Outcome

The most important information relating to monetary policy from the past few months was the RBA’s modelling of alternative interest rate paths, released under Freedom of Information. This indicated that large front-loaded increases in the cash rate, quickly taking it to 4.8 percent, would minimise a quadratic loss function with the inflation and unemployment gaps as arguments.

Foreign central banks appear to be raising their policy rates quickly for this reason. Disagreements with this analysis are unconvincing.

The RBA leadership appears to prefer a more gradual increase in the unemployment rate. However, this runs the risk of a de-anchoring of expectations and accelerating inflation. As the RBA has argued, that will involve even higher unemployment in future.

The RBA’s preferred path seems to reflect aversion to action; it would prefer to make errors of omission than errors of commission, because it gets publicly blamed for the latter.

Others oppose higher rates because they hope that the NAIRU is well below common estimates. If there was any econometric work underpinning these hopes I would take them seriously. Instead, they seem to reflect wishful thinking and a disregard of past experience. Central banks have tried to “test” below-NAIRU unemployment rates before (for example, the RBA in 2007) and the result was rapid acceleration in prices and wages.

Updated: 17 August 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Shadow Board Recommends Further Monetary Tightening, to 4.1 Percent

Australia’s monthly consumer price index (CPI) rose 6.8% in the twelve months to April, up from 6.3% in March and by the same rate as in February. This is unwelcome news as it pushes the inflation rate farther away from the RBA’s target band of 2-3%. The biggest contributor was yet again housing (+8.9%), followed by food and non-alcoholic beverages (+7.9%). The official, seasonally adjusted unemployment rate increased by 0.2 percentage points, to 3.7%. Consumer sentiment took a hit but business sentiment is still holding up quite well. Following on from last month’s interest rate increase, the RBA Shadow Board believes a further rate rise of 25 basis points, to 4.10%, is needed to bring inflation down. In particular, it attaches a 63% probability that the overnight rate should be higher than the current level of 3.85% and a 36% probability that keeping the overnight rate on hold this round is the appropriate policy.

The official Australian seasonally adjusted unemployment rate in April increased from its recent low of 3.5%, to 3.7%, while the labour force participation rate dropped a tenth of a percentage point to 66.7%. Similarly, the underemployment rate decreased to 6.1%. Also in seasonally adjusted terms, total monthly hours worked in all jobs rose by 49m, or 2.6%. Of significance is the wage price index which increased by 3.7% year-on-year in the first quarter of 2023, only 0.3 percentage points higher than in the previous quarter and well below the headline inflation rate. This suggests that so far wages are not fuelling inflation; on the contrary, real wages continue to fall appreciably.

The Australian dollar finished the month (May) near where it started, a little over 66 US¢, after testing the 68 US¢ mark on the upside and the 65 US¢ mark on the downside. Yields on Australian 10-year government bonds rose again after last month’s increase in the overnight rate, putting them at 3.65%, roughly 20 bps below the current cash rate. The spreads between short-/medium-term and 10-year bonds dropped so that all the yield curves are currently inverted. Australian shares retreated slightly from their recent local highs, with the S&P/ASX 200 stock index closing the month of May near 7,100.

The volatile Melbourne Institute and Westpac Bank Consumer Sentiment Index fell by nearly 8% month-over-month in May 2023, to 79.0, a much bigger drop than implied by market expectations. NAB’s index of business confidence, notched up from -1 in March to 0 in April, led by wholesale and followed by finance, business & property, retail and construction. The Judo Bank Australia Composite PMI and Services Sentiment indicator both dropped in May, from 53 to 51.2 and from 53.7 to 51.8, respectively; the Industrial/Manufacturing Sentiment indicator ticked up, from 48 to 48.4, in the same period. The capacity utilisation rate held up in April, as did the Composite Leading Indicator. Considering the consumer and business indicators together, it looks as though the Australian economy may be softening but only slightly, despite the recent extended string of interest rate hikes.

The federal government’s budget, handed down by Treasurer Jim Chalmers on 9 May, revealed much higher personal income tax and company tax receipts than anticipated and thus significantly improves the government’s fiscal position. With many spending programs aimed at modestly relieving cost of living pressures, the budget delivers a small surplus of $4.2 billion. With respect to its impact on inflation, the budget is likely to be broadly neutral.

The outlook for the world economy remains one of the biggest sources of uncertainty. This became evident during the World Economic Forum’s Growth Summit, which took place on 2-3 May 2023, where leading economists were perfectly divided in their projections: 45% thought a global recession is somewhat likely or extremely likely, while the same percentage thought it was somewhat or extremely unlikely. The main concerns are by now familiar: elevated inflation, high energy prices, disrupted supply chains, geopolitical risks, contraction of international trade, financial sector stress.

