Outcome

The RBA should increase the cash rate and communicate its intention to continue to do so until there is substantial evidence that inflation has turned the corner. The latest monthly measure of inflation fell, which is a positive development, but this is one number and inflation at 7.4% is still too high for the current level of the cash rate. In fact, the real cash rate is near a historic low which suggests that monetary policy settings remain quite expansionary. More needs to be done to put monetary policy on a more contractionary stance over the forecast horizon in order to ensure inflation returns to target and inflation expectations remain anchored.

The RBA’s policy settings seem to depend on wishful thinking.

They are hoping that nominal wage growth remains moderate, despite repeated experience of rapid acceleration when the labour market was less tight than it is now.

They are hoping that inflation expectations remain anchored – despite several years of inflation exceeding its target. At some point price and wage setters will start to look at the data and question the RBA’s infallibility.

They are hoping that huge increases in advertised rents do not flow through to paid rents.

They are hoping that supply blockages quickly disappear.

All these risks are asymmetric, with the RBA banking on everything going right. They are not balancing the risks.

They want to avoid an increase in unemployment, which is understandable. But the choice is between a small increase in unemployment now, from a position of overheating when it is bearable; or the risk of a much larger increase later if higher inflation becomes entrenched.

Updated: 27 July 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Shadow Board Advocates Another 25bp Increase of the Cash Rate

According to the Australian Bureau of Statistics, the monthly consumer price index (CPI) rose 7.4% in the year to January. The most significant contributors to this increase were housing (+9.8%), food and non-alcoholic beverages (+8.2%) and recreation and culture (+10.2%). The CPI index excluding volatile items increased by 7.2%, and thus remains far above the RBA’s target band of 2-3%. There are growing signs past interest rate increases are working their way through the economy, which are for example reflected in a weakening consumer outlook, but current economic conditions remain relatively benign. The RBA Shadow Board is convinced further monetary tightening is appropriate. In particular, it attaches an 81% probability that the overnight rate should be higher than the current level of 3.35%, with a mode recommendation of a 25 bps increase, to 3.60%. It attaches a 19% probability that keeping the overnight rate on hold this round is the appropriate policy.

The official Australian seasonally adjusted unemployment rate in January increased from 3.5% to 3.7%, on the back of a small decrease in total employment (-11,500) and a small decrease in the labour force participation rate, to 66.5%. The underemployment rate remained steady at 6.1%. In seasonally adjusted terms total monthly hours worked in all jobs decreased by a substantial 2.1%. The seasonally adjusted wage price index, which unfortunately is only collected quarterly, increased by 3.3% in Q4 of 2022, slightly below the market forecast. This growth rate falls well short of the inflation rate, implying that real wages are currently shrinking by approximately 4%. The upside is that inflationary expectations are remaining remarkably subdued, at least for the moment.

The Australian dollar lost a bit of ground, finishing the month of February barely above 67 US¢. Yields on Australian 10-year government bonds continued to climb and now stand at 3.9%. The spread between 2-year and 10-year bonds has shrunk to below 23 bps, so that, at longer maturities, the yield curve is virtually flat. At short-term and medium-term maturities, the yield curves are inverted. Whether this foreshadows a significant slowdown remains to be seen. Australian shares matched the slide in bond yields and the domestic currency, with the S&P/ASX 200 stock index dropping some 300 points in February, to below 7,300.

After a brief rebound, consumer confidence, as measured by the Melbourne Institute and Westpac Bank Consumer Sentiment Index, continued its year-long decline, from 84.3 in January to 78.5 in February. Retail sales, on the other hand, exceeded market expectations and grew by 1.9% month-on-month. The household saving rate fell for the fifth consecutive month, to 4.5% in December 2022, which roughly equals the level prior to the Covid-19 pandemic. Business indicators, on the other hand, looked up: the NAB’s index of business confidence rose from 0 to 6 in January, close to its long-run average. The manufacturing PMI remained in negative territory, at -6.4, which is nonetheless a significant improvement of more than 10 points. The Judo Bank Australia Services PMI also improved in February (from 48.6 to 50.7). The capacity utilisation rate in January equalled 85.74%, an increase of more than two percentage points. The Westpac-Melbourne Institute Leading Economic Index, a leading indicator of economic activity, fell by 0.1%, the same as in the previous month. The overall picture that emerges from the performance and sentiment indicators is mixed. Businesses are doing alright on the back of relatively strong consumer spending, but the outlook for the future looks less rosy, which presumably reflects the impact of inflation on household budgets as well as tighter monetary policy.

