recovering, and business sentiment is roughly neutral, while asset prices continue to linger near their peaks. The global economy is offering a mixed outlook. Despite the fall in headline inflation, the Shadow Board recommendation is virtually unchanged from the last round: it attaches a 51% probability that holding the overnight rate steady at 4.35% is the optimal policy setting and only a 12% probability that a decrease to 4.1% might be the correct setting.

The seasonally adjusted unemployment rate remained at 4.1% in September, after the labour force participation rate posted a new all-time high of 67.2% and total employment swelled by more than 64,000. The youth unemployment rate decreased to 9.1%, from 9.9% in August. The underemployment rate dropped to 6.3%, and total monthly hours worked in all jobs grew by 0.3% in seasonally adjusted terms. Australian job advertisements increased slightly, by 0.3%, in October, month-over-month. Q3 wages growth will not be released until 11 November but is widely forecast to be slightly below the Q2 reading of 4.1%.

The Australian dollar has lost a bit of ground since the last round, most recently settling near the 66 US¢ mark. The yield on Australian 10-year government bonds spiked in the past six weeks, currently standing at 4.61% (as of 4 November 2024). The short-term yield curve (2y vs 1y) effectively turned flat, with a spread of -8.5 bps; the medium-term yield curve (5y vs 2y) is also flat, with a spread of 9 bps. The long-term yield curve (10y vs 2y) is displaying “normal convexity”, with a widened spread of 49.9 bps. Share prices have consolidated near record highs: the S&P/ASX 200 Index is currently trading slightly below 8,200.

Consumer confidence, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, has increased to 89.8, the highest reading since May 2022, but still below the neutral value of 100. Retail sales grew by 3.1% year-on-year in August, the most recent available number, while the household saving rate was unchanged at the historically low rate of 0.6%. (The sixty-year average is 9.3%.)

Business sentiment has not changed much: the NAB business confidence index was slightly negative again, equal to -2 (September). The Judo Bank Manufacturing and Services PMIs ticked up in October, from 46.7 to 47.3 and from 50.5 to 51, respectively. (50 is the neutral level.) Capacity utilisation in September was, likewise, virtually unchanged at 83.1%. The Composite Leading Indicator increased for the 11th consecutive month, to 99.95 points (September), just shy of the long-run average of 100 points. Of some concern is the high, and growing, number of bankruptcies, which increased to 1225 companies in September. The overall picture for consumer and business sentiment is thus mixed: there are clearly signs that households and businesses are being squeezed but their outlook seems be roughly neutral and holding steady.

The prospects for the global economy remain a cause for concern, from geopolitical conflict to the fracturing of the global trading system. The outcome of the US election will significantly shape this outlook, with noticeable implications for the Australian economy. The World Bank in its Global Monthly for October 2024 points out that, “indicators for geopolitical risk have been rising since late July, partly reflecting escalating conflict in the Middle East,” and, while financial market volatility remains moderate, gold prices have reached record highs. The report further highlights that there is continued divergence between services and manufacturing, the latter continuing to contract, in part due to higher commodity prices, including energy. Economic conditions in many advanced economies, especially the euro area, remain feeble, and the growth rate for China in 2024Q3 has slowed to 4.6% year-on-year. On the upside, the US economy, with its firm labour market, looks quite strong, emerging market and developing economies are rebounding moderately, and global financial conditions are stabilising.

