Outcome

With CPI inflation running at 7.8% annually and 6.8% in February, and the policy rate at 3.6% real interest rates are significantly negative. The nominal policy rate is also well below the most recent growth in nominal GDP at 2.1% (8.4% annualized) in the December quarter and 12% of the year to December. Monetary policy will need to be more contractionary if inflation is to fall back into the target band of 2-3%. Higher interest rates are not only needed to slow consumption but also to offset the weaker $A which feeds further into imported goods inflation. While major central banks are raising interest rates the inflationary impulse from overseas will be felt in Australia through higher import prices exacerbated by a weaker $A. The more slowly the RBA responds the more likely that other input costs such as wages will also respond to the inflationary impulse making the work of monetary policy that much harder over the medium term. Concerns about possible financial stability can be dealt with using other instruments of financial stability policy and income distribution issues should be dealt with by fiscal policy. Neither of these issues should deter the RBA from its main goal of returning inflation to target.

The RBA’s inflation forecast seems optimistic.

We have strong upward pressures on wages, rents, electricity, and inflation expectations.

Admittedly, recent inflation was boosted by temporary supply constraints that are unwinding. But experience in countries where these constraints emerged earlier does not suggest they will bring a quick disinflation.

Coupled with an unemployment rate that is very low and falling, policy needs to tighten faster than the RBA’s assumptions.

To pause for reasons of financial stability would be counter-productive. It would imply that the RBA is worried about something the public has not been told about.

Updated: 5 January 2025/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Caution Growing but Shadow Board Recommending Further 25bp Cash Rate Increase

Australia’s monthly consumer price index (CPI) rose 6.8% in the year to February, down from 7.4% in January, still well above the RBA’s target band of 2-3%. The biggest contributors to this increase were housing (+9.9%), food and non-alcoholic beverages (+8.0%), and transport (+5.6%). Although the labour market remains very firm, the consumer and business outlook weakened slightly, suggesting past interest rate rises are slowly affecting spending. The RBA Shadow Board believes another rate rise, to 3.85%, is called for. In particular, it attaches a 66% probability that the overnight rate should be higher than the current level of 3.60%. However, it attaches a 34% probability that keeping the overnight rate on hold this round is the appropriate policy, suggesting growing caution about further tightening.

The official Australian seasonally adjusted unemployment rate in February improved from 3.7% to 3.5%. Total employment increased by 65,000 and full-time employment even rose by 75,000. The labour force participation rate edged up 0.1 percentage points, to 66.6%, whereas the underemployment rate dropped by 0.3 percentage points. Also in seasonally adjusted terms, total monthly hours worked in all jobs increased by a massive 72 million, or 3.9%. Wage growth data is collected with substantial lags; so far there is little evidence that the spike in inflation has led to a concomitant increase in wages pressure.

The Australian dollar went mostly sideways, finishing the month close to where it started, near the 67 US¢ mark. Yields on Australian 10-year government bonds fell significantly, from 3.9% to below 3.3%, that is, to below the current cash rate. The spread between 2-year and 10-year bonds remained constant. At longer maturities, the yield curve is virtually flat, at short-term and medium-term maturities, the yield curves remain inverted. There is growing uncertainty about the rate at which interest rates will peak in the current cycle, and when. Australian shares went south but recovered some ground in the final days of the month; the S&P/ASX 200 stock index concluded this week’s trading just shy of 7,200.

The Melbourne Institute and Westpac Bank Consumer Sentiment Index was unchanged in March, whilst retail sales grew 0.2% month-on-month in February, a significant drop from the 1.8% posted in January. NAB’s index of business confidence dropped 10 points to -4 in February. The Composite Leading indicator remained unchanged at 98.6 points and the Judo Bank Australia Composite PMI dropped to 48.1 in March, down 2.5 points from February. The Westpac-Melbourne Institute Leading Economic Index, a leading indicator of economic activity, fell for the fourth month in a row, while the Small Business Sentiment index remains in negative territory. The capacity utilisation rate also dropped by half a percentage point. Overall, these readings point to a deterioration of the economic outlook, both for the manufacturing and services industries, which is to be expected following the most aggressive monetary tightening in decades. However, so far there are no signs of an impending collapse of economic activity and so a soft landing still looks feasible.

