Outcome

The incoming data over the last month has been broadly consistent with expectations; the labour market is still operating with very little (if any) spare capacity and inflationary pressures remain significant.

While the RBA should ‘look through’ the supply side shocks created by the conflict in Ukraine and manufacturing and supply disruptions in China (due to ongoing lockdowns), it is also clear that aggregate demand is running ahead of the economy’s supply capacity, and momentum needs to be cooled to move the economy back towards an equilibrium (balanced position).

It is therefore appropriate interest rates continue to rise from their current position. But the RBA should be increasingly mindful that they have already tightened policy significantly, and that it will take time for the full impact of this tightening to flow through to the economy. Further significant increases in the cash rate run the risk of the policy settings becoming too contractionary as we move into 2023, particularly given that a global monetary tightening cycle is now well underway.

A slower pace of rate rises is therefore more appropriate, to allow the Board to assess their impact on the economy and lower the risk of interest rates overshooting and the economy going through a sharper than necessary slowdown in growth momentum.

If the cash rate follows market expectations, then inflation is projected to remain above the target and unemployment to remain below the NAIRU for several years. A faster pace of increases would bring these variables closer to their targets so seems unambiguously preferable. Moreover, I am sceptical of forecasts that inflation will quickly return to target while U<NAIRU.

Updated: 18 July 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin

Shadow Board Advocating Further Rate Rise

The latest inflation number of 6.1% (Q2 of 2022 for headline CPI and 4.9% for inflation), are dashing hopes that inflation is merely a blip and will quickly return to within the RBA’s target band of 2-3%. Many other indicators suggest inflation will remain high for some time: a tight labour market, a high capacity utilisation rate, supply chain constraints, high energy and food prices, the ongoing Covid-19 pandemic as well as natural disasters. The RBA Shadow Board thus strongly advocates in favour of further interest rate increases. It is 91% confident that the overnight rate should be raised to above the current setting of 1.35%, whilst only attaching a 9% probability that keeping the overnight rate on hold this round is the appropriate policy.

As widely projected and nonetheless astonishing, Australia’s seasonally adjusted unemployment rate posted a new record low of 3.5% in June 2022. The youth unemployment rate also fell, by 0.9 percentage points, to 7.9%. Moreover, the labour participation rate ticked up to a historic high of 66.8%. These positive numbers were possible due to a large jump in employment of 88,400, to a record high of 13.6 million, while total monthly hours worked in all jobs remained steady. Other labour market indicators such as job vacancies and job advertisements, which improved yet again, highlight the favourable conditions in the Australian labour market. The biggest concern remains weak wages growth. In the current high inflation environment, real wages are falling by more than 3 percent, thus reducing living standards for millions of Australian wage earners. This situation is unsustainable – either nominal wages will have to rise to make up for lost ground, or the inflation rate will have to settle down to preserve real wages.

After testing a low of 67 US¢ mid-month, the Aussie dollar rallied in the second half of July to finish near the 70 US¢ mark. Going forward, the value of the Aussie dollar will depend significantly on the interest rate gap between the domestic cash rate and overseas interest rates, especially US rates. Yields on Australian 10-year government bonds have fallen a little, equalling around 3.1% on 31 July. Yield curves and interest rate spreads, especially at longer term maturities (e.g. 10-year versus 2-year), have not changed much. Australian stock prices followed a pattern similar to the Aussie dollar – after a low in the middle of the month, stock prices rallied, matching the behaviour of overseas stock markets. The S&P/ASX 200 stock index finished the month just shy of 7,000.

Consumer confidence has continued its steady decline: the Melbourne Institute and Westpac Bank Consumer Sentiment Index dropped for the eighth month in a row, by 3 percent, to 83.8 in July. Retail sales increased by a mere 0.2% month-on-month, while private sector credit growth did not change. Business confidence likewise suffered another month; NAB’s index of business confidence dropped from 10 in April, to 6 in May, and 1 in June, and both the services and manufacturing PMIs dropped from 49.2 to 48.8 and from 54 to 52.5, respectively. The capacity utilisation rate remains high at 84.79%. The Westpac-Melbourne Institute Leading Economic Index declined by 0.2% year-on-year, based on its most recent reading in June. The S&P Global Australia Composite PMI also fell, for the fourth straight month. Hence, the gap between relatively weak consumer and business confidence, which are seen to lead the economy, and the relatively strong performance indicators, which are supposed to measure the current state of the economy, raise the possibility that the Australian economy may be slowing in the midterm.

