Outcome

According to the Australian Bureau of Statistics (ABS), annual CPI inflation is now at 7.3 % (trimmed inflation at 6.1 %), one of the highest figures in the last 30 years. In the meantime, the labour market remains strong in Australia, with unemployment at 3.5 % (lowest in the last 50 years). There are many uncertainties, particularly internationally and geopolitical. The outlook for global economic growth has weakened. The RBA has the difficult task of bringing down this inflation to its target while maintaining full employment. With inflation at 7.3 % and the cash rate target at 2.60%, I believe the RBA should continue with its monetary policy tightening, respond strongly, and increase the cash rate in this monthly meeting.

The latest data has broadly evolved in line with expectations, and is continuing to signal that the economy is operating beyond capacity; employment has broadly held steady since May, suggesting that there is very little additional labour force capacity in the local economy. This is generating domestic inflationary pressures which are combining with global supply shocks, and warranting further monetary tightening from the RBA.

But the inflationary headwinds in Australia are much less pronounced than elsewhere, which will allow the RBA to keep the cash rate below other central bank policy rates. While this will put downward pressure on the AUD and potentially generate further inflationary pressures, the stronger economic environment and continued strength in commodity prices will push against this, and should limit a further depreciation of the currency – the AUD has held steady at around 0.63 US cents in recent weeks, despite the divergence in market views on the outlook for local interest rates.

Moving through 2023, assuming no further supply side shocks, the headline rate of inflation should ease, and with monetary and fiscal policy now putting a drag on growth moment – the economy is likely to expand by less than 2% in calendar year 2023 – attention will turn to interest rate cuts towards the end of the year. Given the inherent uncertainty in the outlook it is too early to say whether a rate cut will definitely be appropriate in late 2023 or the first half of 2024, the timing for the next cycle will be critically dependent on the extent of the acceleration in wages growth and the speed with which the current cost push inflation eases.

With underlying inflation at its highest level in decades and rising quickly, maintaining a negative real cash rate is hard to justify. Especially as we see further strong upward pressure on major components like wages, rents, imports and energy.

The increase in rates so far is not nearly enough to get the economy back on target soon. It hasn’t even been enough to raise the exchange rate, the most important channel by which monetary policy influences inflation.

There remains a large risk that expectations of inflation will start to adapt to recent prices increases. This is asymmetric – the risk of a downward adjustment is negligible. If expectations do rise, a large increase in unemployment will be needed.

We have a choice between a sharp increase in interest rates now or an even larger increase if we delay. The former would be less painful and less risky.

Updated: 14 May 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Shadow Board Very Confident that a 25 bps Rise Necessary

While some leading economic indicators, especially consumer and business confidence measures, are softening slightly, and there are persistent risks from global economic developments, the domestic labour market remains tight and the capacity utilisation rate high. The latest inflation figures (7.3% in Q3 of 2022 for headline CPI and 6.1% for core inflation), well above the RBA’s target band of 2-3%, confirm the need for tighter monetary policy. The RBA Shadow Board strongly advocates such further tightening. It is 88% confident that the overnight rate should be raised to above the current setting of 2.60%, with a mode recommendation of a 25 bps increase, whilst only attaching a 9% probability that keeping the overnight rate on hold this round is the appropriate policy.

Australia’s labour market in September looked almost the same as in August. The seasonally adjusted unemployment rate was unchanged at 3.5%, the labour participation rate was likewise unchanged, at 66.6%, and total employment increased by less than 1,000. Total monthly hours worked in all jobs fell by 1 million, while the underemployment rate ticked up to 6.0%. Job vacancies and job advertisements were a little lower, at 471,000 and 240,000, respectively, but still close to their historic highs. Overall, the Australian labour market remains tight, and there is increasing anecdotal evidence that this is leading to higher wages growth, as expected. The next release of the wage price index (WPI) for Q3, on 16 November, should confirm this, although the consensus forecast for the percentage change in the WPI remains well below the current inflation rate.

The Australian dollar fell in the first half of October to find support at 62 US¢ and rebound to above 64 US¢. Yields on Australian 10-year government bonds receded a little from their recent high, closing the past week (29 October) at 3.78%. The yield curve retains its normal convexity but has shifted down slightly. The spread between 10-year versus 2-year bonds, equalling 46 bps, barely budged. Australian stock prices posted slight gains in October and remain moderately volatile; the S&P/ASX 200 stock index ended the week just below 6,800.

Consumer confidence hardly changed: the Melbourne Institute and Westpac Bank Consumer Sentiment Index, equal to 84.45 in September, fell by less than one point in October. Business confidence also softened in the same month; NAB’s index of business confidence deteriorated from 10 to 5, as did the services PMI (from 53.3 in August to 48 in September); the S&P Global Australia Composite PMI fell to 49.6 in October from 50.9 in the previous month. The capacity utilisation likewise decreased by half a percentage point, to 85.8%. The six-month annualised growth rate of the Westpac-Melbourne Institute Leading Economic Index, which is interpreted as the likely pace of economic activity relative to the trend in three to nine months, fell from -0.33% in August to -1.15% in September, the weakest since the beginning of the Covid pandemic in early 2020. While further confirmatory data is necessary, it does suggest that clouds in the sky are forming for consumers and businesses, a consequence of wider economic threats and rising interest rates.

