Outcome

March

2024

The RBA’s projections imply an excessively long and risky return of inflation to its target of 2.5%.

However, the outlook for unemployment has deteriorated, so further large increases in the cash rate no longer seem necessary.

Updated: 22 December 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

RBA Shadow Board Recommends Another Round Of Holding Overnight Rate Steady

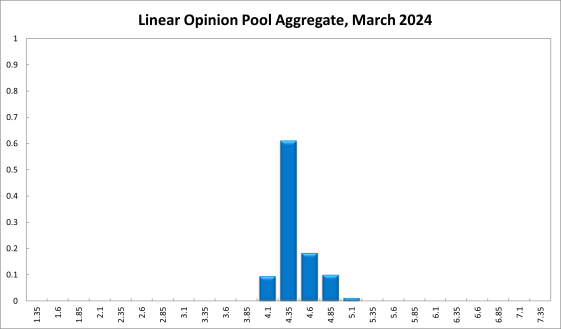

Australia’s monthly consumer price index (CPI) inflation rate was 3.4% in the year to January 2024, unchanged from the previous month and the lowest reading since November 2021, with food prices the main culprit for rising prices. The monthly CPI inflation rate, excluding volatile items, was 4.1%, still well above the RBA’s target band of 2-3%. The unemployment rate rose slightly, but consumer confidence lifted, as did the outlook for the business sector. Similar to the last round, the Shadow Board strongly favours holding the overnight rate steady at 4.35%, attaching an unchanged 61% probability that this is the optimal policy setting, while only attaching a 9% probability that a rate cut, to below 4.1%, is the appropriate policy.

The official seasonally adjusted unemployment rate, according to the Australian Bureau of Statistics, increased from 3.9% to 4.1%, the highest in two years, on the back of a small increase in full-time employment of 11,000 and a decrease in part-time employment of a similar magnitude. The labour force participation rate, too, held steady, while the underemployment rate nudged from 6.5% to 6.6%. There was no new data on job vacancies and advertisements. Hours worked in January 2024 contracted by around 49 million, or 2.5%. The seasonally adjusted wage price index, the standard measure for capturing economy-wide wages growth, increased by 4.2% year-on-year in Q4 of 2023, the highest reading in 15 years. On a quarterly basis, wages grew by 0.9%, 0.4 percentage points less than in the previous quarter. Wages are expected to grow by another 4.2% in Q1 of 2024 and similarly to the end of the year which, should inflation dampen further, implies that real wages are finally making up some of the ground lost in past years.

For the past two months, the Australian dollar has been range-bound, between 64.5 and 66.5 US¢. Yields on Australian 10-year government bonds barely moved above 4.1%. The yield curve in short-term maturities (2y vs 1yr) remains inverted, with a spread of -26.4 bps (on 17 March); the one in medium-term vs short-term maturities (5y vs 2y), however, flattened, with a small spread of 3.5 bps. The yield curve in long-term vs short-term maturities (10y vs 2y), maintains its normal convexity, with the spread widening slightly to 34.7 bps. Global stock markets are making new highs, and Australian shares are not excepted. After the S&P/ASX200 climbed above 7,800 earlier in March, it is now trading around 7,650.

Consumer confidence in January, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, improved in February, from 81 to 86. Retail sales, after a 2.7% month-over-month contraction in December 2023, expanded by 1.1% in January 2024. The NAB business confidence index, at 0 in February 2024, remains below the long-run average, notably because of a relatively weak retail sector. The Judo Bank Composite and Services PMI expanded further in February, to 52.1 and 53.1, respectively, whereas the Manufacturing PMI was down 2.3 points, from a previous reading of 50.1, also in February. The capacity utilisation rate, after a blip, fell slightly, to 83.4%. The Composite Leading Indicator increased for the fifth month in a row, to 99.1. Australian industry activity, as measured by the Ai Group Industry Index, contracted for the 22nd consecutive month, but at a lessening pace. These numbers continue to provide mixed signals, making the optimal monetary policy setting more difficult to gauge.