After a remarkable two-year rally, Australian house prices are falling. According to CoreLogic, dwelling values fell 1.3% on average nationally in July. In Sydney, property values are 5.2% lower than their January peak, a deeper fall than what the market experienced at the beginning of the global financial crisis in 2008. Higher borrowing costs are widely expected to generate further declines in house prices, through 2023, despite an increase in immigration and a strong labour market.

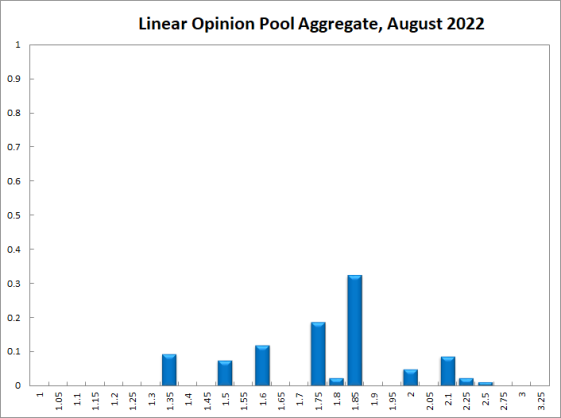

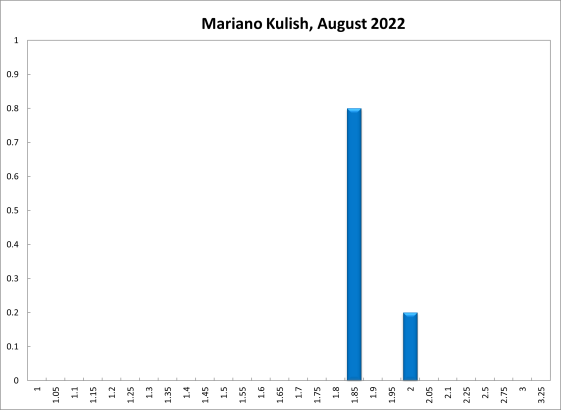

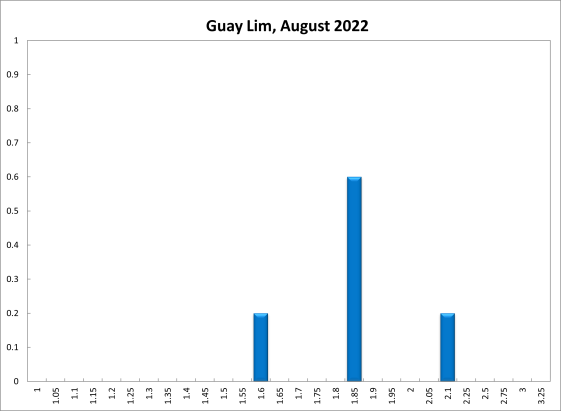

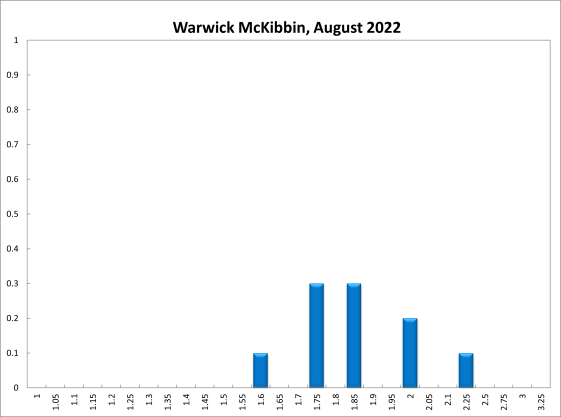

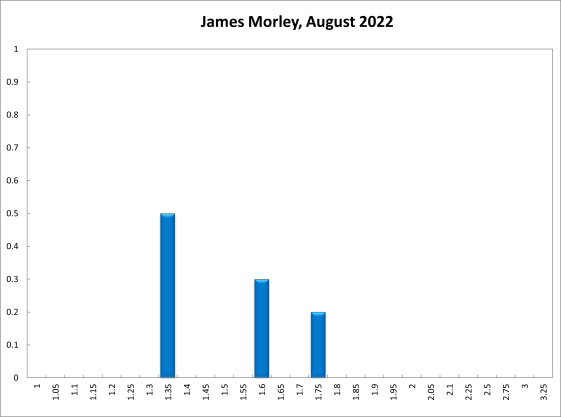

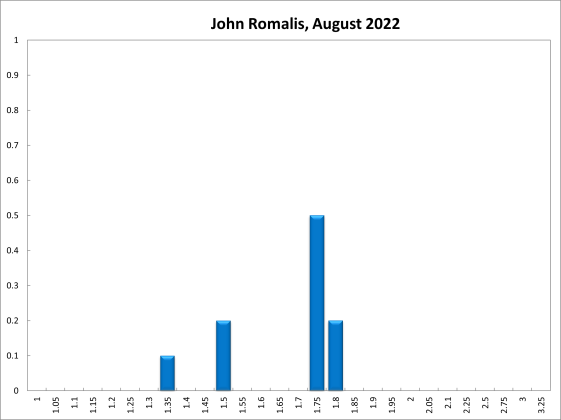

Three months ago, the Reserve Bank of Australia embarked on a tightening cycle after the official cash rate target stood at the historically low level of 0.1% for one-and-a-half years. For the current (August) round, the Shadow Board is advocating that the overnight interest rate be raised further, above the current level of 1.35%, attaching a 91% probability that this is the appropriate policy stance. It attaches a mere 9% probability that keeping the overnight rate on hold is the appropriate policy and a 0% probability that a decrease is appropriate.