The Federal Budget, which was announced last week, can be seen as consolidatory, roughly halving the budget deficit of $80 billion projected half a year ago. While disappointing many who were hoping for concrete cost-of-living relief, a more expansionary budget would make the RBA’s task of fighting inflation more difficult.

The global economy continues to be a source of major downside risks. Inflation is a problem virtually everywhere, especially in the developed world but increasingly, too, in emerging countries. German CPI inflation was 10.4% year-on-year in October, coinciding with a surprise increase of quarterly GDP growth of 0.3% in Q3. Nevertheless, Europe is expected to slip into recession going into winter. Aggregate demand in the US remains very strong, which will embolden the Federal Reserve Bank to continue its aggressive interest rate policy. The International Monetary Fund (IMF) downgraded its economic outlook for Asia in the face of global monetary tightening, high energy and food prices and the Ukraine war. The IMF expects Asia to grow by 4% this year and 4.3% next year, almost a full percentage point less than projected six months ago. The IMF also warned of the prospect that strategic competition and national security concerns may severely hamper global trade and prosperity, a dynamic that would also hurt Australian living standards.

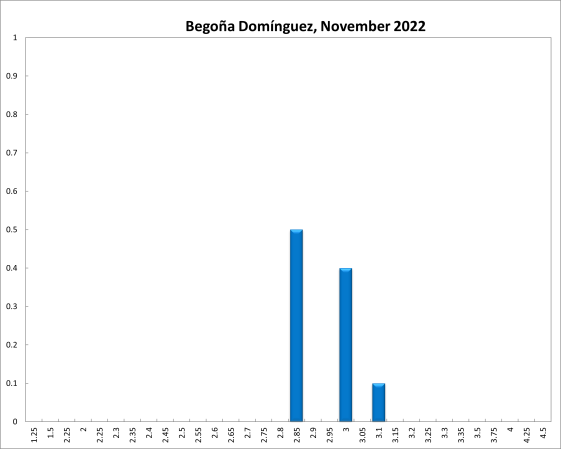

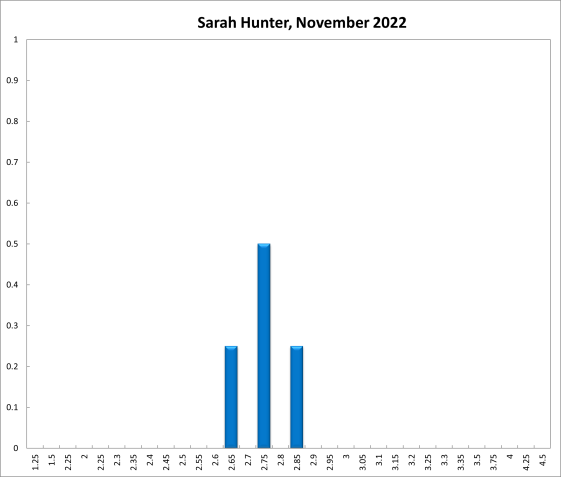

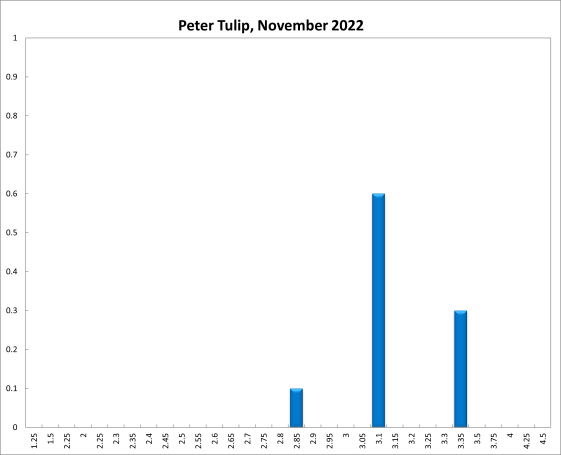

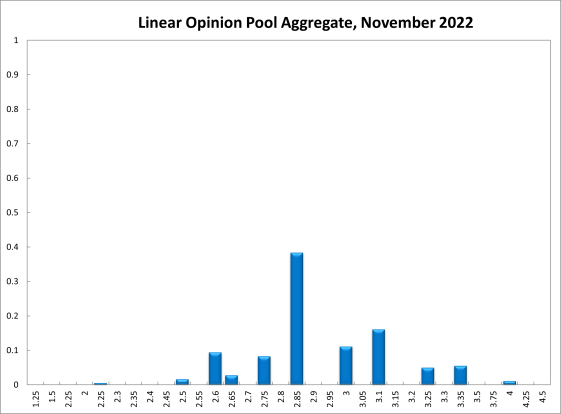

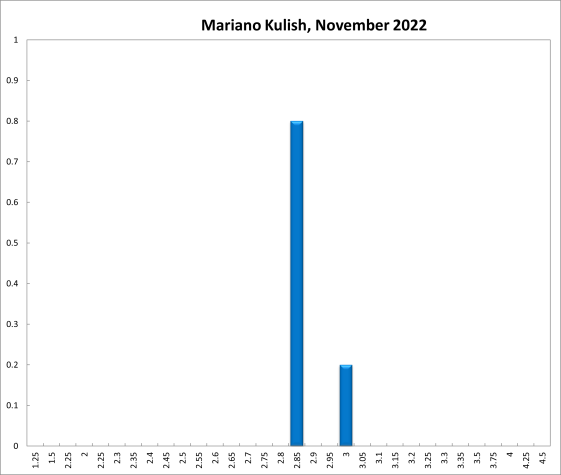

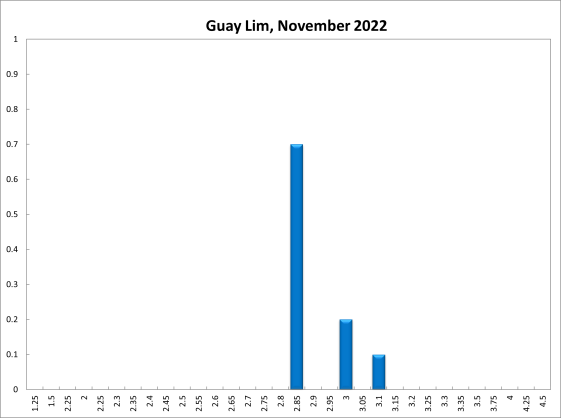

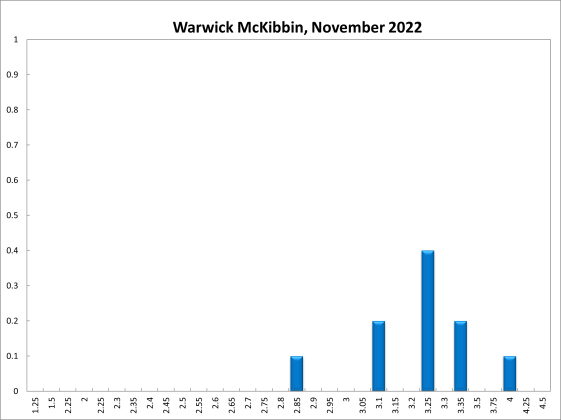

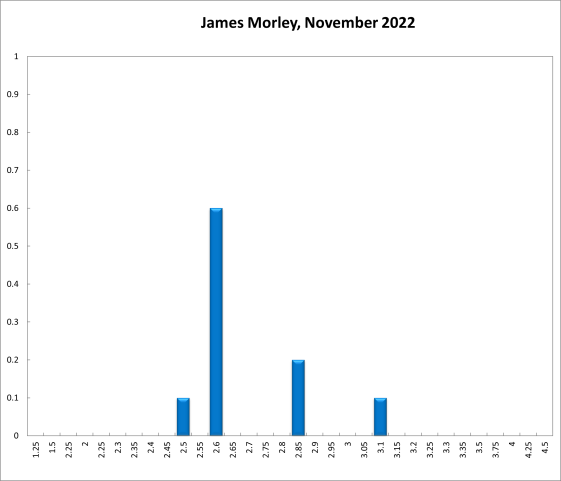

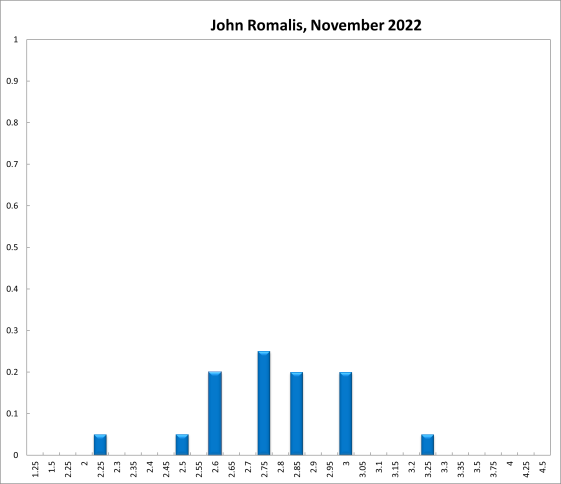

The tightening cycle, which the Reserve Bank of Australia embarked on half a year ago, is due to expand further. For the current (November) round, the Shadow Board is advocating that the overnight interest rate be raised again, above the current level of 2.60%, attaching an 88% probability that this is the appropriate policy stance, with a mode recommendation of a 25 bps increase. The Board attaches a 9% probability that keeping the overnight rate on hold is the appropriate policy and a mere 2% probability that a decrease is appropriate.