The outlook for the rest of the world is unlikely to improve significantly in the near future, as major economies, in particular Europe, Japan and China, have slowed significantly. For the US, where spending remains strong and the labour market tight, inflation is proving more persistent than hoped, dashing the prospect of an imminent loosening of monetary policy by the Federal Reserve. Unabated geopolitical tensions maintain pressure in the energy markets and are strengthening many countries’ resolve to decouple from global goods markets. While many analysts and international organizations still expect a “soft landing” for the world economy, sizeable downside risks remain.

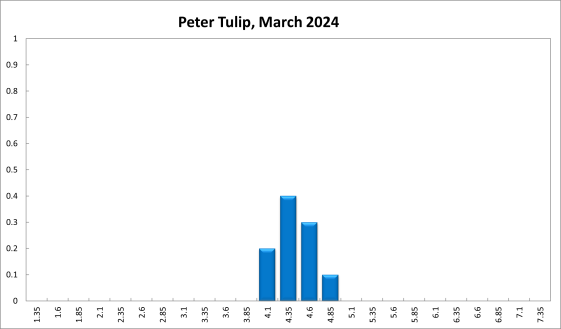

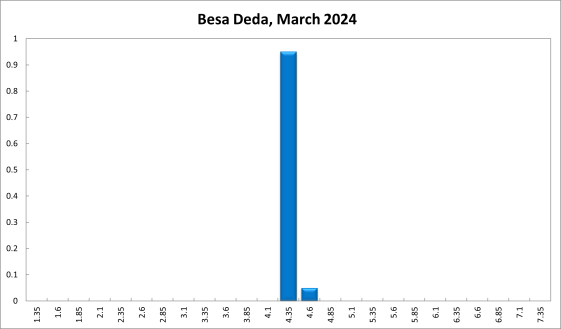

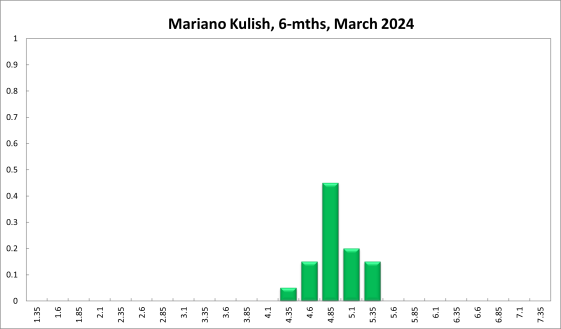

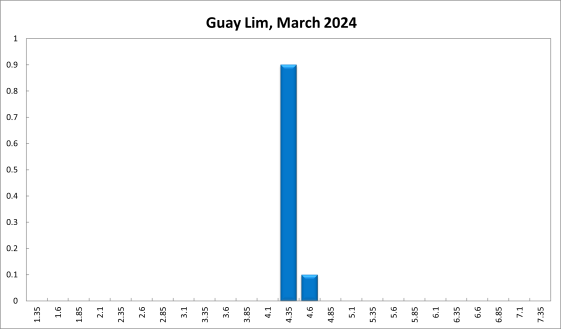

The Shadow Board’s current view of monetary policy remains firmly in favour of holding steady: it attaches an unchanged 61% probability that keeping the overnight rate, currently equal to 4.35%, on hold is the appropriate policy, while attaching a 29% probability (down 3 percentage points from the previous round) that the overnight right should increase, to 4.6% or higher, and a 9% probability that the overnight right should decrease to 4.1%.

