Outcome

The likelihood of the cash rate remaining higher for longer and the potential for a further hike is higher given the Q1 CPI outcome.

The RBA should increase the cash rate at its next meeting and communicate its intention to continue tightening policy until inflation is confidently inside the target band. While inflation has been slowing, it has proven to be quite persistent and the return to target much slower than anticipated. A prolonged period of time with inflation above the target risks a de-anchoring of inflation expectations from the target which would make stabilising inflation harder down the track. Policy should put more weight on the risks associated with doing too little. Because of this I would suggest increasing the cash rate.

The monetary policy decision is relatively simple.

The outlook is for inflation to remain above the midpoint of the target, 2.5%, and for the unemployment rate to be below estimates of its sustainable rate, 4.5%.

A higher path for the cash rate would bring inflation and unemployment closer to their targets.

Central banks try to stabilise inflation for good reasons. Without a tightening in policy, a prolonged period of above-target inflation would be likely to increase inflation expectations, leading to a substantial increase in unemployment. The cost of reducing this risk is a modest increase in unemployment in the short run. An increase in the cash rate now would deliver lower more stable unemployment in the long run.

Updated: 30 June 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Overnight Rate Should Remain at 4.35% But Upside Risk Increasing, According to RBA Shadow Board

Australia’s consumer price index (CPI) inflation rate was 3.6% year-on-year in Q1 of 2024, half a percentage point lower than in the previous quarter but above market expectations of 3.4%. The monthly CPI indicator increased by 3.5% in the year to March 2024, also higher than expected. Measures of core inflation as well as producer price inflation, likewise, exceeded expectations, raising concern that overall inflation is not returning to the RBA’s target band of 2-3% quickly enough. There are growing signs, however, that the labour market is weakening, while the outlook for Australian business is dimming. As in the last round, the Shadow Board recommends holding the overnight rate steady at 4.35%, attaching a 51% probability that this is the optimal policy setting but, given recent domestic and overseas inflation data, it sees more upside risk than in previous rounds.

After the surprise drop in February, the official seasonally adjusted unemployment rate increased from 3.7% to 3.8% in March, owing to a small decrease in total employment of 6,500 and a drop in the labour force participation rate of 0.1%, to 66.6%. At the same time, the underemployment rate decreased to 6.5%. In the same month, job advertisements declined by 1.0% month-over-month, and job vacancies posted their seventh consecutive quarterly decline, to 363,000, after a peak from 476,000 in Q2 of 2022. Total hours worked in all jobs, increased by 0.9% in March. The next release of the seasonally adjusted wage price index, the standard measure for capturing economy-wide wages growth, will not be until 15 May, too late to inform the decision in the current interest rate round. Wages growth, for which the most recent reading was 4.2% in Q4 of 2023, is widely expected to only change a little, if at all.

The Australian dollar continued to mostly trade sideways, finding support above 64 US¢ and resistance below 66 US¢. Recent inflation data, both domestic and overseas, has pushed yields on Australian 10-year government bonds up, to 4.46%. The yield curve in short-term maturities (2y vs 1yr) remains inverted, with a somewhat narrower spread of -21.6 bps (on 3 May); the one in medium-term vs short-term maturities (5y vs 2y) is completely flat, without a spread. The yield curve in long-term vs short-term maturities (10y vs 2y), maintains its normal convexity, with the spread also having narrowed marginally, to 31.7 bps. Share prices remain elevated, despite expectations that global interest rates are likely to remain higher for longer. The S&P/ASX200, after a brief excursion above 7,800 in early April, finished the month almost exactly where it was six weeks ago before the March round, around the 7,650 mark.

