Outcome

June

2024

The RBA is taking too long to get inflation back to target. The risks are not balanced.

Updated: 27 December 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Amid Mixed Economic Data, Overnight Rate Should Remain at 4.35%: RBA Shadow Board

Australia’s monthly consumer price index (CPI) inflation rate increased by 3.6% in the 12 months to April, following a 3.5% rise in the 12 months to March. The trimmed mean measure of core inflation, based on the last reading in late April, equalled 4.0% year-on-year, reinforcing concerns that inflation is not aligning with the RBA’s target band of 2-3% rapidly enough. Other economic data paints a confusing picture, from a remarkably resilient labour market and buoyant stock markets, to weakening consumer and business sentiment. As in the previous round, the Shadow Board recommends holding the overnight rate steady at 4.35%, attaching a 45% probability that this is the optimal policy setting, yet seeing a slight increase in downside risk, compared to the previous round.

Australia’s labour market continues to present a complex picture with mixed signals. In May 2024, the seasonally adjusted unemployment rate decreased by 0.1 percentage points to 4%, following a three-month high in April. This improvement coincided with a stable labour force participation rate of 66.8%. Notably, the rise in employment was primarily driven by an increase in full-time positions, which grew by over 41,700, while part-time employment dropped by just over 2,000. The underemployment rate held steady at 6.7%. However, total monthly hours worked in all jobs declined by 0.5% in seasonally adjusted terms. Job advertisements saw a 2.8% increase in April, with updated job vacancy data expected next month. The wage price index, a key indicator of wage growth across the economy, increased by 4.1% year-on-year in Q1 of 2024, or 0.8% quarter-on-quarter, aligning with market expectations. With inflation running at less than 4%, this suggests that real wages are gradually recovering without significantly contributing to inflationary pressures.

After a short bout of heightened volatility, the Australian dollar continued its sideways trading pattern, pushing above 65 US¢ and consolidating below 67 US¢. The yield on Australian 10-year government bonds has decreased slightly to 4.20% as of June 14, 2024, reflecting a slight reduction from earlier figures. The short-term yield curve (2y vs 1y) remains inverted, with the spread narrowing to -34 bps, while the medium-term yield curve (5y vs 2y) essentially remains flat with a spread of -5bps. The long-term yield curve (10y vs 2y) is slightly convex, with a spread of 23 bps. The Australian stock market, represented by the S&P/ASX200, has remained robust despite expectations of prolonged high global interest rates. After briefly surpassing 7,800 in early June, it closed recently around 7,750, indicating resilience amid fluctuating market conditions.

Consumer confidence, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, remains subdued, dropping 2.4%, to 82.4 points, in April 2024, continuing its long-standing trend below the neutral value of 100. Retail sales rose by 0.1% month-on-month, after a 0.4% fall in the previous month. The NAB business confidence index dropped to -2 in May 2024, the lowest level in six months. Sentiment worsened especially in manufacturing, transports, and construction, reflected in a slight drop of the Judo Bank Manufacturing PMI. The Services PMI also fell, from 53.6 to 52.5, as did the Composite PMI, indicating growing weakness in the business sector. Capacity utilization decreased marginally, to 83.2%, remaining above the long-term average of 81.3%. The six-month annualized growth rate in the Westpac-Melbourne Institute Leading Economic Index, which predicts economic activity relative to trend three to nine months ahead, was flat in April 2024, while the Composite Leading Indicator also fell slightly, supporting the view that business’s concerns about the future are growing. Australian industry activity, as measured by the Ai Group Industry Index, fell considerably in May 2024, posting the 25th consecutive month of contraction. There are pockets of resilience but the outlook for Australian businesses remains challenging.

In its latest Global Economic Prospects report, the World Bank highlights that the global economy is expected to stabilize for the first time in three years in 2024—but at a level that is weak by recent historical standards. Global growth is projected to hold steady at 2.6% in 2024 before edging up to an average of 2.7% in 2025-26, which is well below the 3.1% average in the decade before COVID-19. This forecast implies that over 2024-26, countries accounting for more than 80% of the world’s population and global GDP will continue to grow more slowly than they did in the pre-pandemic decade. Overall, developing economies are projected to grow at an average rate of 4% over 2024-25, slightly slower than in 2023. In advanced economies, growth is set to remain steady at 1.5% in 2024 before rising to 1.7% in 2025.