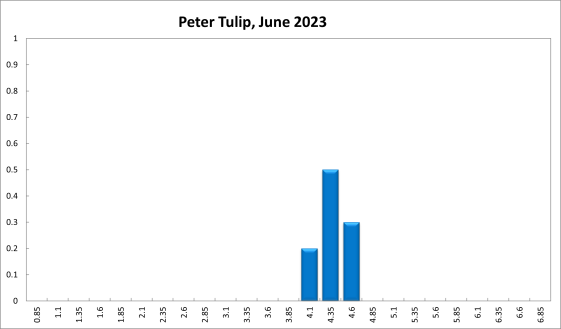

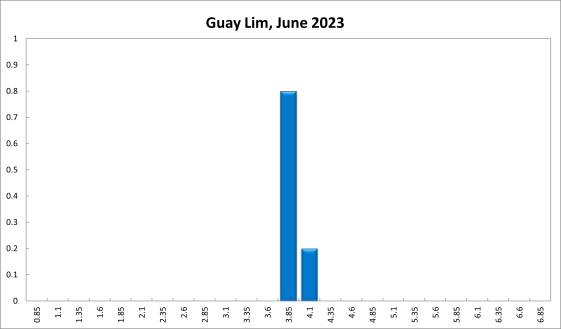

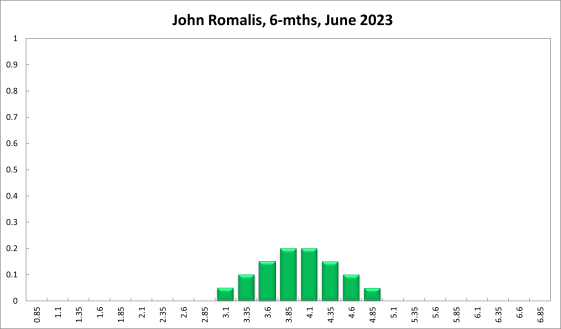

For the current (June) round, the Shadow Board believes that, on balance, the overnight rate should rise again: it is attaching a 36% probability that pausing the tightening cycle is the appropriate policy and a 63% probability that another rate rise, above the current level of 3.85%, is the appropriate policy stance, with a mode recommendation of a 25 bps increase to 4.10%. The probability attached to a required rate reduction is negligible (only one percent).

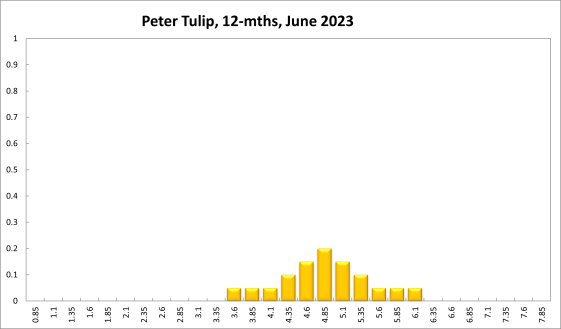

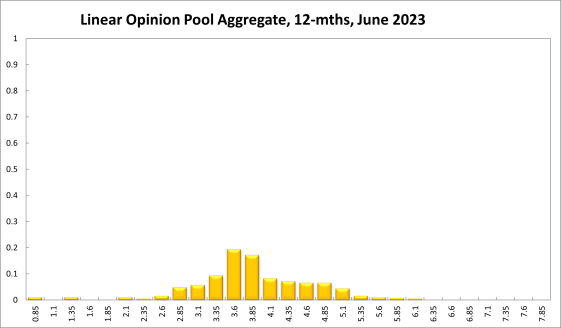

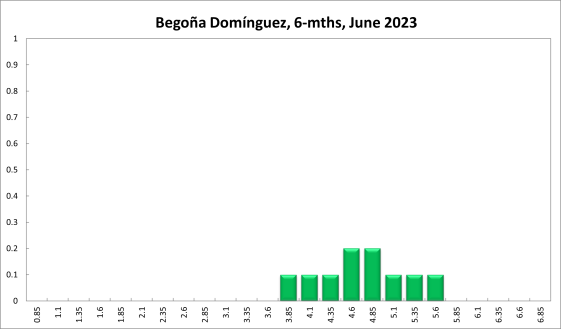

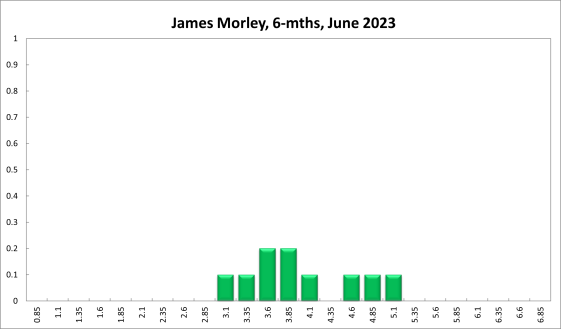

The probabilities at longer horizons have shifted slightly: 6 months out, the confidence that the cash rate should remain at the current setting of 3.85% equals 21%; the probability attached to the appropriateness of an interest rate decrease equals 15%, while the probability attached to a required increase equals 64%. The mode recommendation at this horizon is, as for the current recommendation, 4.10%, 25 bps above the current level.