There are no significant shifts in the global economic outlook, the main risks still emanating from the war in Ukraine and other geopolitical tensions, high energy prices, possible disruptions in financial markets, and a retrenchment of international trade.

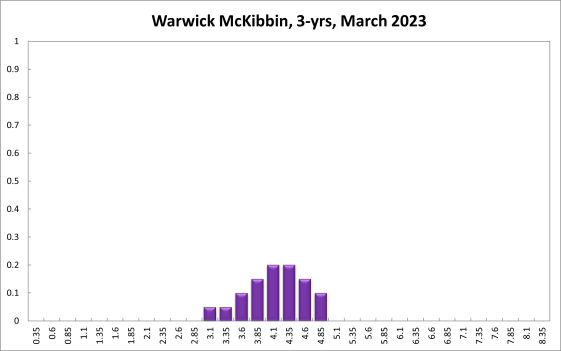

For the current (March) round, the Shadow Board’s conviction that the tightening cycle needs to continue has strengthened. It is attaching an 81% probability that another rate rise, above the current level of 3.35%, is the appropriate policy stance, with a mode recommendation of a 25 bp increase to 3.6%. The Board attaches a 19% probability that keeping the overnight rate on hold is warranted, and it completely rules out the possible need to cut the overnight rate.

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 3.35% equals 9%; the probability attached to the appropriateness of an interest rate decrease equals 7%, while the probability attached to a required increase equals 84%. The mode recommendation at this horizon is 3.85%, 50 bps above the current level, the same level as in the February round.

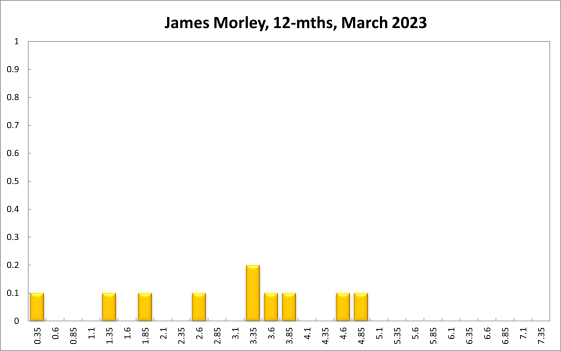

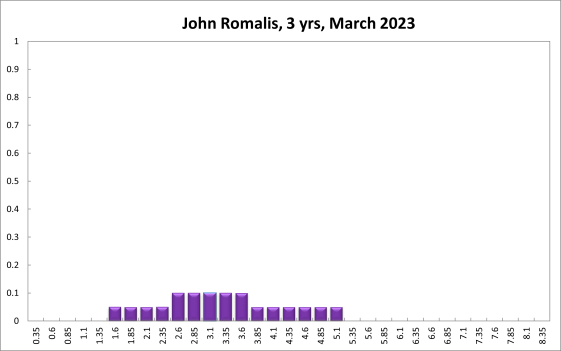

One year out, the Shadow Board members’ confidence that the appropriate cash rate is at the current level of 3.35% equals 13%. The confidence in a required cash rate decrease, to below 3.35%, is 11% and in a required cash rate increase, to above 3.35%, equals 71%. Three years out, the Shadow Board attaches a 13% probability that the overnight rate should equal 3.35%, a 34% probability that a lower overnight rate is optimal and a 53% probability that a rate higher than 3.35% is optimal.

The range of the probability distributions shifted up and narrowed by 25 bps. For the current recommendation the distribution extends from 3.35% to 4.35% (compared to a range of 2.850% to 4.10% in the previous round). For the 6-month horizon it extends from 2.60% to 5.85% (compared to a range of 2.60% to 5.60% in the previous round). The range for the 12-month horizon changed from 0.10%-5.35% to 0.35% to 6.1%. The range for the 3-year horizon, which was identical to the 12-month horizon in the last round, changed from 0.1%-5.85% to 0.35%-6.35%.