Consumer confidence, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, remains subdued. After spiking to 86 in February, it has retreated to 82. The index has now remained below the neutral value of 100 for over two years. Retail sales dropped by 0.4% month-over-month in March 2024, 0.6 percentage points below expectations, with most industries experiencing a contraction. There was a marginal improvement in business indicators, with the NAB business confidence index edging up to 1 in March 2024 and the Judo Bank Manufacturing PMI, Services PMI and Composite PMI, likewise, ticking up, to 49.6, 53.6, and 53, respectively. The capacity utilisation rate dropped slightly, to 83.2% in March, but remains above the long-run average of 81.3%. The six-month annualized growth rate in the Westpac-Melbourne Institute Leading Economic Index, which is supposed to predict the pace of economic activity relative to trend three to nine months ahead, dropped from -0.03% in February to -0.23% in March. On the upside, the Composite Leading Indicator climbed for the sixth month in a row, to 99.24 in March 2024. Australian industry activity, as measured by the Ai Group Industry Index, fell by 3.6 points to -8.9 points, the 24th consecutive monthly contraction. The industry index for the construction sector deteriorated far more, falling to -25.6 points in April and thus indicating a deep contraction. Taken together, the outlook for Australian businesses looks to be worsening.

In its latest World Economic Outlook, the International Monetary Fund (IMF) argues that the global recovery is, “steady but slow and differs by region.” The baseline forecast for world economic growth is 3.2% during 2024 and 2025, unchanged from the previous year, involving a slight acceleration for advanced economies and a modest slowdown in emerging market and developing economies. The IMF concludes that the global economy has been surprisingly resilient, despite monetary tightening, noting that growth is held back by structural frictions and “dimmer prospects for growth in China and other large emerging market economies”, which will affect global trade. Of course, armed conflict and geopolitical tensions remain an immediate concern. The persistence of inflation, especially in the US, and the consequent need for monetary policy to be tighter for longer than expected, is of immediate relevance to the RBA.