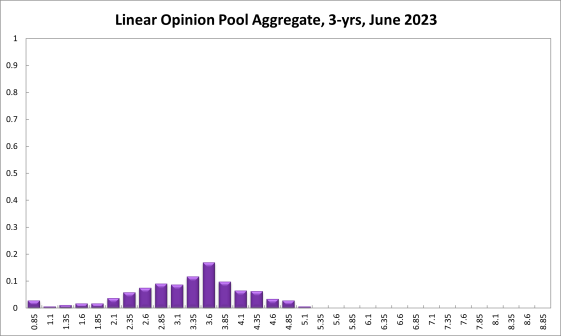

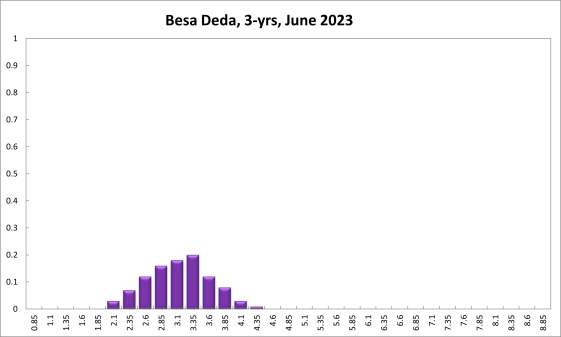

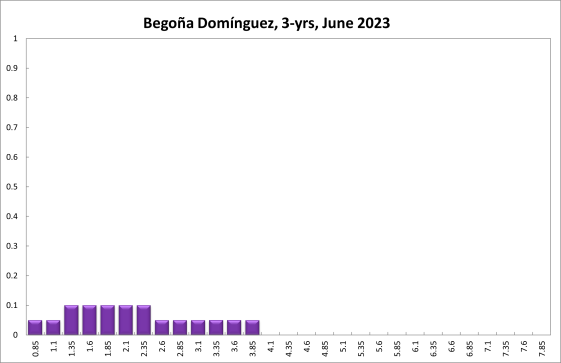

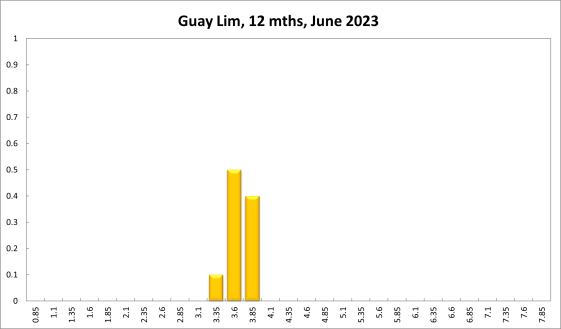

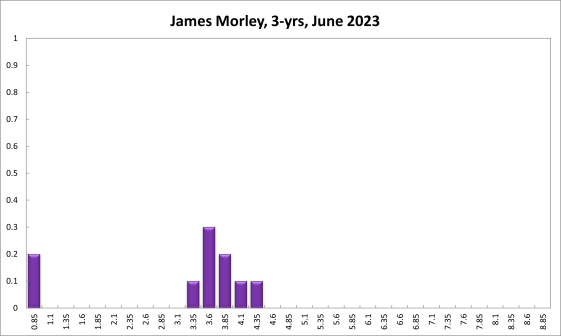

One year out, the Shadow Board members’ confidence that the appropriate cash rate is at the current level of 3.85% equals 17%. The confidence in a required cash rate decrease, to below 3.85% equals 45%, and its confidence in a required cash rate increase, to above 3.85%, is 38%. Three years out, the Shadow Board attaches a 10% probability that the overnight rate should equal 3.85%, a 71% probability that a lower overnight rate is optimal and a 19% probability that a rate higher than 3.85% is optimal.

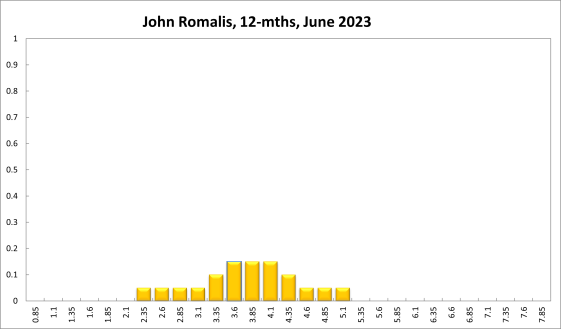

The range of the probability distribution for the current recommendation expanded by 25 bps, extending from 3.60% to 4.60% (compared to a range of 3.60% to 4.35% in the previous round). For the 6-month horizon it extends from 3.35% to 5.85% (compared to a range of 2.60% to 5.60% in the previous round). The range for the 12-month horizon, at 0.85%-6.10%, has merely shifted up 25 bps, whereas the range for the 3-year horizon contracted by 150bps, from 0.60%-6.35% to 0.85%-5.1%.