The real estate market remains an important risk factor as house prices continue to retreat from last year’s high and more than 800,000 fixed interest rate mortgages are about to convert to adjustable rates. Early this year, nearly one quarter of mortgage holders were estimated to be at risk of mortgage stress, which occurs when homeowners put more than 30% of pre-tax income to mortgage payments. Currently, high employment rates are preventing most households from defaulting but even a modest uptick in the unemployment rate could change the picture significantly.

The global economy is still suffering from the conflation of high inflation, high energy prices, high indebtedness and geopolitical tensions, with few signs any of these are abating. The failure of SVB in California and some smaller banks turned the spotlight once again onto the financial system and its fragilities, which are making it far more difficult for central banks to pursue their joint economic and financial mandates.

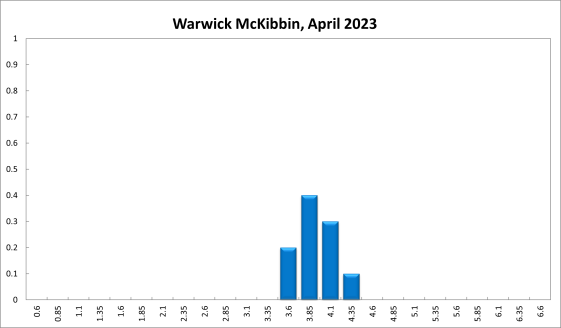

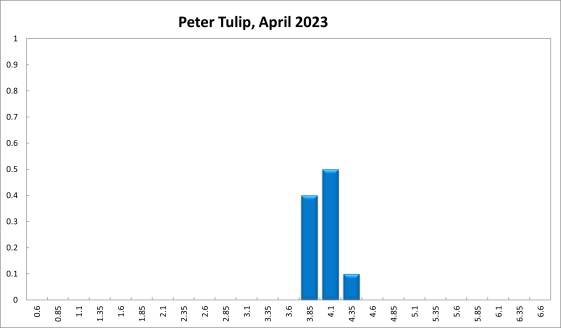

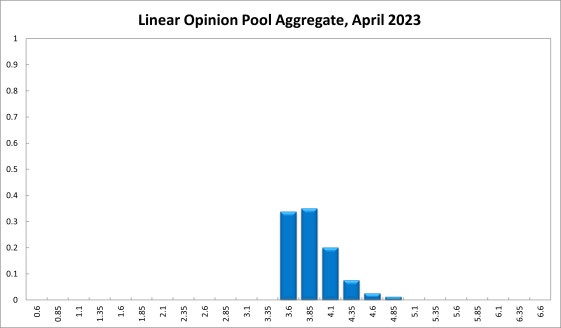

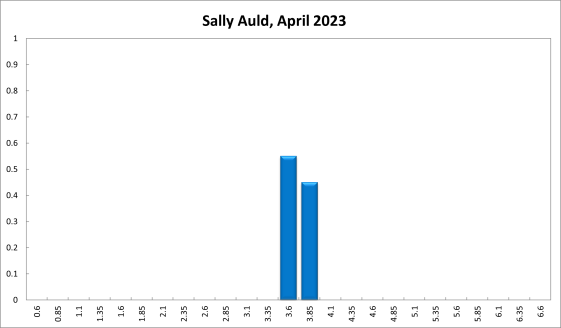

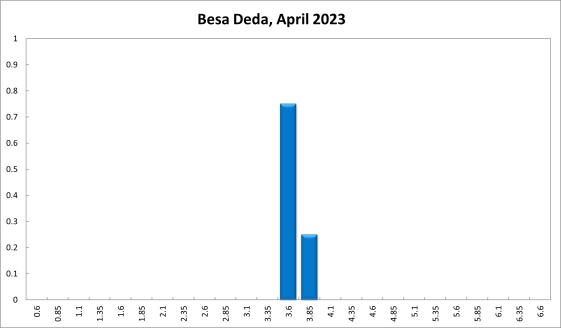

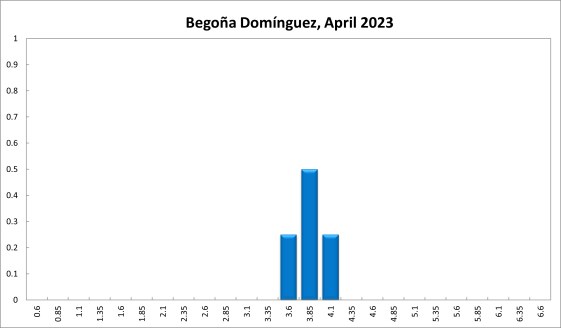

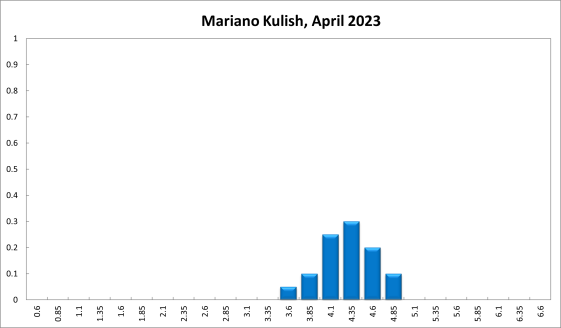

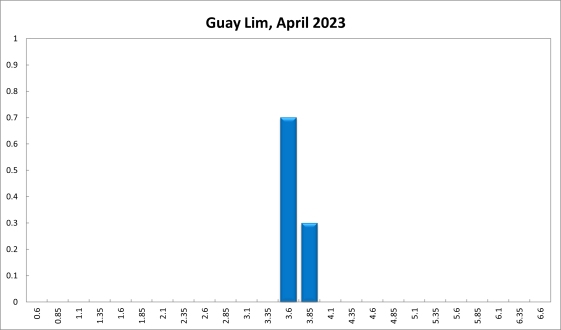

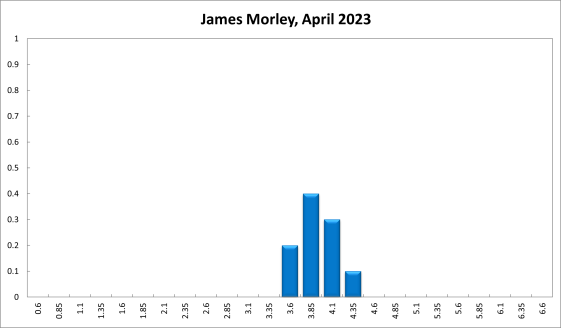

For the current (April) round, the Shadow Board is less confident about the need for further tightening, compared to previous rounds: it is attaching a 34% probability that pausing the tightening cycle is the appropriate policy. Correspondingly, it is attaching a 66% probability that another rate rise, above the current level of 3.60%, is the appropriate policy stance, with a mode recommendation of a 25 bp increase to 3.85%. The Board completely rules out the possible need to cut the overnight rate.