The report underscores significant downside risks, including potential escalations in geopolitical conflicts, particularly in the Middle East, and financial stress in vulnerable emerging market and developing economies. High borrowing costs and restrictive credit conditions are expected to persist, posing challenges, especially for economies with low creditworthiness. Nonetheless, there are some positive signals, such as the reduced risk of a global recession, largely due to the resilience of the U.S. economy. At the same time, trade growth in 2024 is projected to be only half of what it was in the decade before the pandemic. The World Bank emphasizes the need for comprehensive policy actions to bolster investment, enhance fiscal sustainability, and foster international cooperation to tackle global challenges such as climate change and food insecurity.

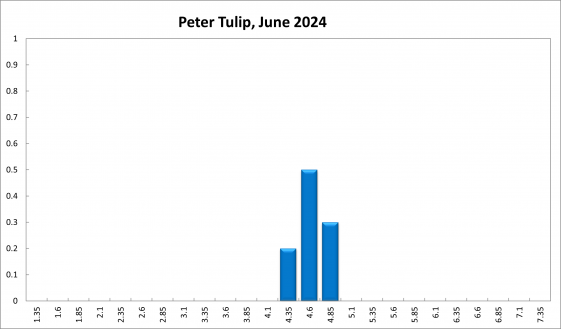

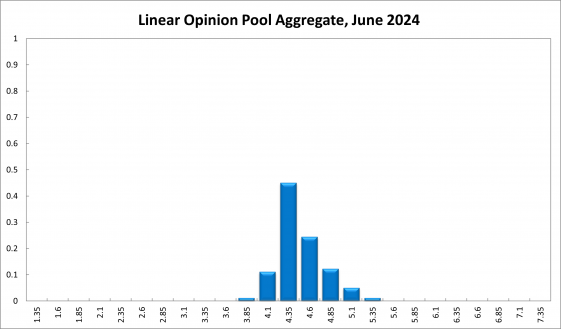

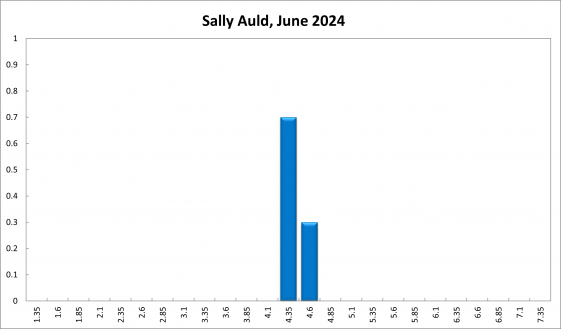

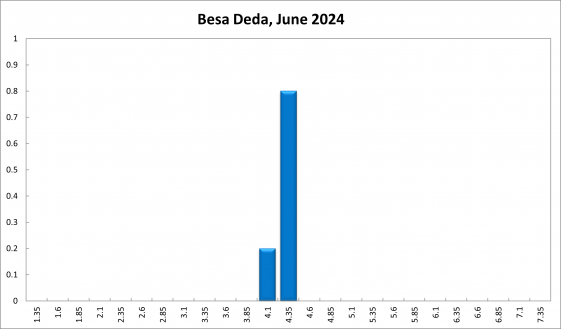

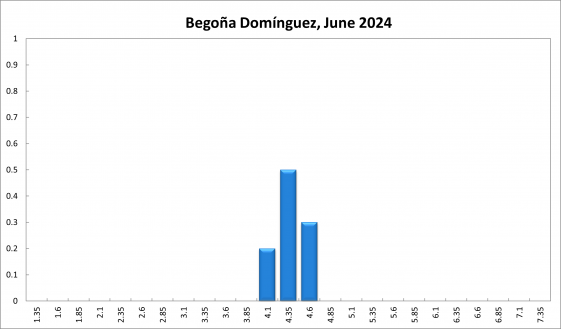

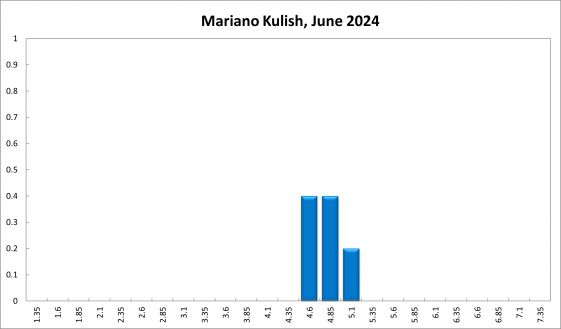

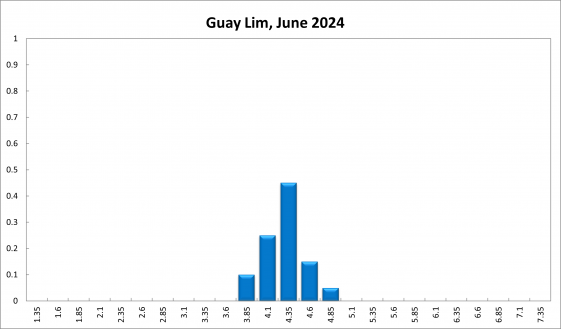

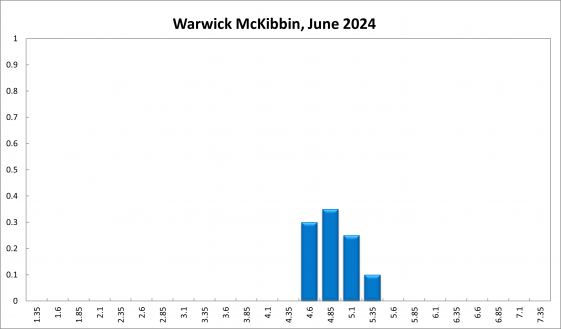

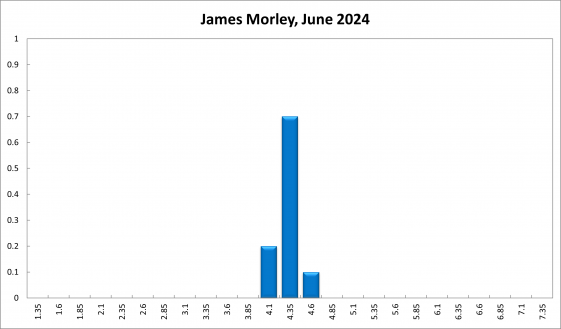

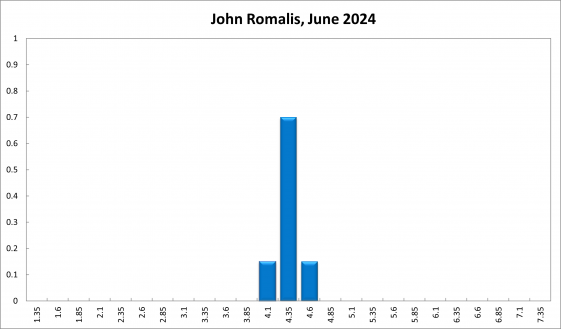

The Shadow Board’s recommendation remains unchanged, and its assessment of risks has shifted slightly to the downside since the last round. The Board recommends holding the overnight interest rate steady at 4.35%, attaching a 45% probability that this is the appropriate setting (down from 51%), a 43% probability (down from 44%) that the overnight right should increase, to 4.6% or higher, and a 12% probability that the overnight right should decrease to 4.1% (up from 6%).