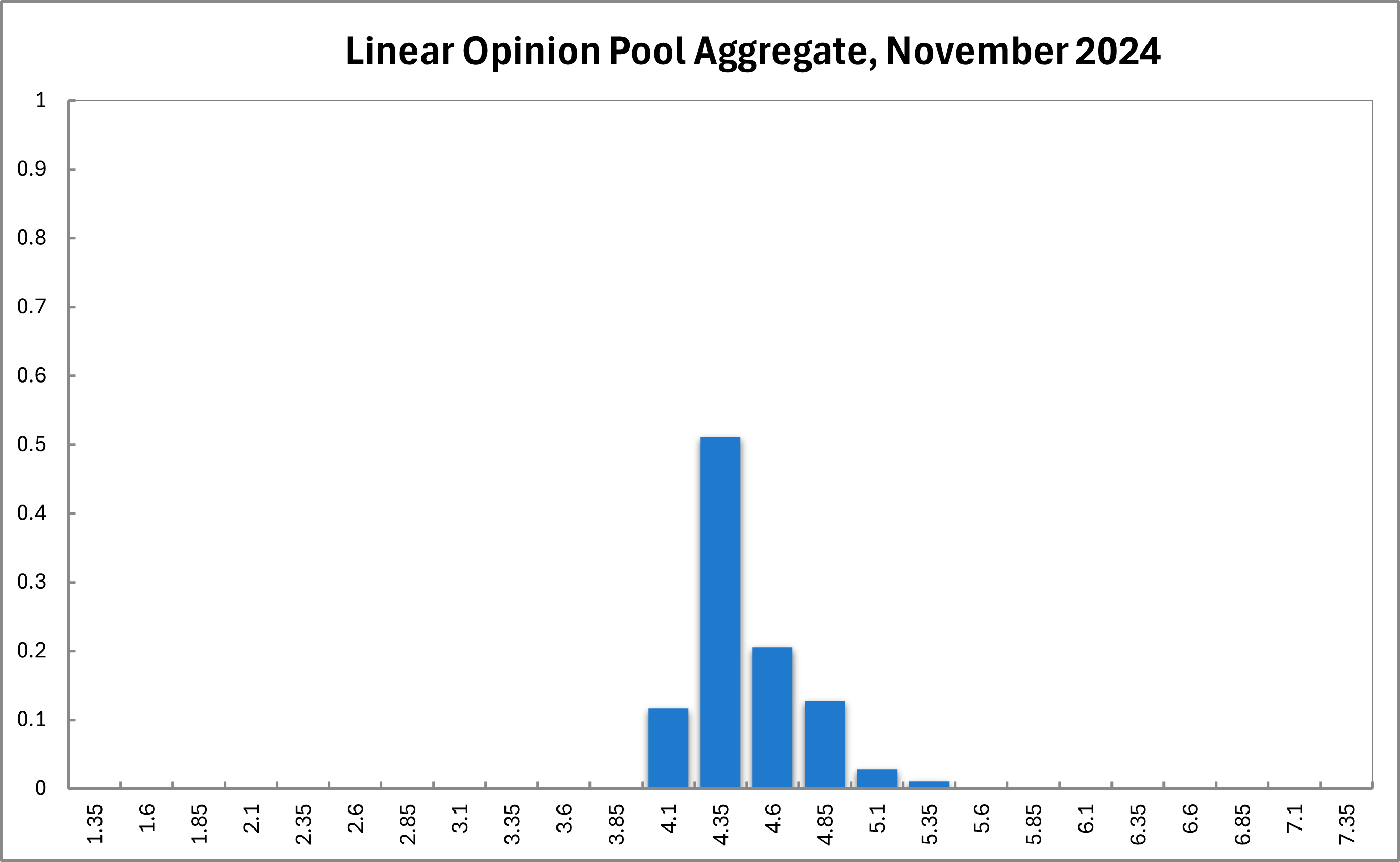

The Shadow Board’s conviction of keeping the overnight rate, currently equal to 4.35%, on hold is virtually unchanged. The Board attaches a 51% probability that this is the appropriate setting (52% in previous round), a 37% probability (38%) that the overnight right should increase, to 4.6% or higher, and a 12% probability (10%) that the overnight right should decrease to 4.1%.