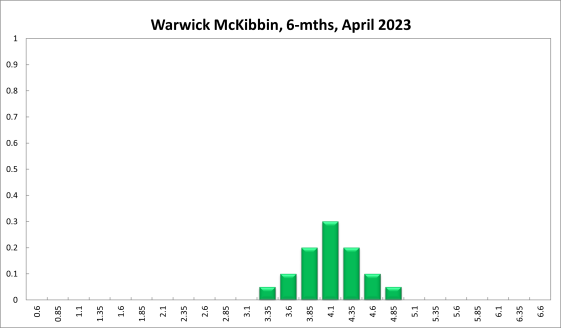

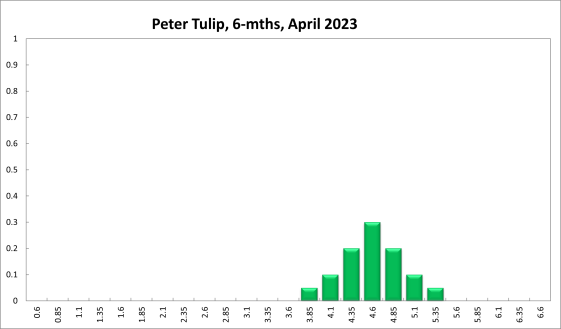

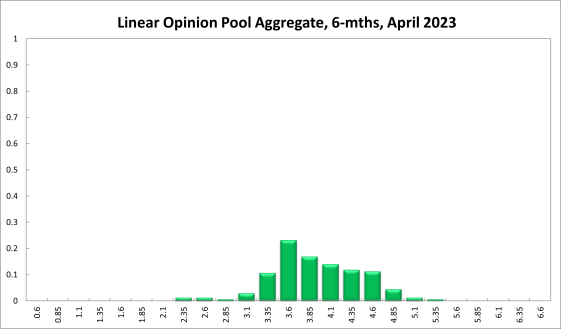

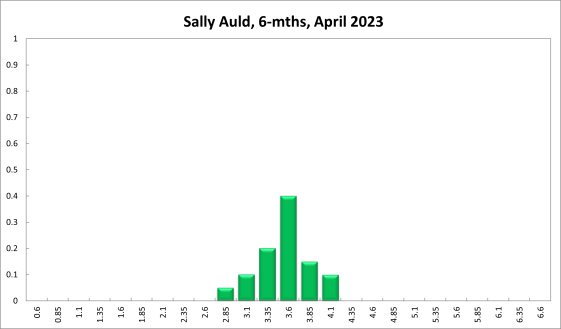

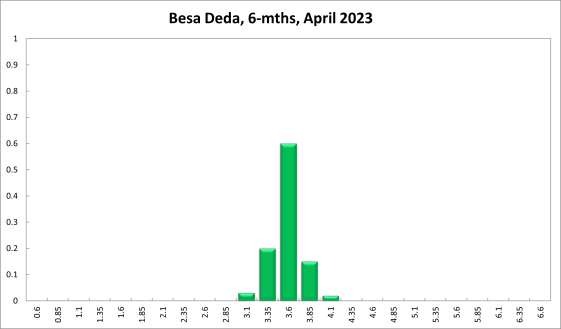

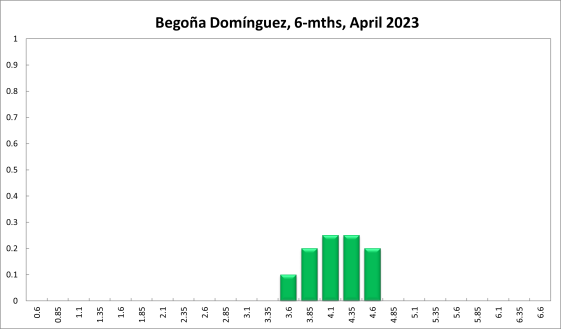

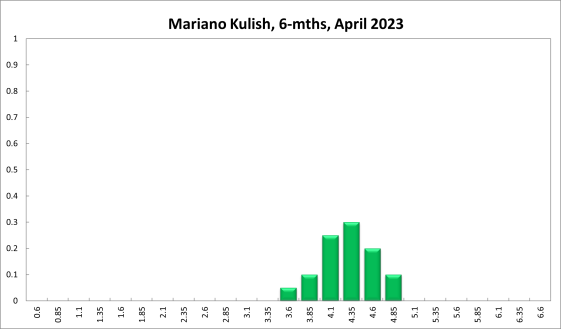

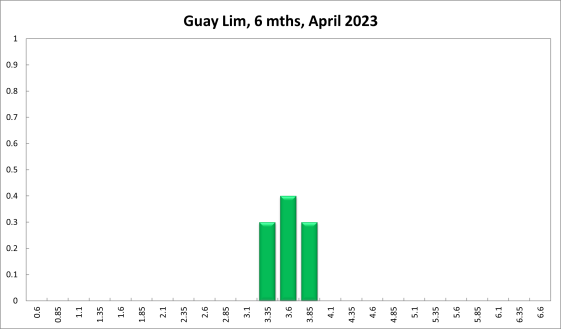

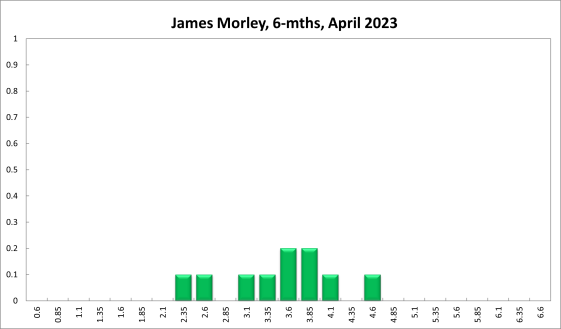

The probabilities at longer horizons look a bit different: 6 months out, the confidence that the cash rate should remain at the current setting of 3.60% equals 23%; the probability attached to the appropriateness of an interest rate decrease equals 17%, while the probability attached to a required increase equals 60%. The mode recommendation at this horizon is, once again, 3.85%, 25 bps above the current level, the same level as in the February and March rounds.