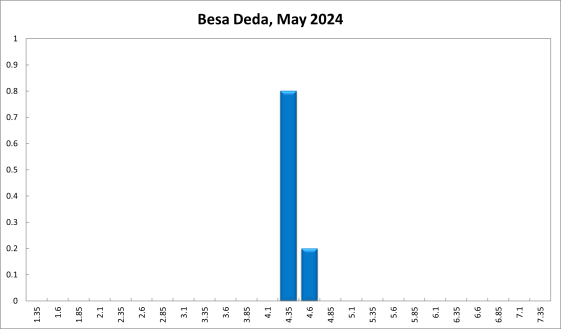

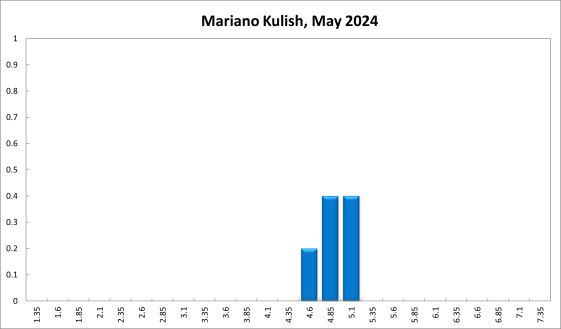

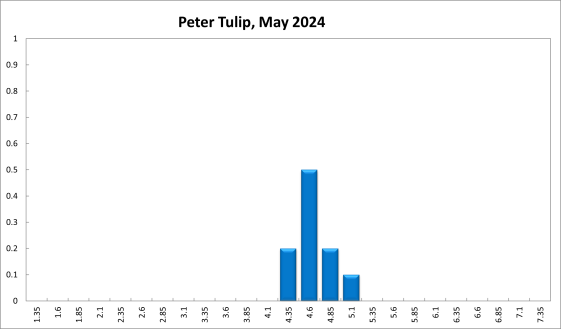

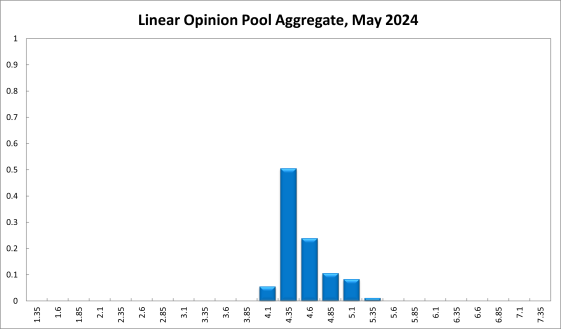

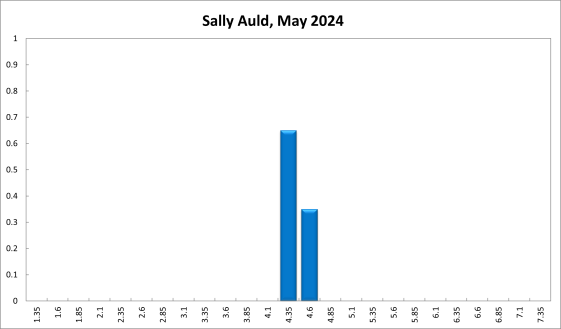

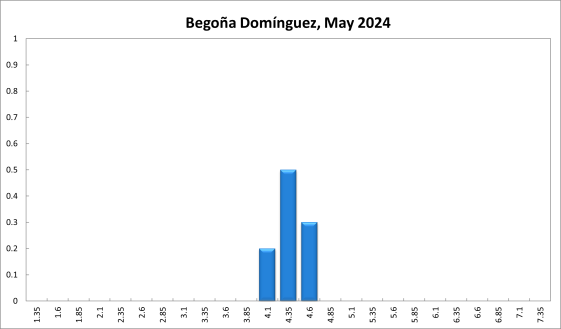

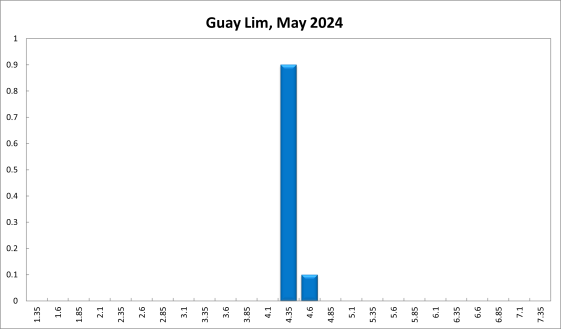

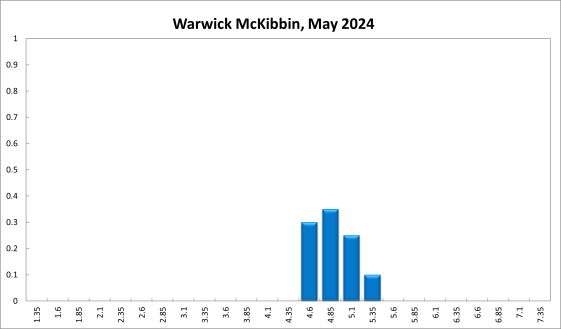

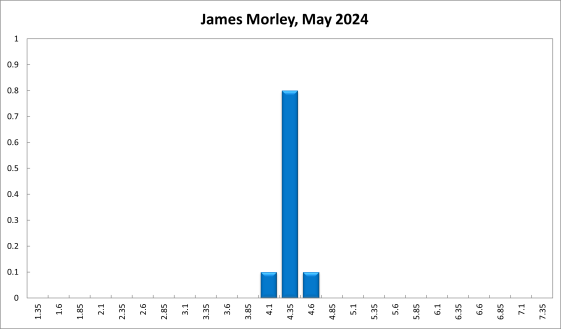

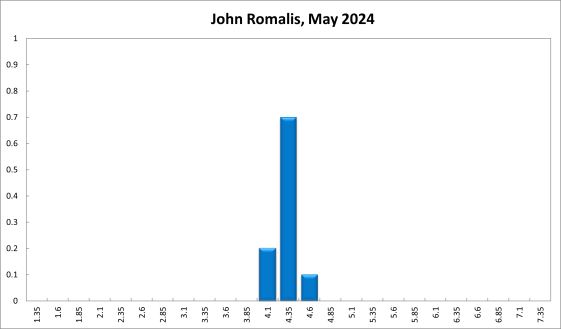

On balance, the Shadow Board recommends holding the overnight interest rate steady at 4.35%. However, compared to the last round, it is less confident about this recommendation and sees more upside risk. In particular, the Board attaches a 51% probability that keeping the overnight rate on hold is the appropriate policy (down 10 percentage points), while attaching a 44% probability (up from 29%) that the overnight right should increase, to 4.6% or higher, and a 6% probability that the overnight right should decrease to 4.1% (down from 9%).