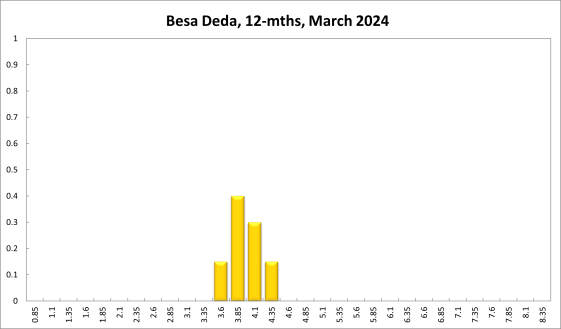

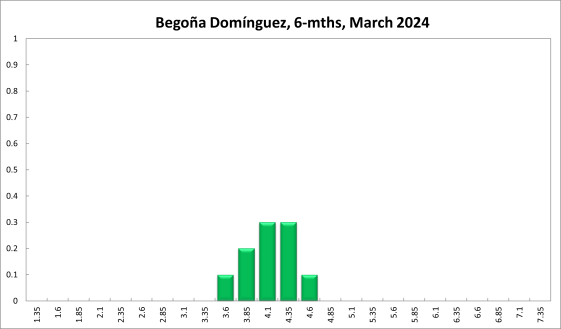

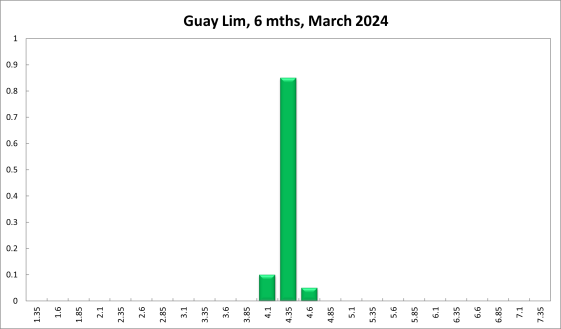

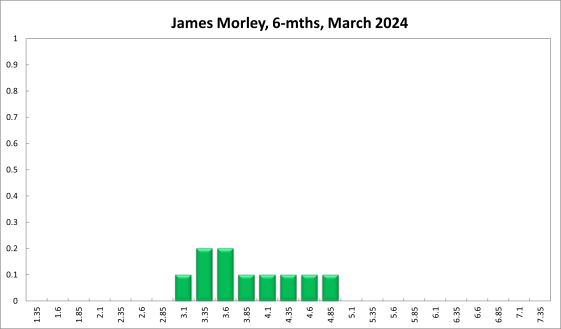

The probabilities at longer horizons, likewise, barely changed: 6 months out, the confidence that the cash rate should remain at the current setting of 4.35% equals 35% (up 2 percentage points); the probability attached to the appropriateness of an interest rate decrease equals 30% (up 2 percentage points), while the probability attached to a required increase equals 35%. The mode recommendation at this horizon continues to be 4.35%.