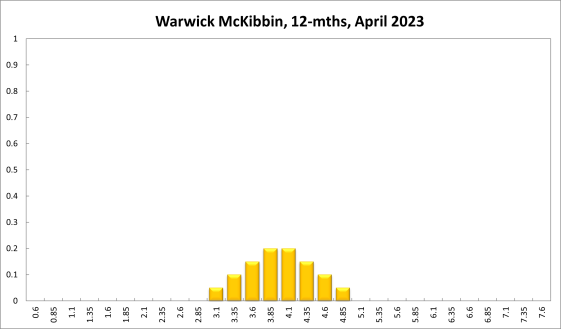

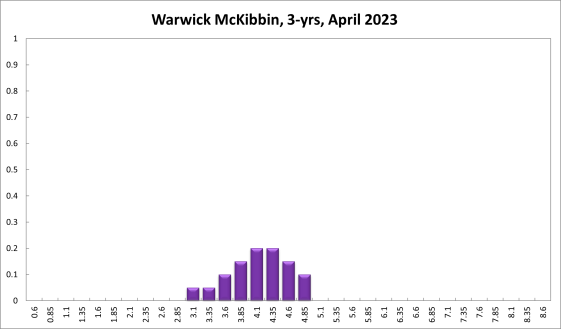

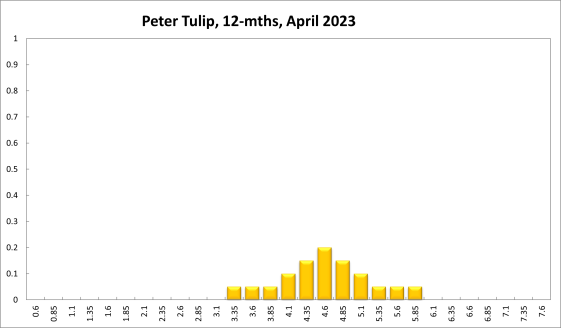

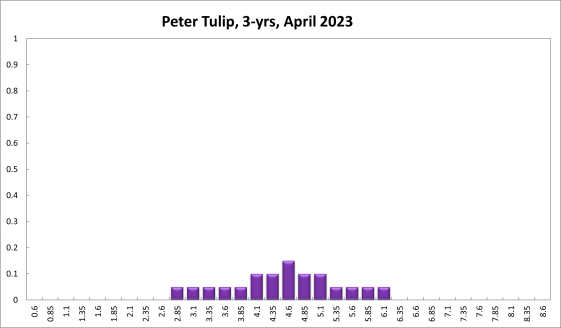

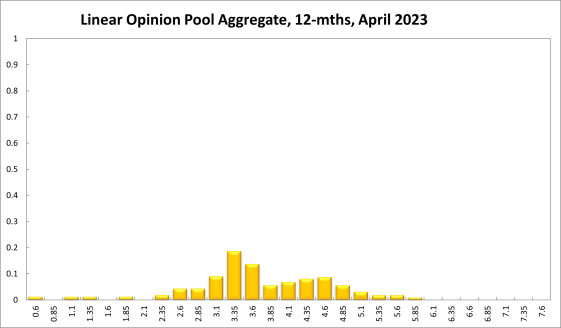

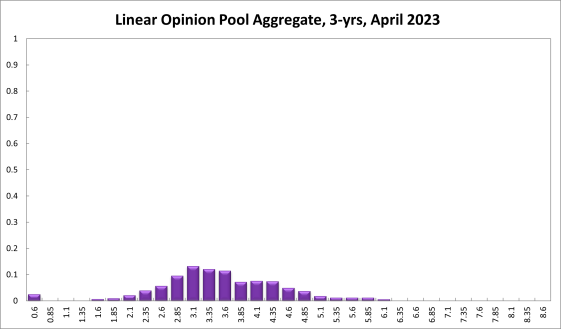

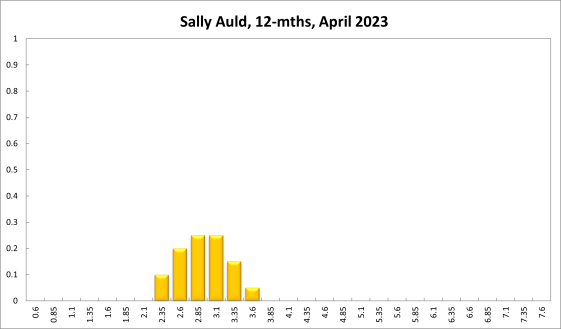

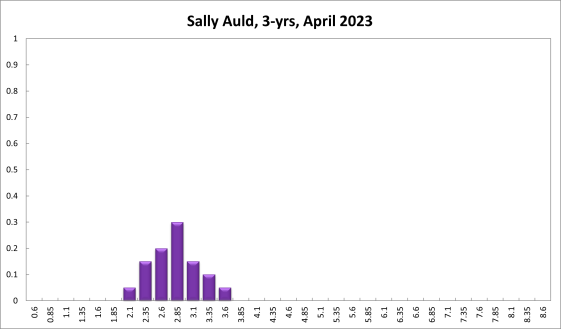

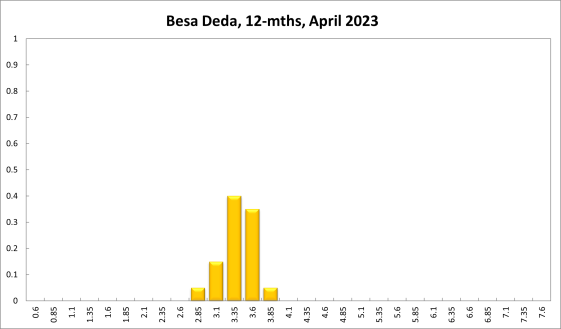

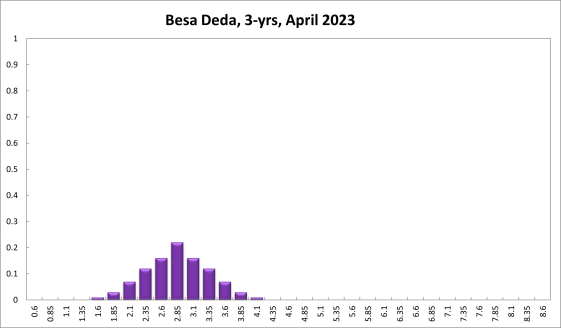

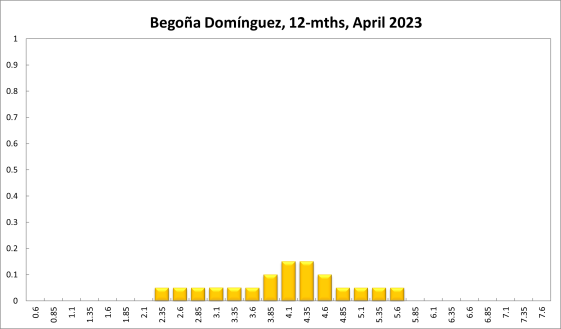

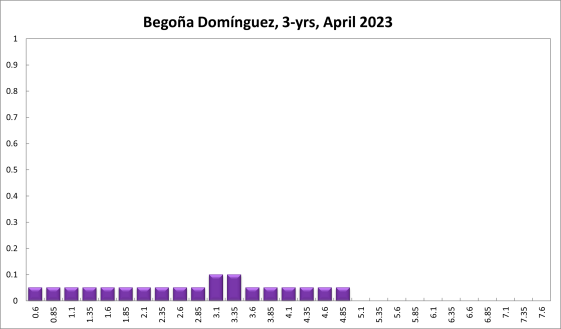

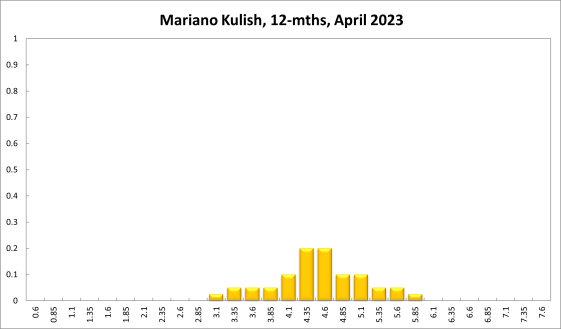

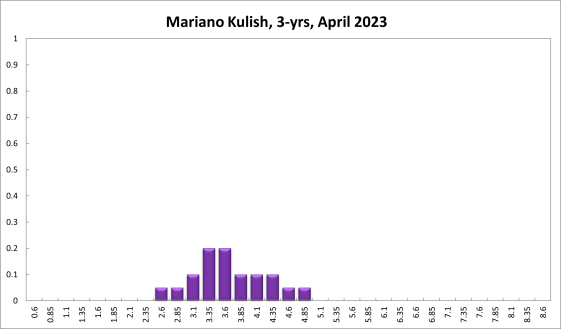