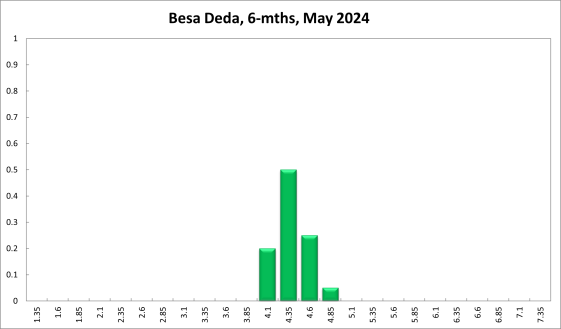

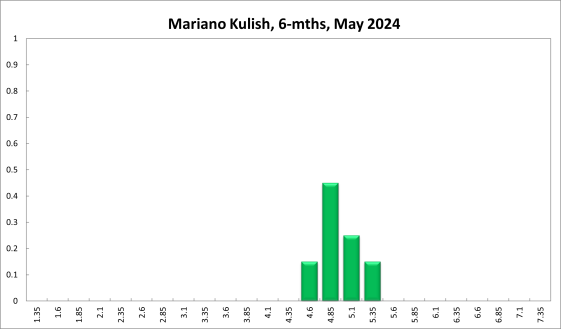

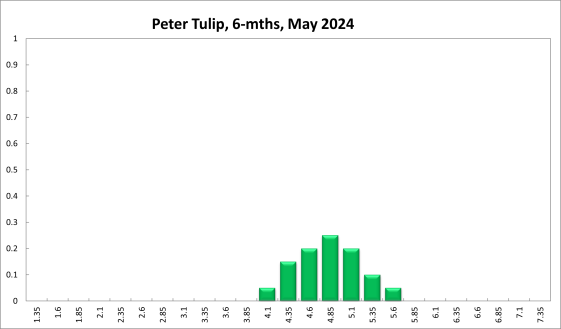

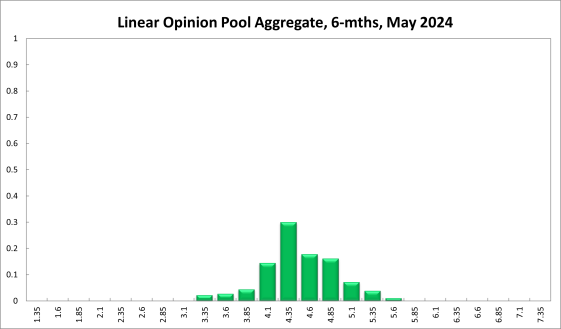

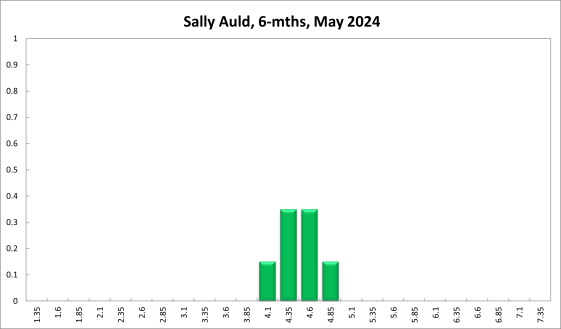

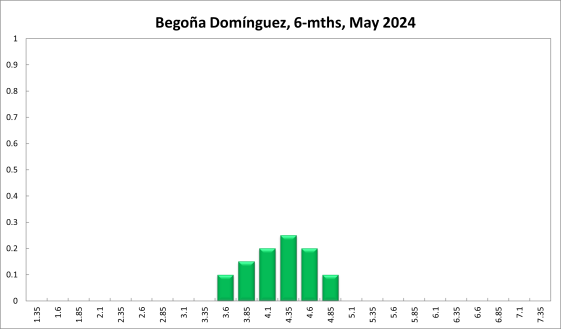

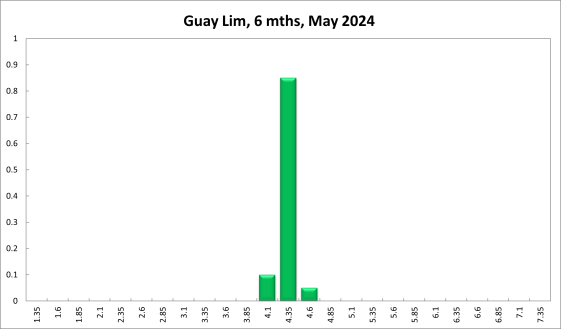

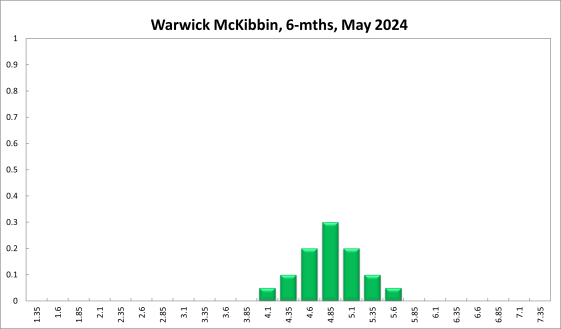

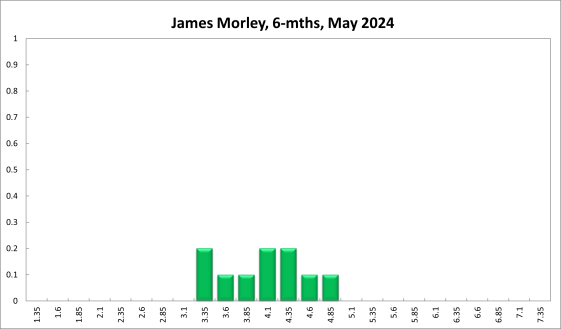

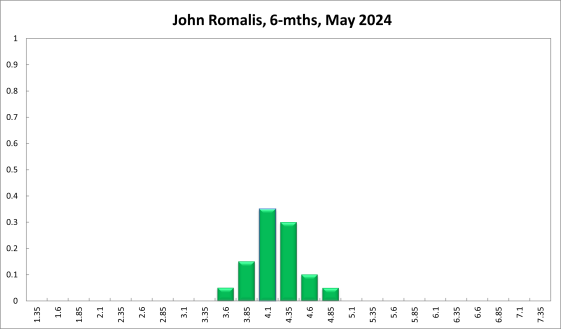

The probabilities at longer horizons broadly paint a similar picture: 6 months out, the confidence that the cash rate should remain at the current setting of 4.35% equals 30% (down 5 percentage points); the probability attached to the appropriateness of an interest rate decrease equals 24% (down 6 percentage points), while the probability attached to a required increase equals 46%. The mode recommendation at this horizon is unchanged at 4.35%.