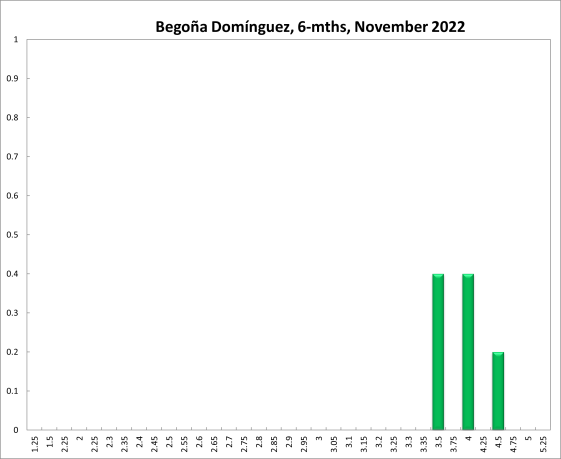

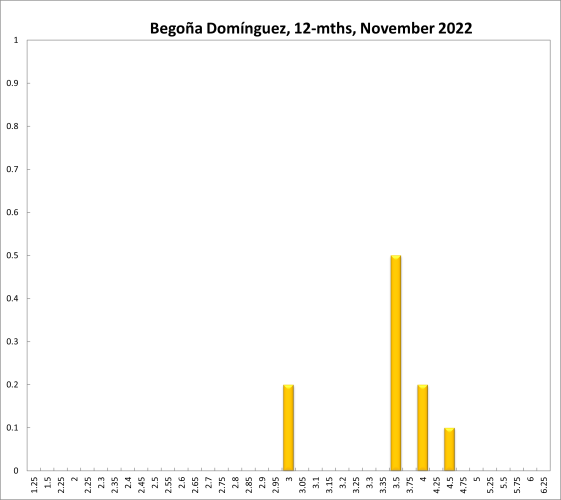

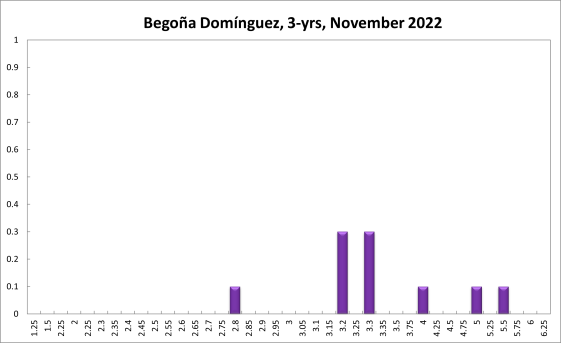

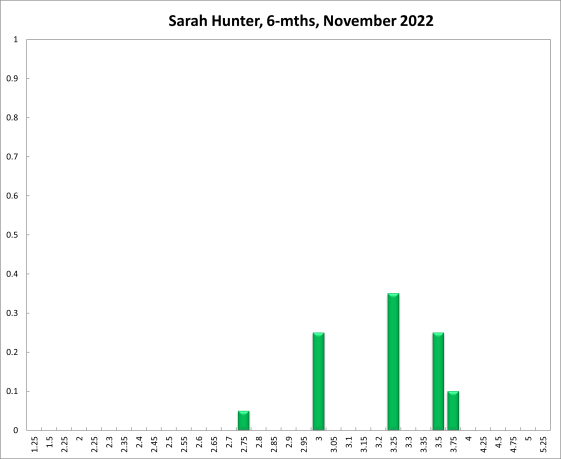

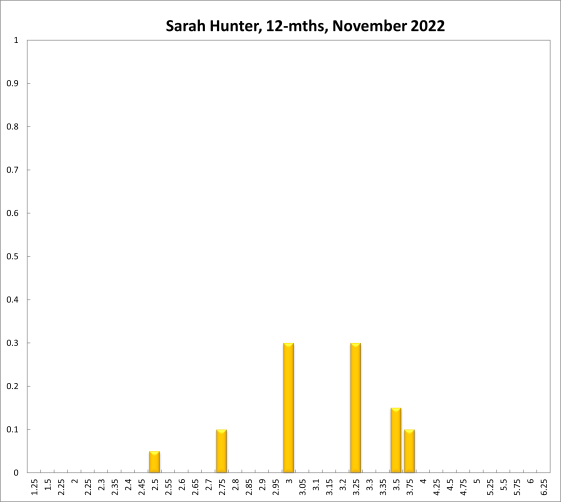

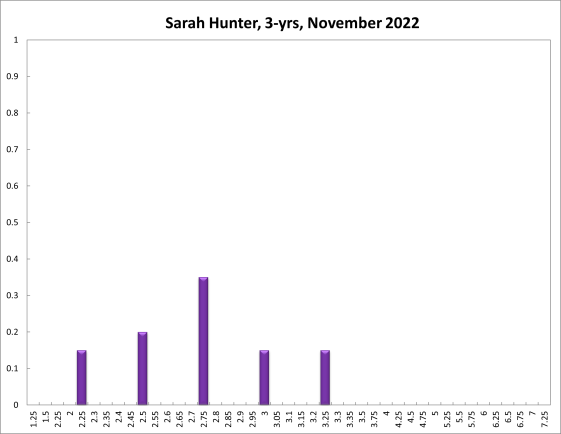

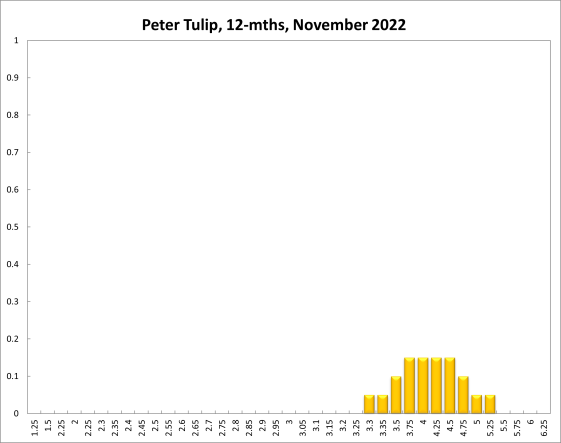

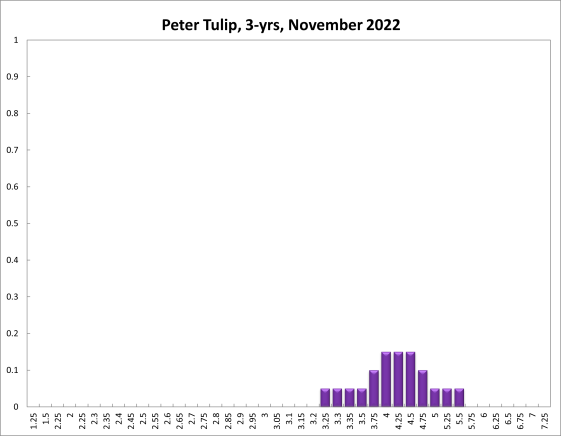

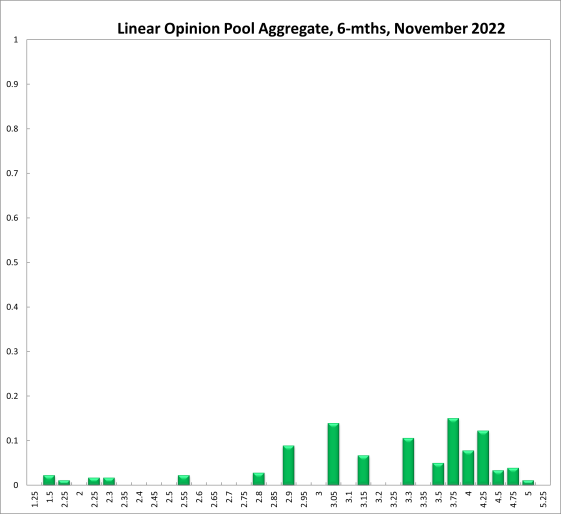

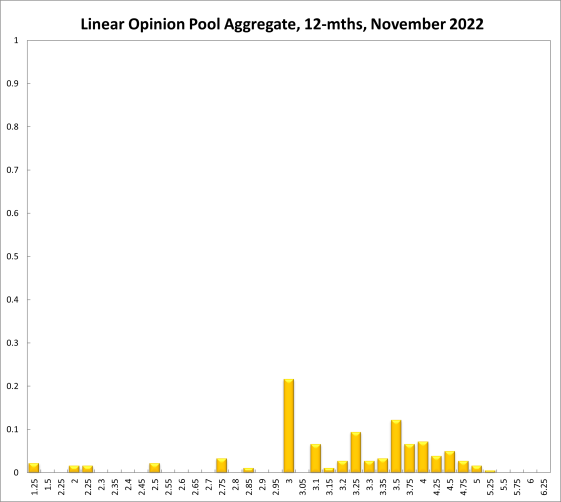

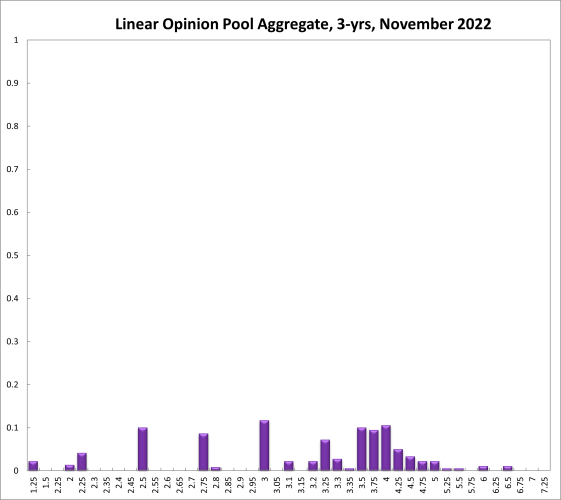