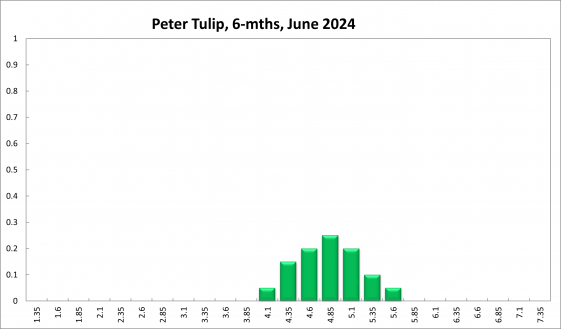

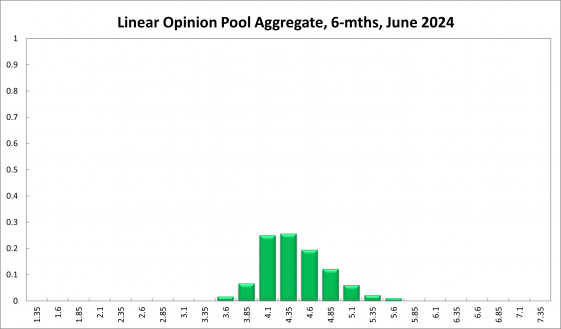

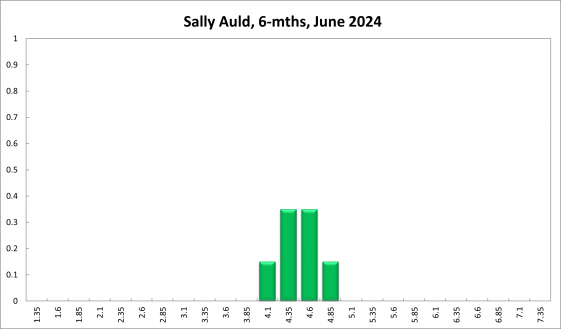

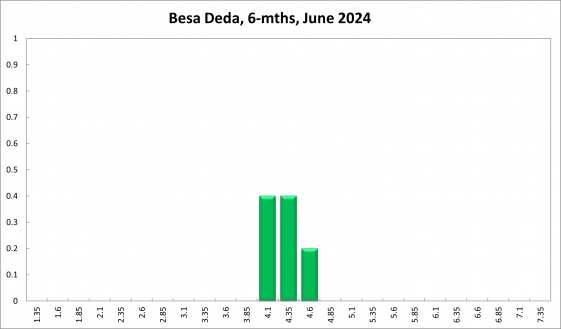

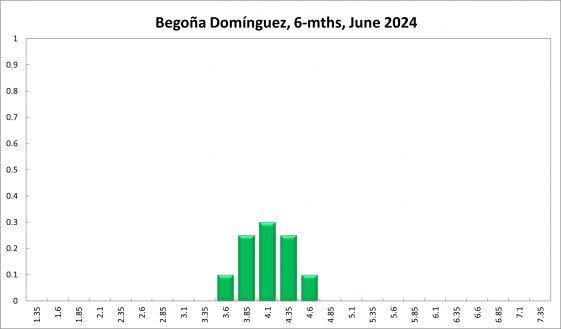

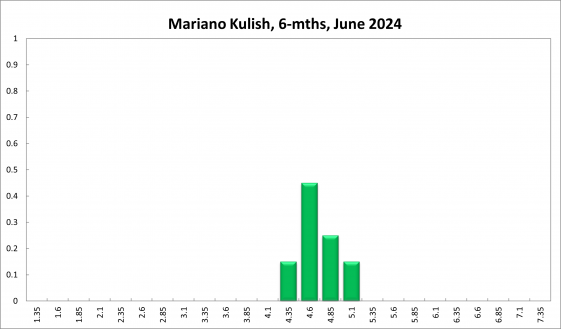

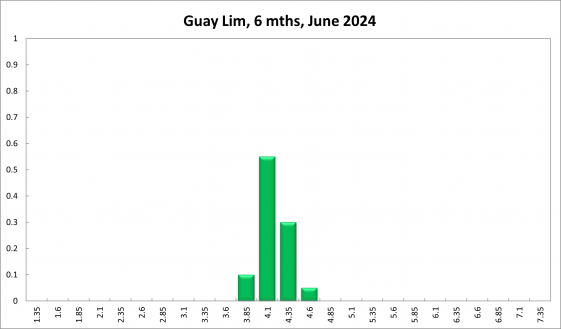

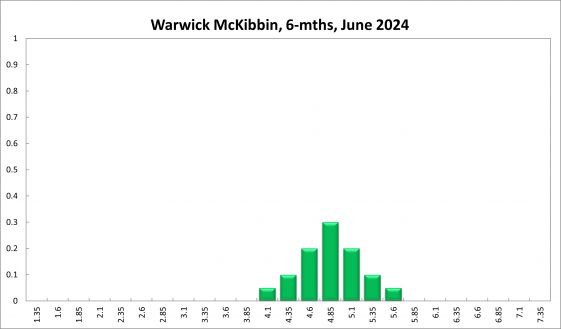

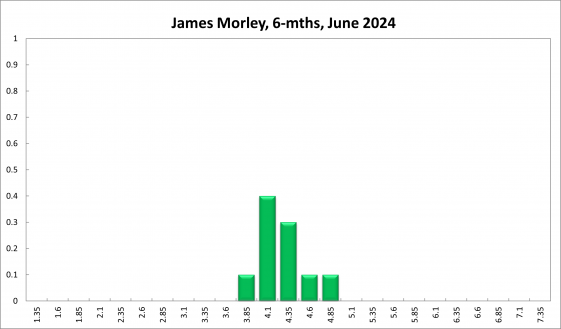

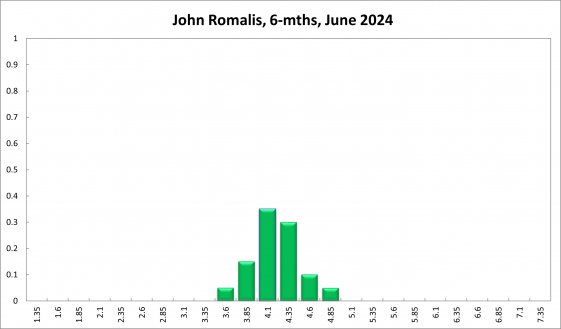

A similar picture emerges for the probabilities at longer horizons: 6 months out, the confidence that the cash rate should remain at the current setting of 4.35% equals 26% (down 4 percentage points); the probability attached to the appropriateness of an interest rate decrease equals 33% (up 9 percentage points), while the probability attached to a required increase equals 41% (down 5 percentage points). The mode recommendation at this horizon is unchanged at 4.35%, just.