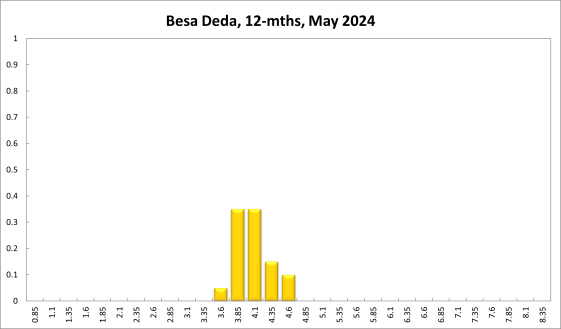

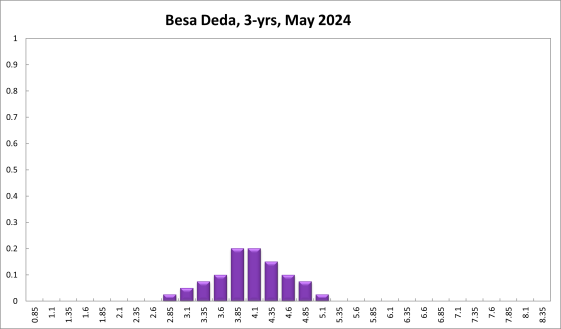

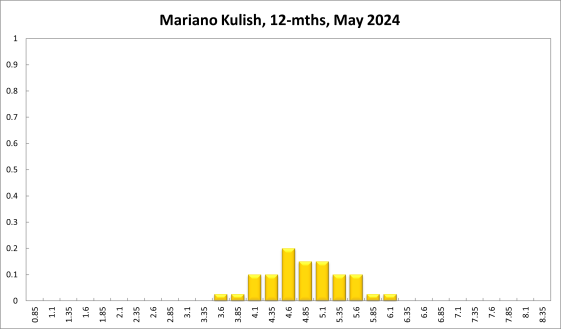

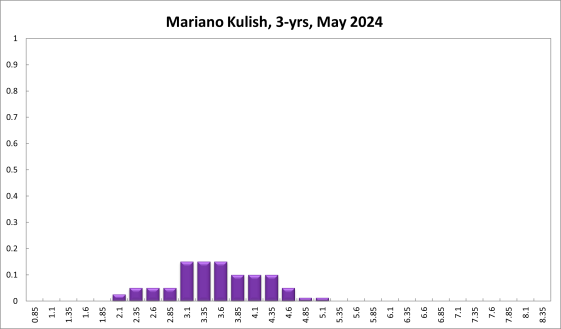

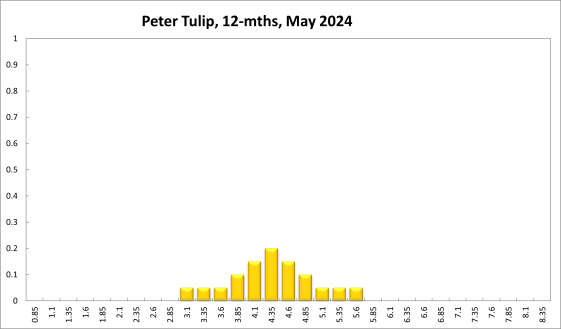

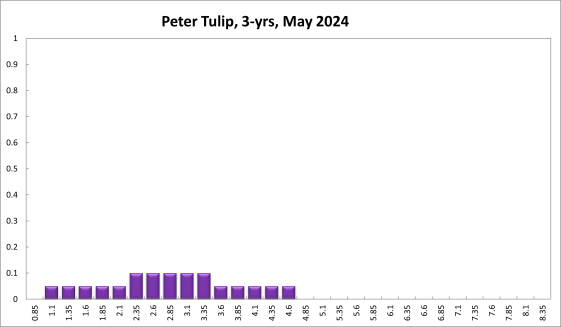

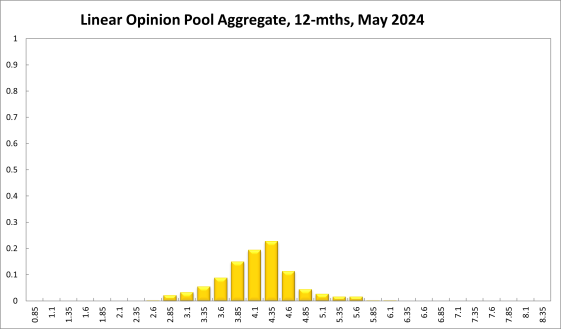

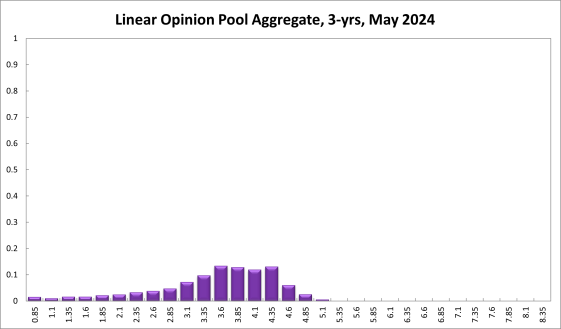

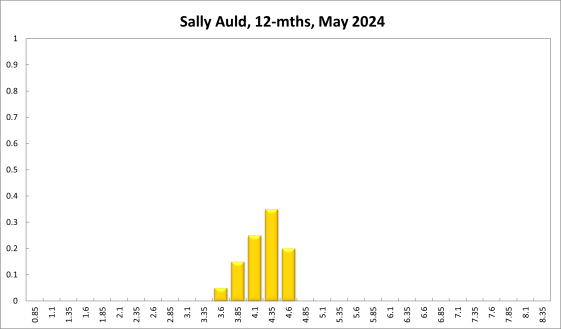

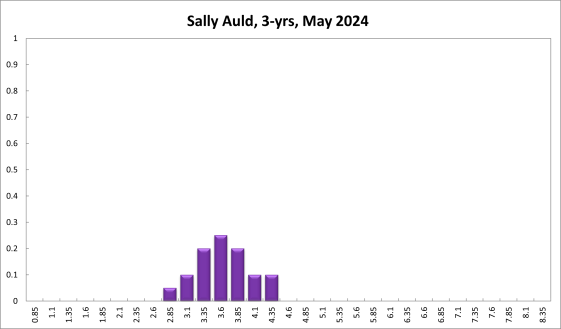

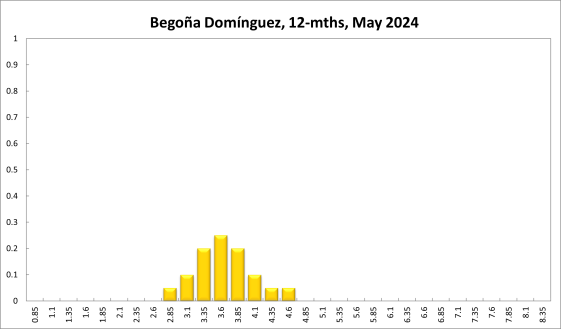

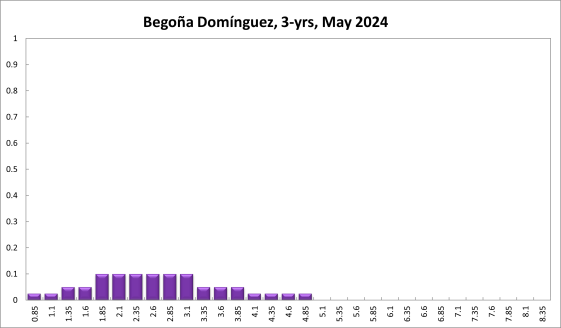

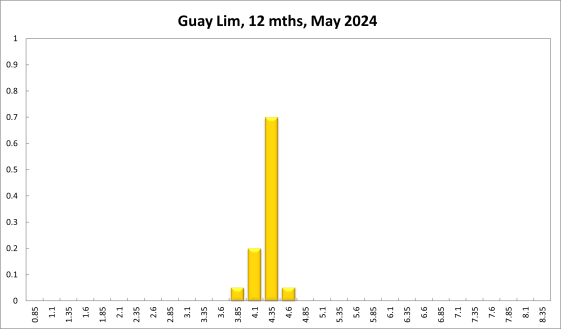

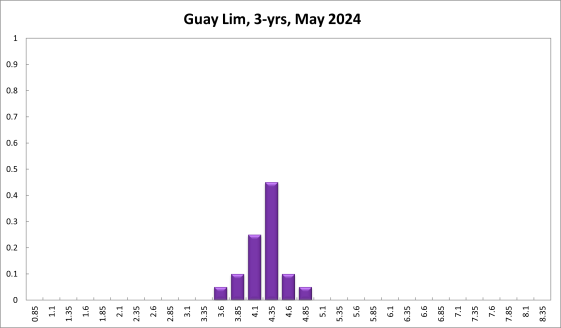