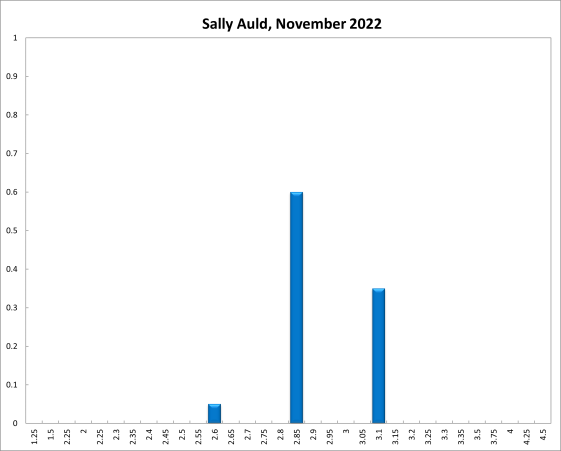

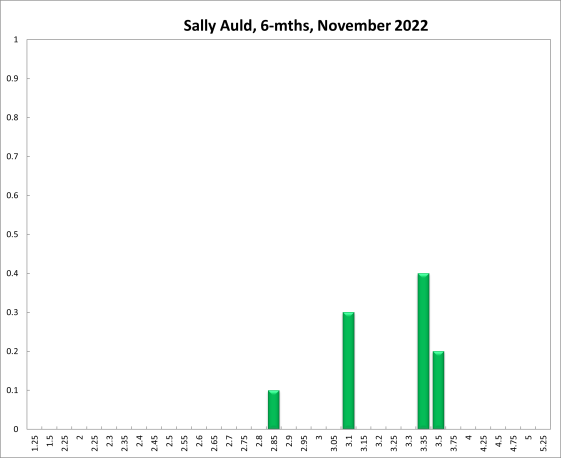

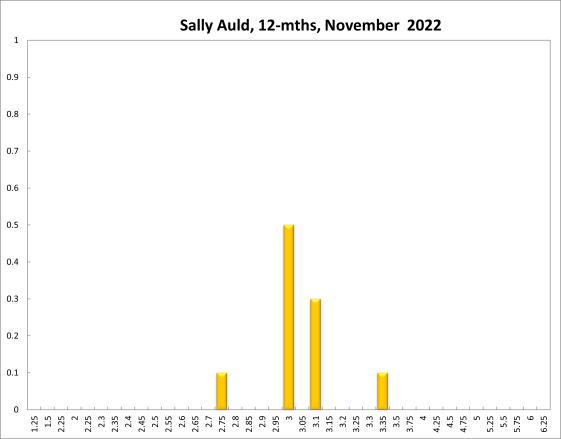

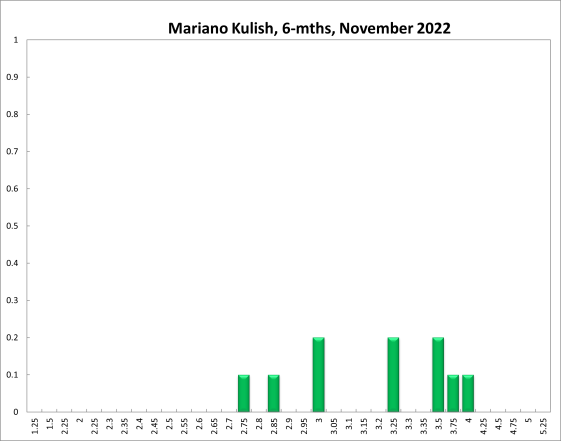

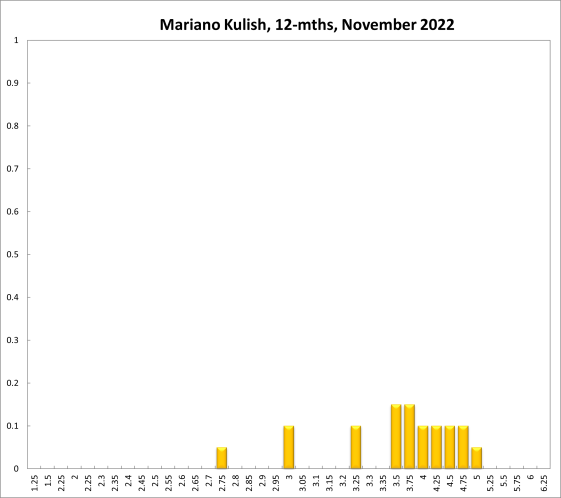

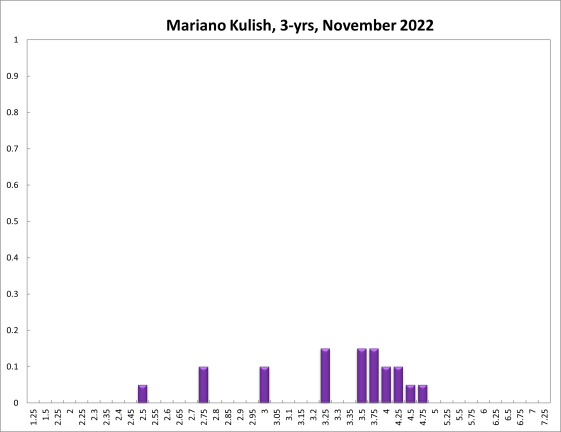

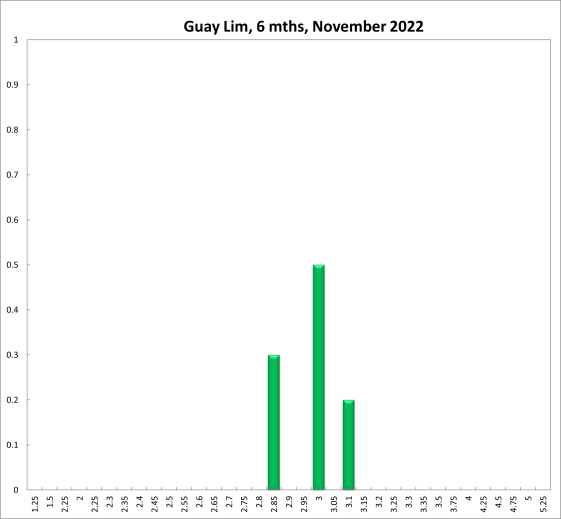

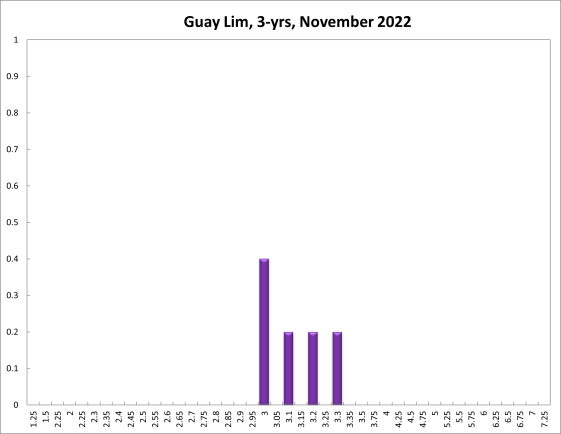

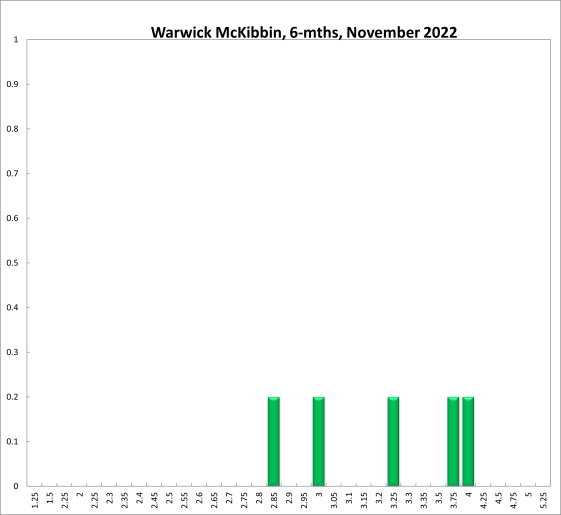

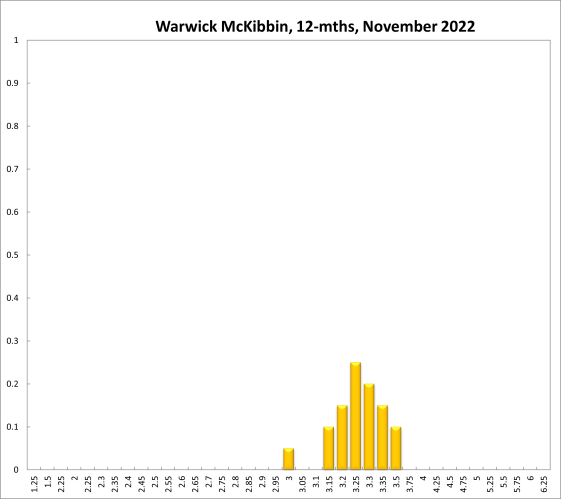

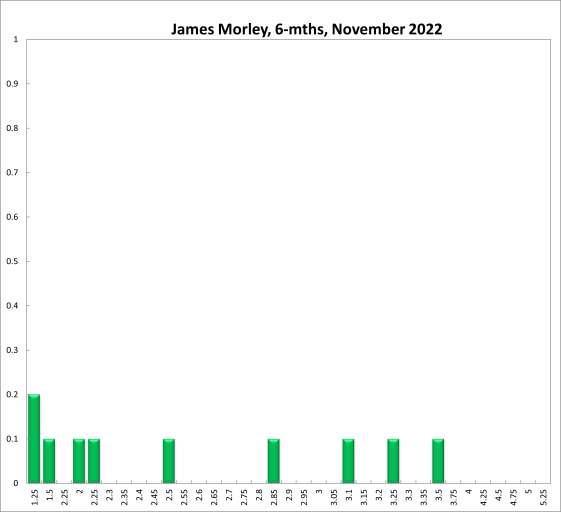

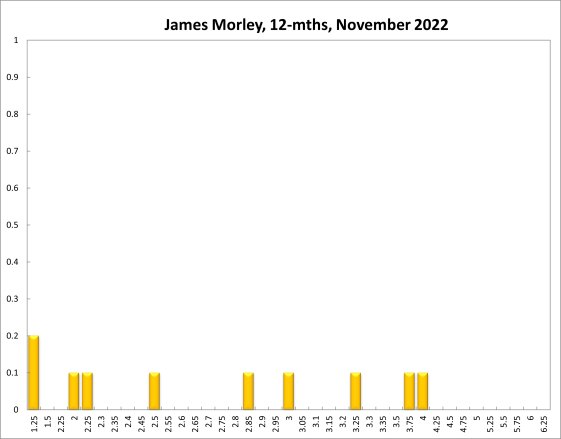