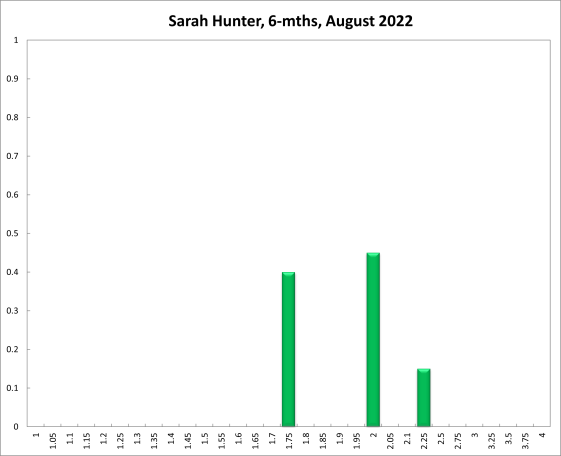

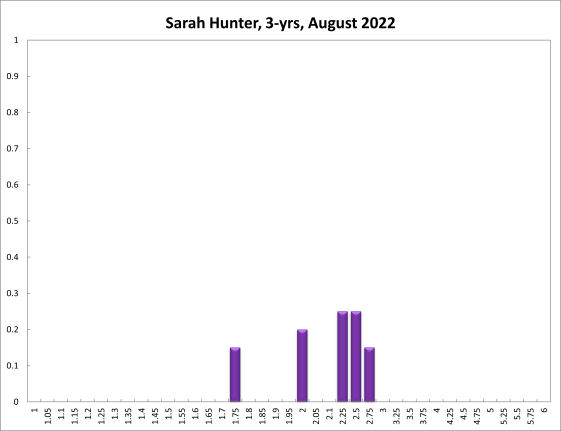

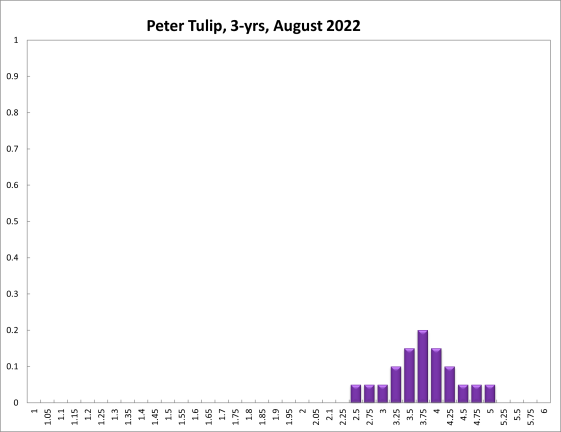

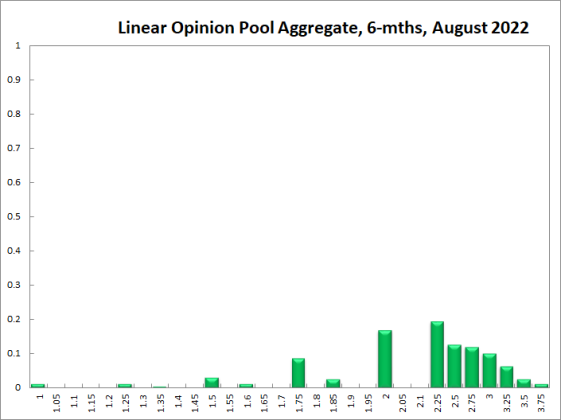

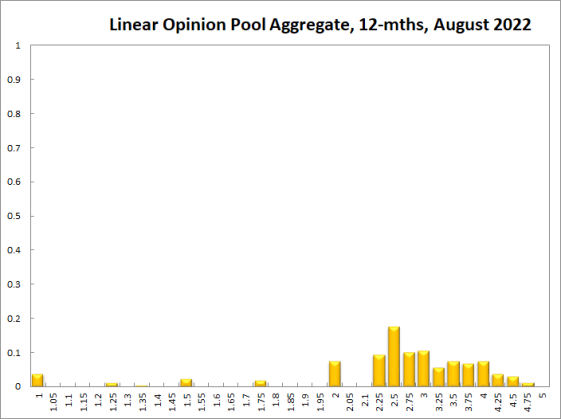

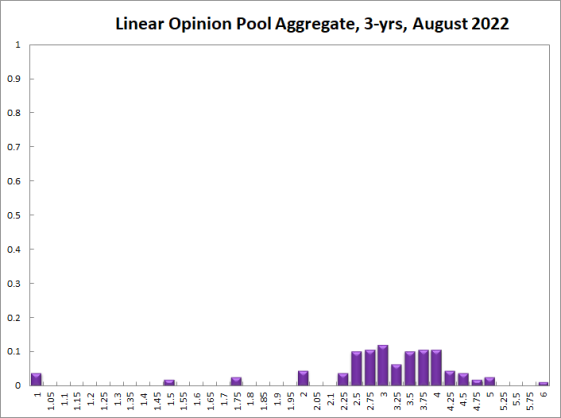

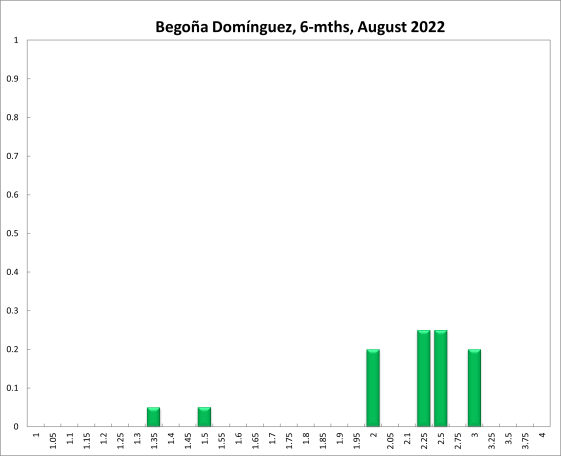

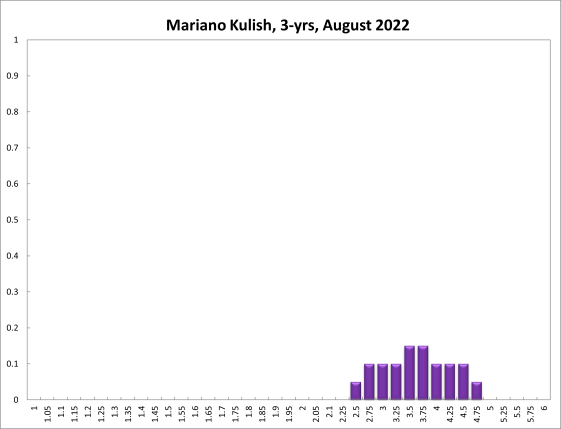

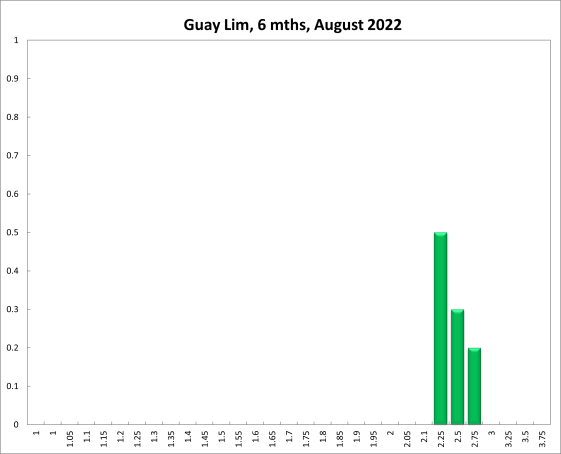

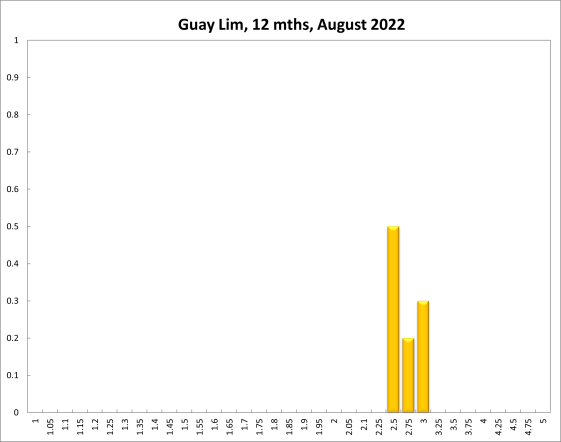

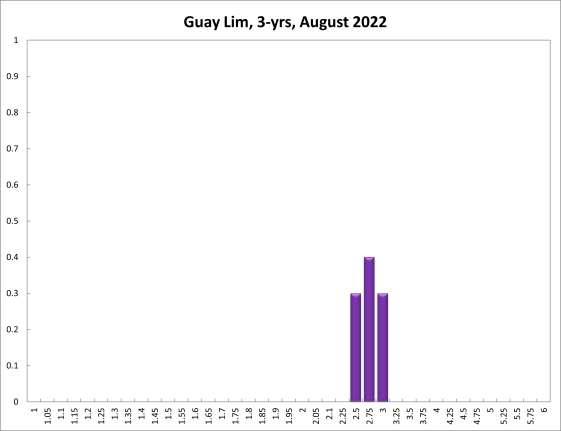

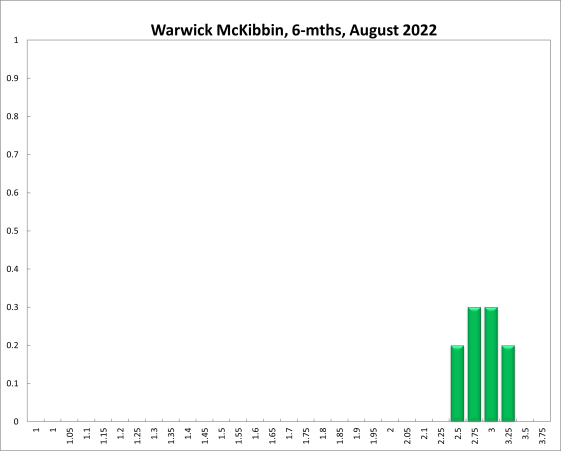