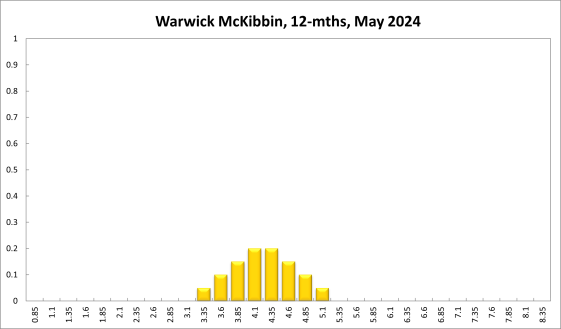

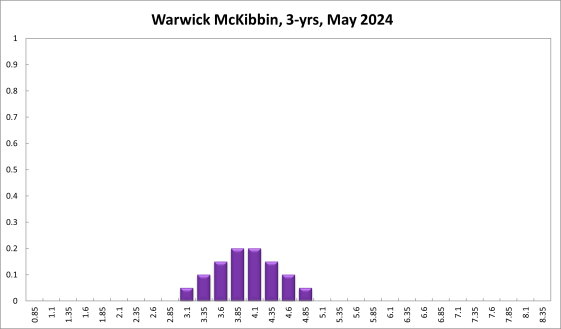

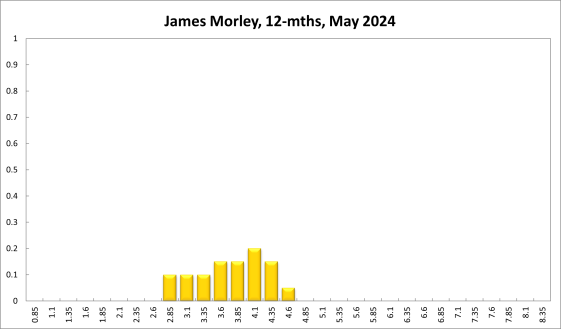

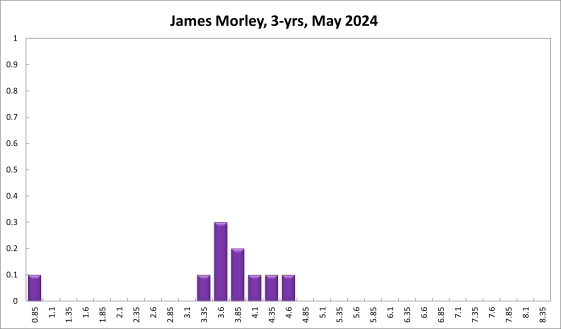

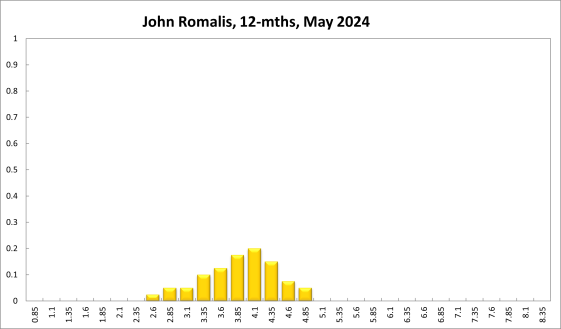

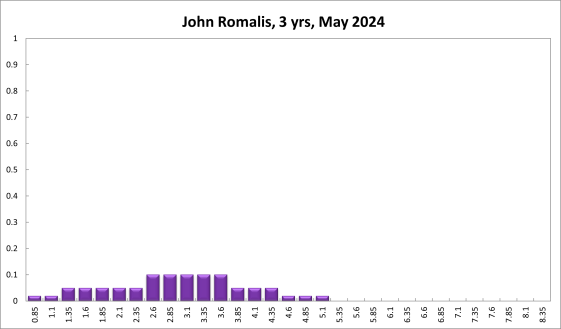

One year out, the Shadow Board members’ confidence that the appropriate cash rate should remain at the current level of 4.35%, equals 23% (up from 19%). The confidence in a required cash rate decrease, to below 4.35%, equals 55% (down from 63%), and its confidence in a required cash rate increase, to above 4.35%, is 23% (up from 18%). Three years out, the Shadow Board attaches a 13% probability that the overnight rate should equal 4.35% (down from 14%), a 78% probability that a lower overnight rate is optimal (up from 77%) and an unchanged 9% probability that a rate higher than 4.35% is optimal.

The ranges of the probability distributions have shifted up slightly as follows: They extend from 4.10% to 5.35% (previously 4.10% to 5.10%) for the current recommendation, from 3.35% to 5.6% (previously 3.10% to 5.60%) for the 6-month horizon, from 2.60% to 6.1% (previously 2.60% to 5.85%) for the 12-month horizon, and from 0.85%-5.10% (unchanged) for the 3-year horizon.