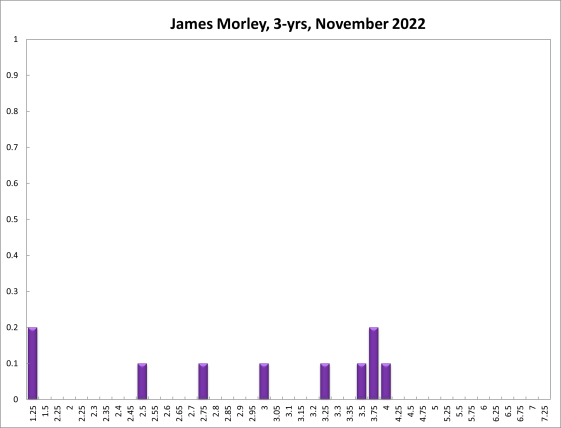

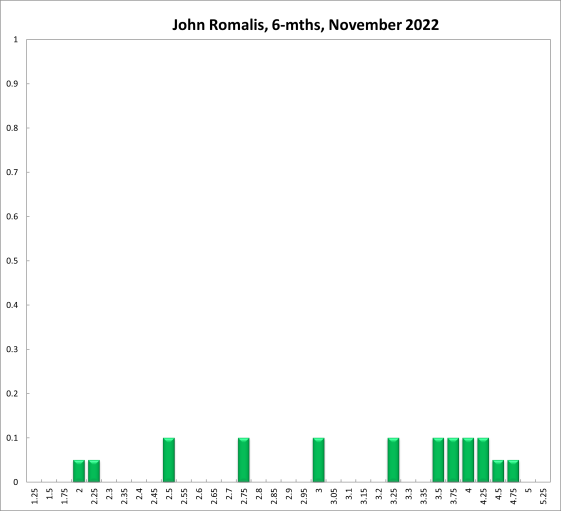

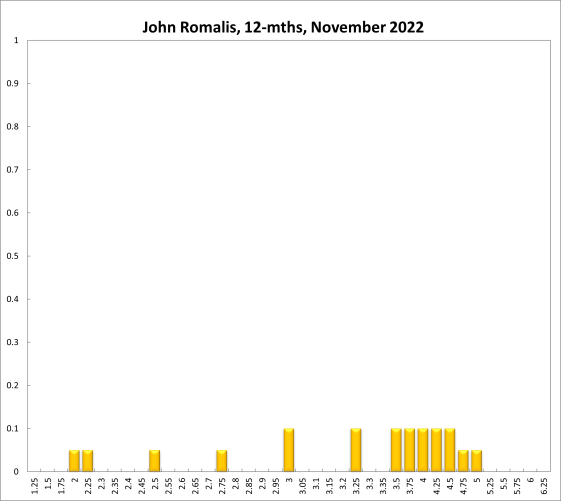

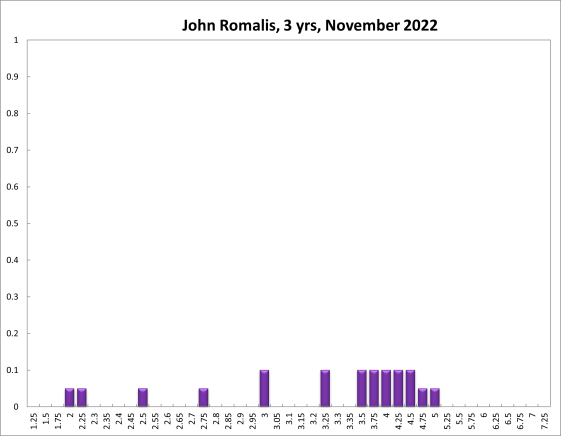

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 2.60% equals 0%; the probability attached to the appropriateness of an interest rate decrease equals 9%, while the probability attached to a required increase equals 91%. One year out, the recommendations are similar. The Shadow Board members’ confidence that the appropriate cash rate is 2.60% equals 0%. The confidence in a required cash rate decrease, to below 2.60%, is 8% and in a required cash rate increase, to above 2.60%, equals 92%. Three years out, the Shadow Board attaches a 0% probability that the overnight rate should equal 2.60%, an 18% probability that a lower overnight rate is optimal (which is double what it was in the previous month) and an 82% probability that a rate higher than 2.60% is optimal.

The range of the probability distributions for the current and 6-month recommendations has changed only slightly: for the current setting, it extends from 2.25% to 4.00% (compared to a range of 2.25% and 4.25% in the previous round) and for the 6-month horizon it extends from 1.5% to 5.00% (compared to a range of 1.25% to 5.00% in the previous round). The range for the 12-month horizon extends from 1.25% to 5.25%. The 3-year horizon range increased slightly; it extends from 1.25% to 6.5%.