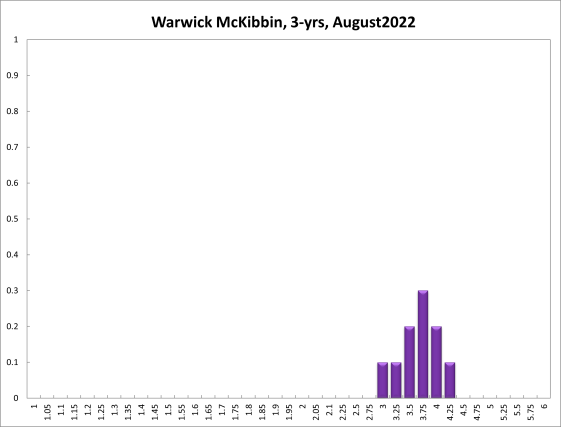

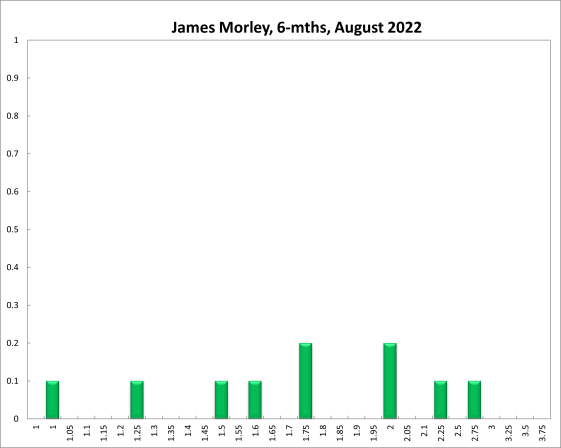

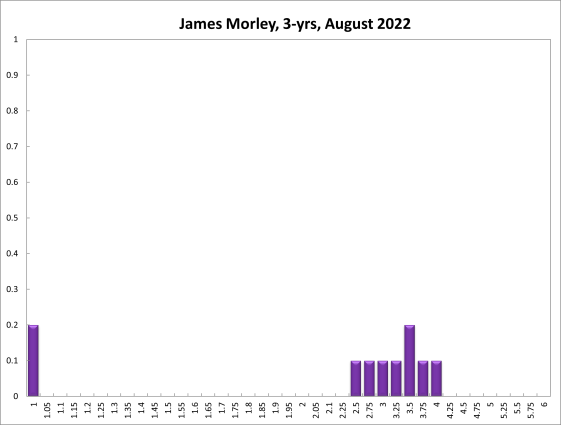

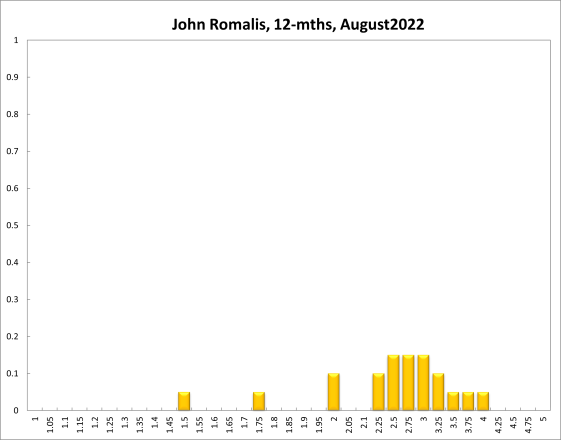

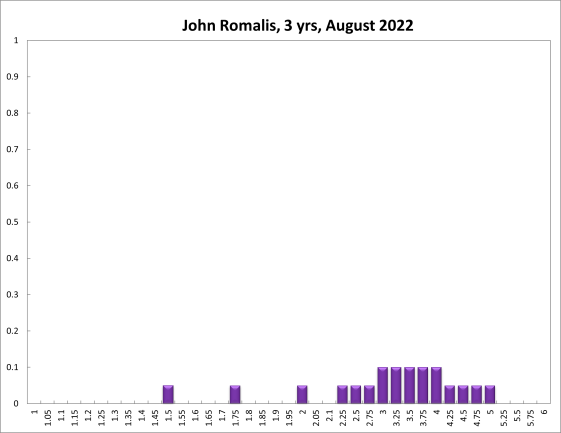

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 1.35% equals 1%; the probability attached to the appropriateness of an interest rate decrease equals 3%, while the probability attached to a required increase equals 97%. One year out, the recommendations are