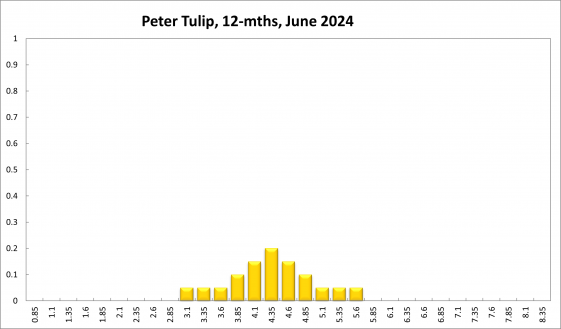

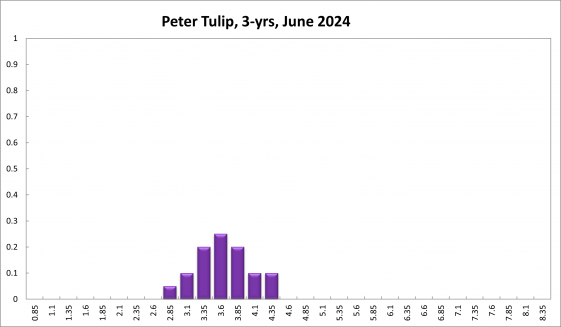

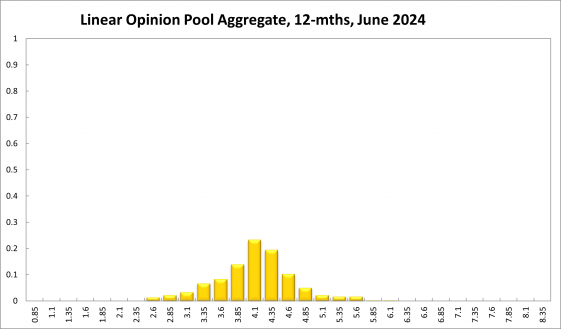

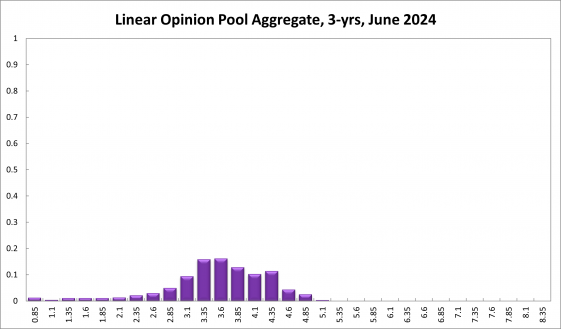

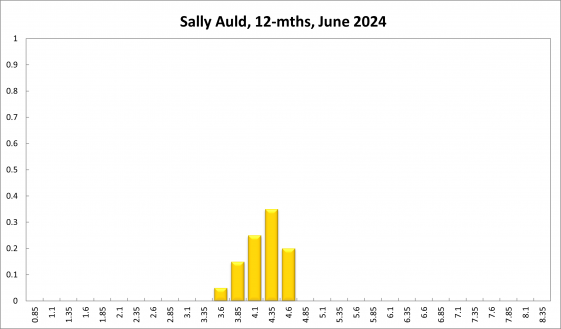

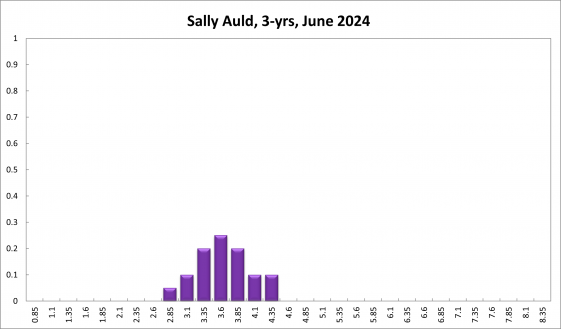

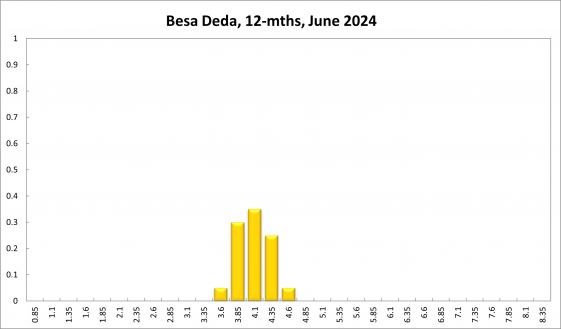

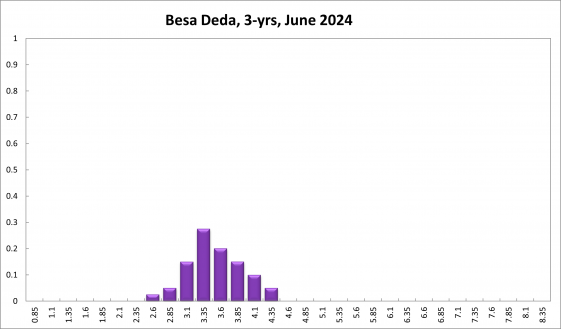

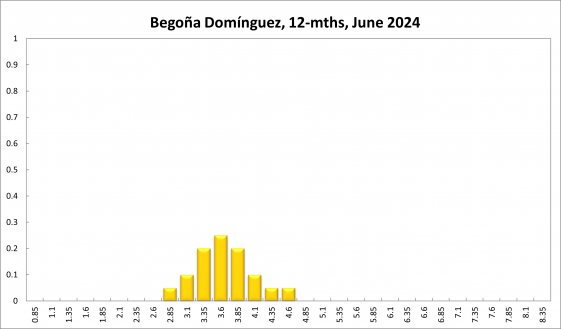

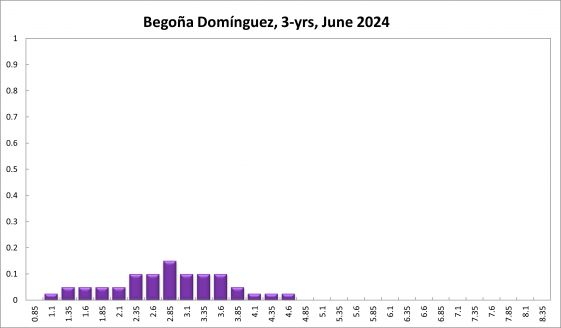

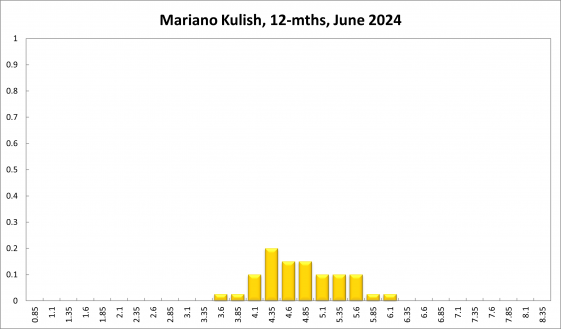

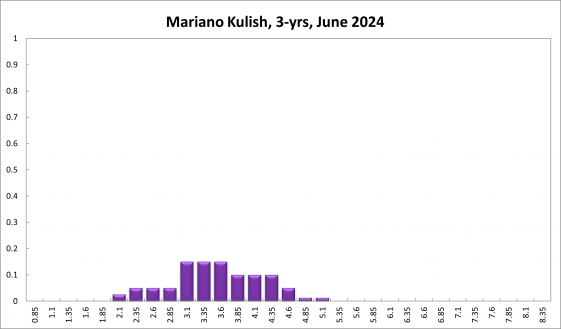

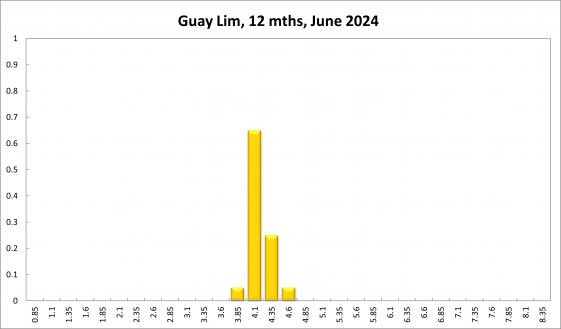

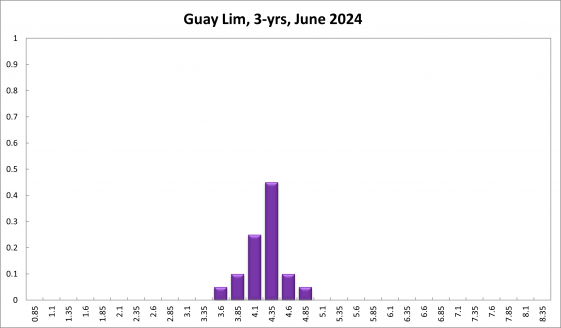