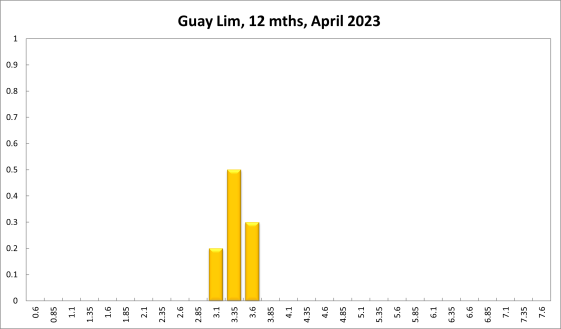

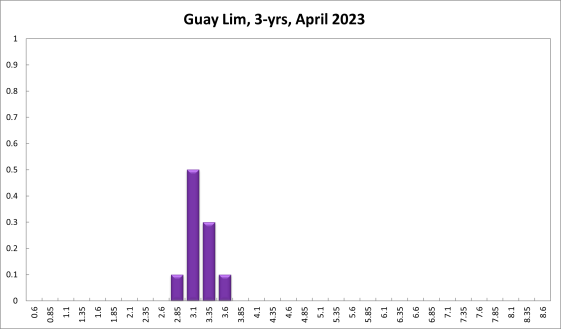

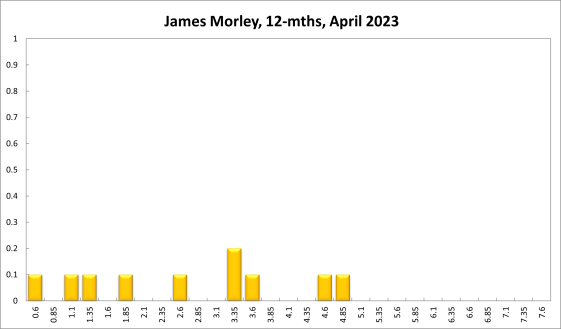

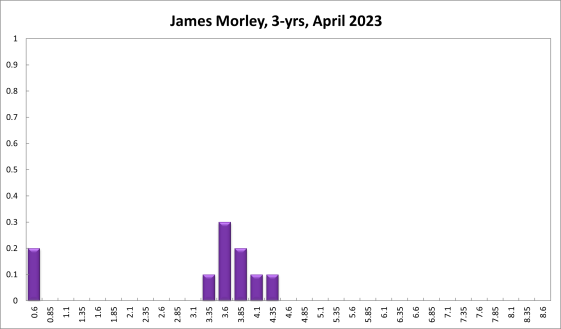

One year out, the Shadow Board members’ confidence that the appropriate cash rate is at the current level of 3.60% equals 14%. The confidence in a required cash rate decrease, to below 3.60%, is 43% and in a required cash rate increase, to above 3.60%, equals 43%. Three years out, the Shadow Board attaches a 12% probability that the overnight rate should equal 3.60%, a 51% probability that a lower overnight rate is optimal and a 37% probability that a rate higher than 3.60% is optimal.

The range of the probability distributions shifted up and widened by 25 bps. For the current recommendation the distribution extends from 3.60% to 4.85% (compared to a range of 3.35% to 4.35% in the previous round). For the 6-month horizon it extends from 2.60% to 5.35% (compared to a range of 2.60% to 5.85% in the previous round). The range for the 12-month horizon changed from 0.35%-6.1% to 0.60%-5.85%. The range for the 3-year horizon changed from 0.35%-6.35% to 0.60%-6.10%.