similar. The Shadow Board members’ confidence that the appropriate cash rate is 1.35% equals 1%. The confidence in a required cash rate decrease, to below 1.35%, is 5% and in a required cash rate increase, to above 1.35%, equals 95%. Three years out, the Shadow Board attaches a 0% probability that the overnight rate should equal 1.35%, a 4% probability that a lower overnight rate is optimal and a 96% probability that a rate higher than 1.35% is optimal.

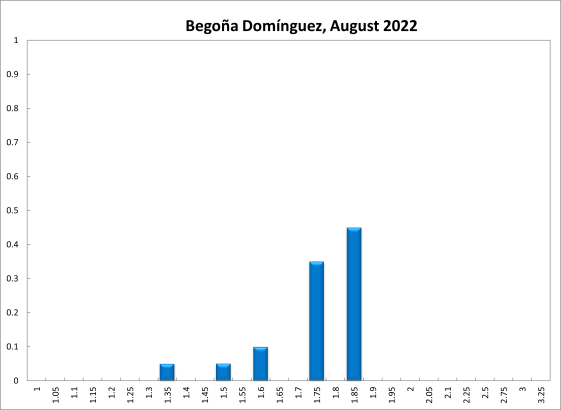

The range of the probability distributions for the current and 6-month recommendations, widened further, reflecting a continued reassessment of the tail risks by at least some members: for the current setting, it extends from 1.35% to 2.5%, and for the 6-month horizon it extends from 1.0% to 3.75% (compared to a range of 0.75 to 3.25% in the previous round). The range for the 12-month horizon now extends from 1.0% to 4.75%, and for the 3-year horizon from 1.0% to 6.0%.