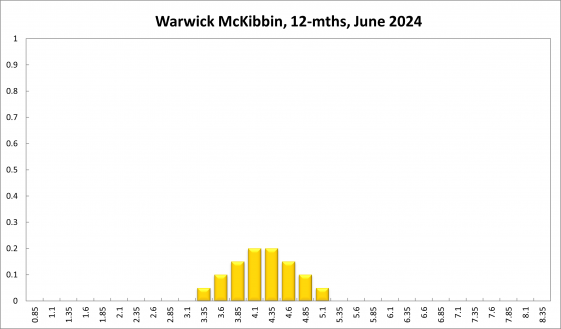

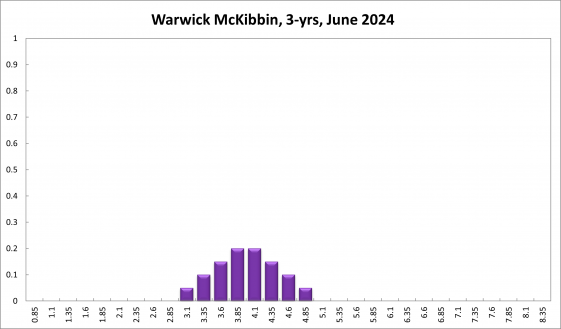

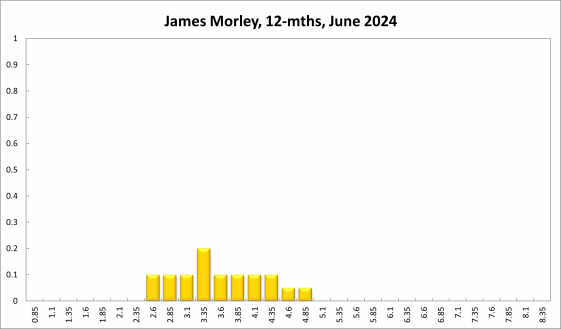

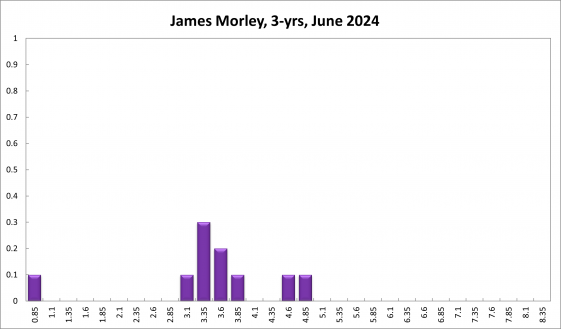

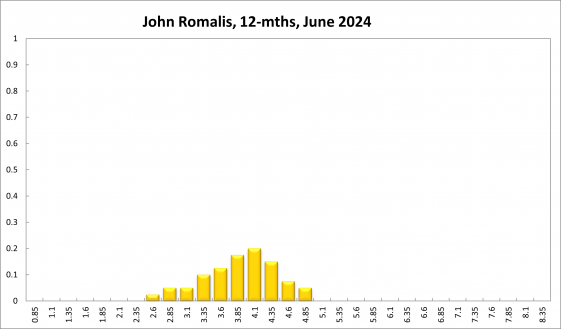

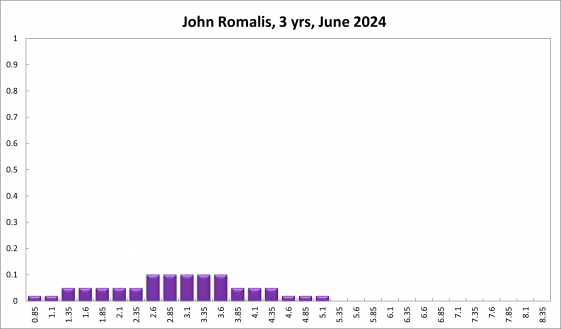

One year out, the shift towards monetary easing becomes more prominent: the Shadow Board members’ confidence that the appropriate cash rate should remain at the current level of 4.35%, equals 19% (down from 23%). The confidence in a required cash rate decrease, to below 4.35%, equals 59% (down from 55%), and its confidence in a required cash rate increase, to above 4.35%, is 21% (down from 23%). Three years out, the Shadow Board attaches an 11% probability that 4.35% is the appropriate setting for the overnight rate (down from 13%), an 81% probability that a lower overnight rate is optimal (up from 78%) and a 7% probability that a rate higher than 4.35% is optimal (down from 9%).

The ranges of the probability distributions have barely changed and are as follows: they extend from 3.85% to 5.35% for the current recommendation, from 3.60% to 5.60% for the 6-month horizon, from 2.60% to 6.10% for the 12-month horizon, and from 0.85%-5.10% for the 3-year horizon.