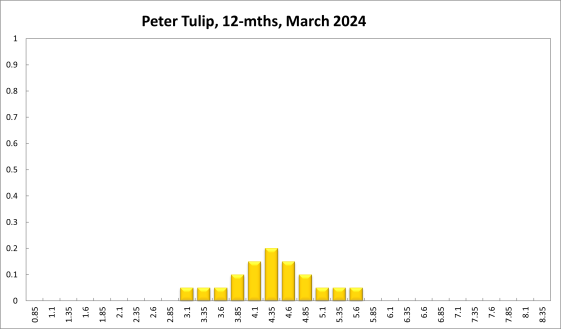

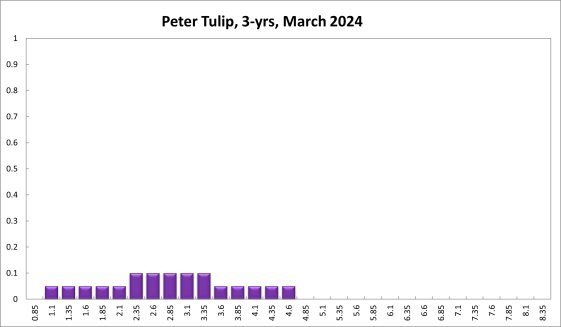

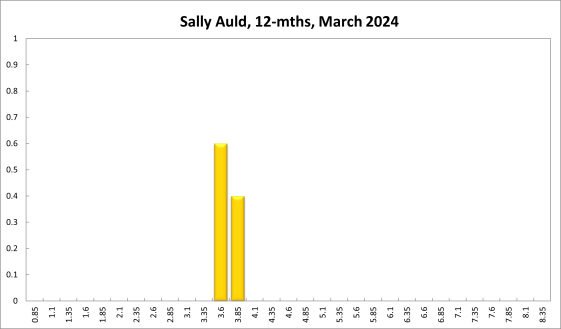

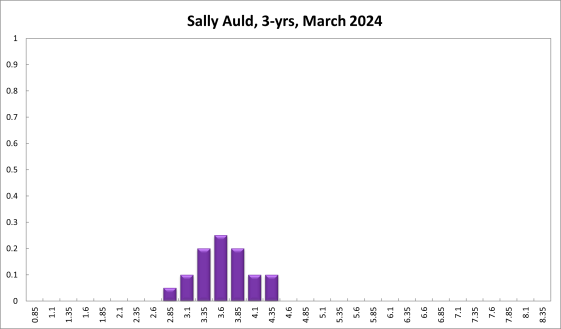

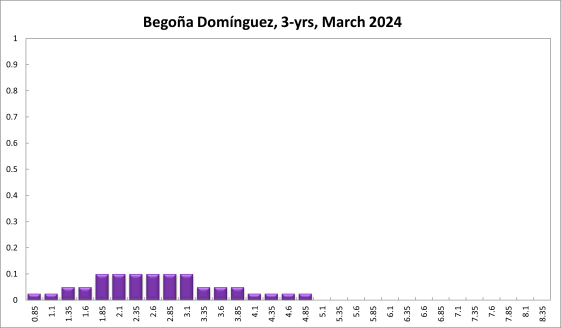

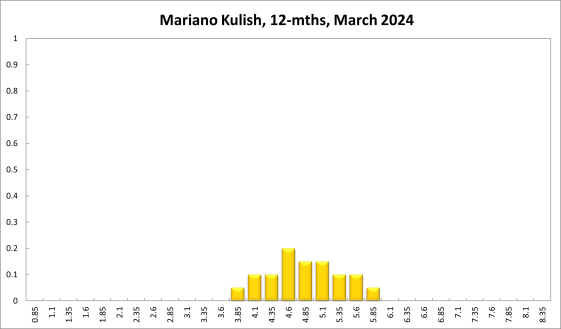

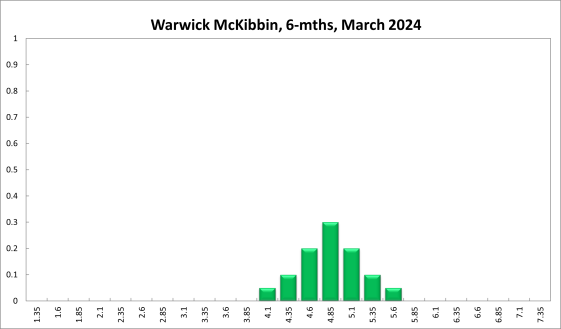

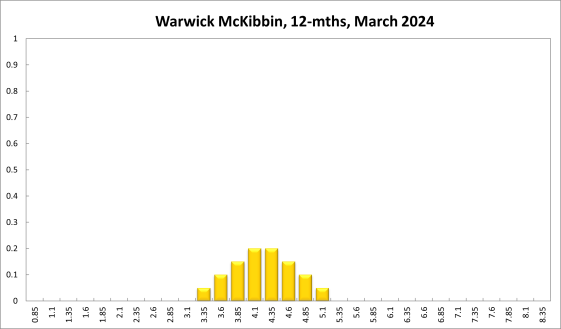

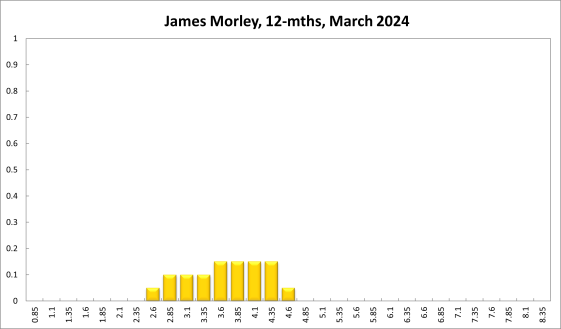

One year out, the Shadow Board members’ confidence that the appropriate cash rate should remain at the current level of 4.35%, equals 19%, as in the previous round. The confidence in a required cash rate decrease, to below 4.35%, equals 63% (up 5 percentage points), and its confidence in a required cash rate increase, to above 4.35%, is 18%. Three years out, the Shadow Board attaches an unchanged 14% probability that the overnight rate should equal 4.35%, a 77% probability that a lower overnight rate is optimal (also unchanged) and a 9% probability that a rate higher than 4.35% is optimal.

Except at the 6-month horizon, the ranges of the probability distributions have remained the same. They extend from 4.10% to 5.10% for the current recommendation, from 3.10% to 5.60% for the 6-month horizon, from 2.60% to 5.85% for the 12-month horizon, and from 0.85%-5.10% for the 3-year horizon.