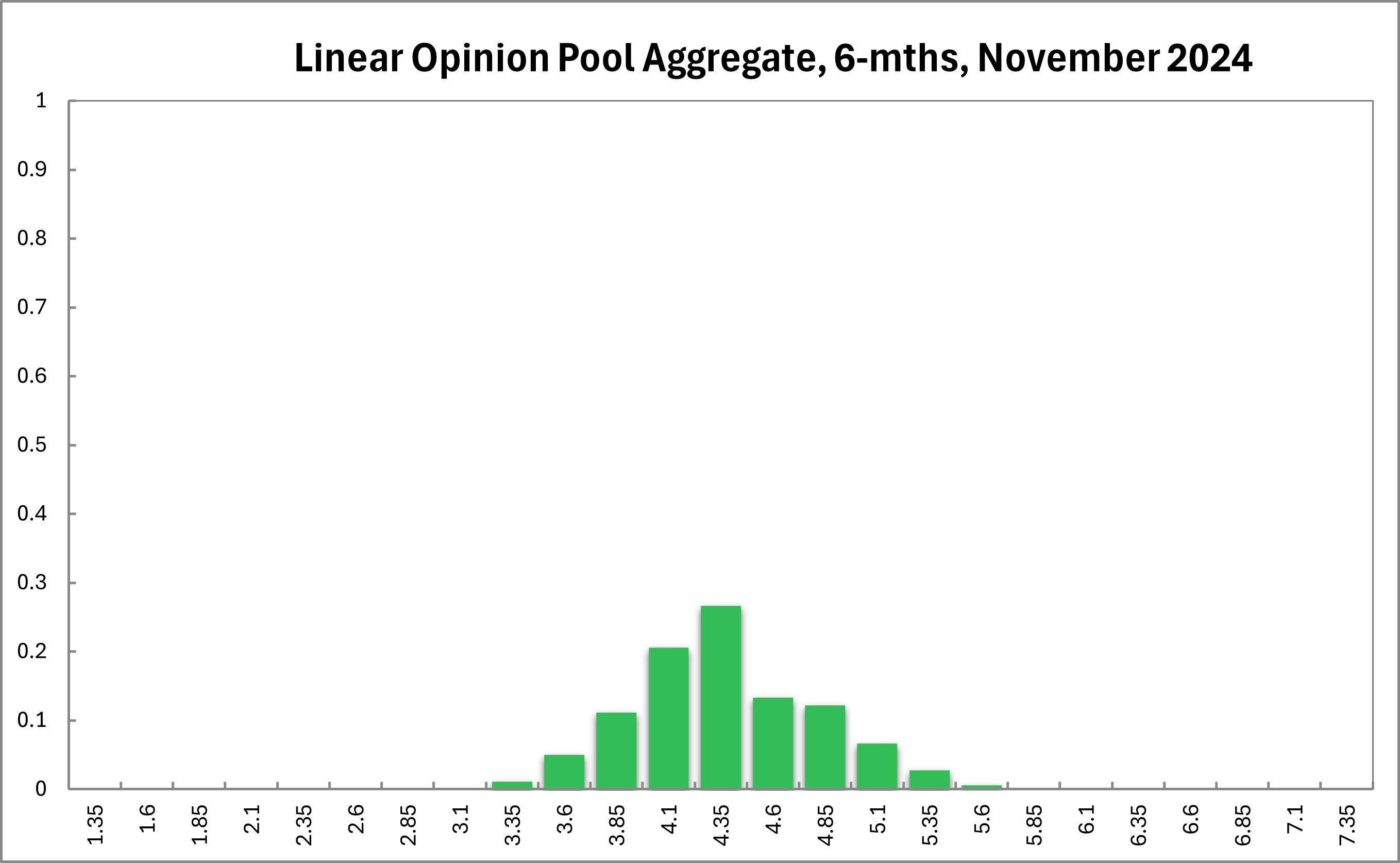

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 4.35% equals 27% (previously 32%); the probability attached to the appropriateness of an interest rate decrease equals 38% (35%), while the probability attached to a required increase equals 36% (33%).

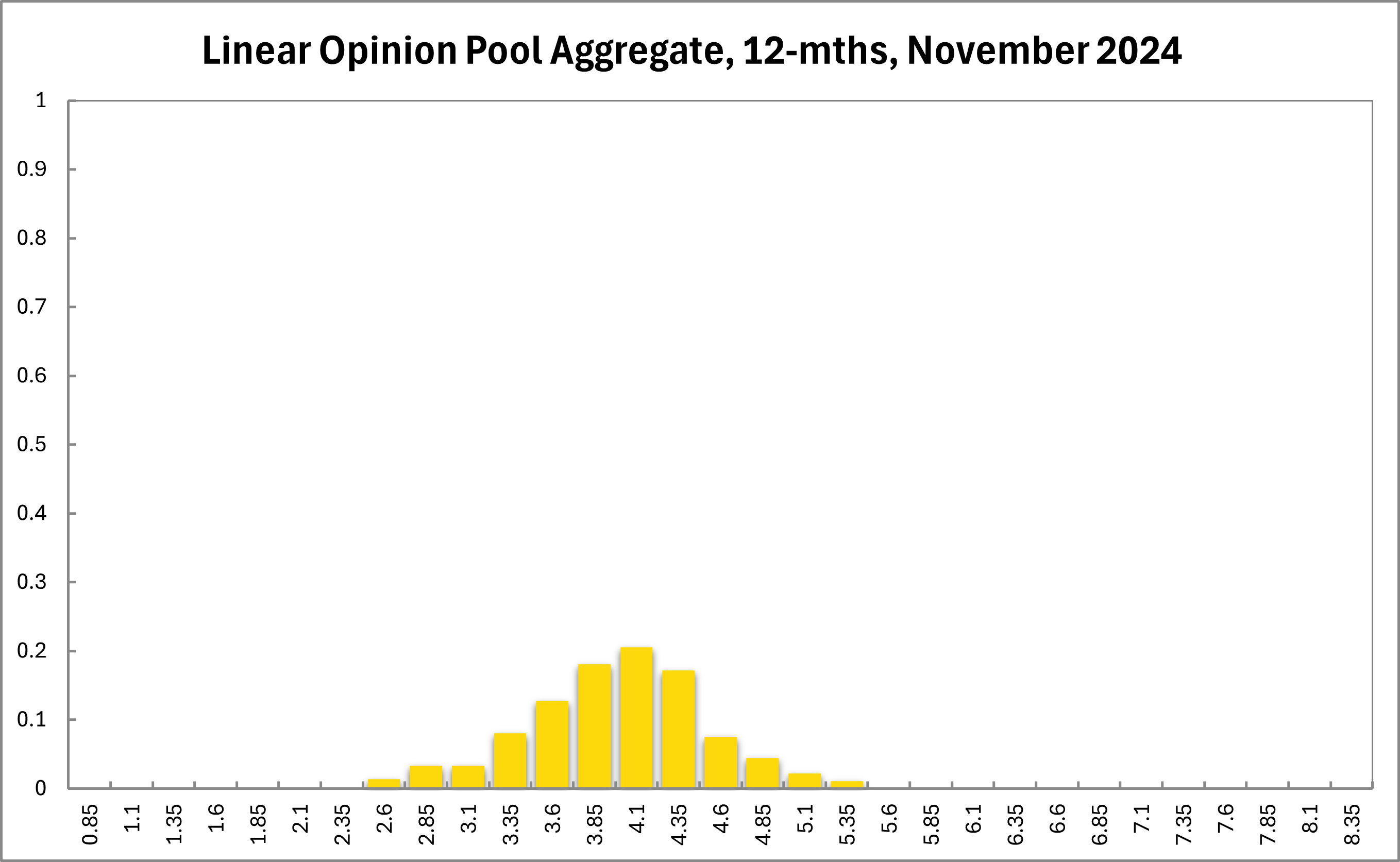

One year out, the Board’s recommendation continues to tilt towards monetary easing: members’ confidence that the appropriate cash rate should remain at the current level of 4.35%, equals 17% (16%), while the confidence in a required cash rate decrease, to below 4.35%, equals 68% (70%), and its confidence in a required cash rate increase, to above 4.35%, is 15% (14%). Three years out, the Shadow Board attaches an 11% probability that 4.35% is the appropriate setting for the overnight rate (previously 12%), an 80% probability that a lower overnight rate is optimal (79%) and an unchanged 9% probability that a rate higher than 4.35% is optimal.

The ranges of the probability distributions are also virtually unchanged and are as follows: they extend from 4.10% to 5.35% for the current recommendation, from 3.35% to 5.60% for the 6-month horizon, from 2.60% to 5.35% for the 12-month horizon, and from 0.85%-5.10% for the 3-year horizon.

Updated: 21 November 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin