Aggregate

Favourable Economic Data Suggests Interest Rates Will Not Remain Low for Much Longer

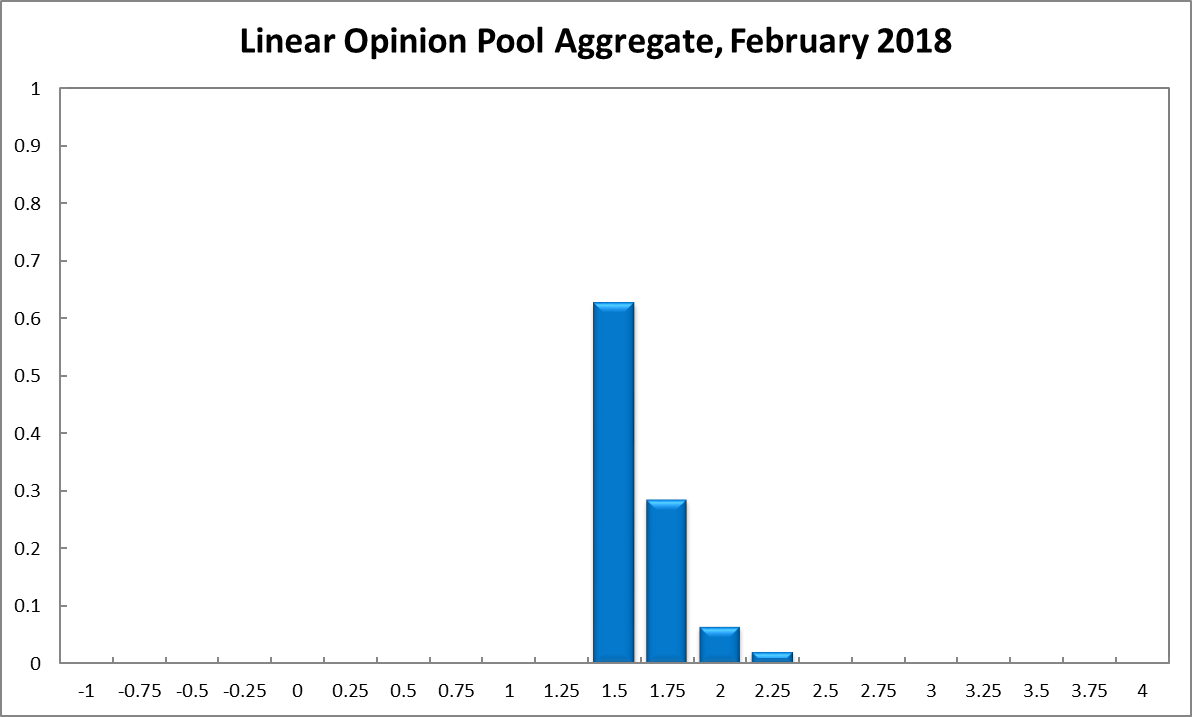

Domestic CPI inflation rose slightly from 1.8% year-on-year in the third quarter of 2017 to 1.9% in the fourth quarter, still below the Reserve Bank of Australia’s official target band 2-3%. Otherwise favourable economic data, both domestic and overseas, has convinced the RBA Shadow Board that there is no chance a further reduction in interest rates could be called for. Instead, it attaches a 63% probability that holding interest rates steady at 1.5% is the appropriate setting, while the confidence in a required rate hike equals 37%. Looking to mid- and end-year there is a slight shift in the Board’s assessment in favour of higher interest rates.

Australia’s seasonally adjusted unemployment rate unexpectedly rose to 5.5% in December, according to the Australian Bureau of Statistics, after a near five-year low of 5.4%. This is attributable to an increase in the participation rate from 65.5% to 65.7%, as there was solid growth in employment, both full-time and part-time. The latest figures still put nominal wages growth at 2%. The sustained weak real wage growth increasingly becomes a problem as economic growth is not generating additional purchasing power, and thus consumption demand, for a large section of the population. It is also leaves household balance sheets vulnerable in light of their high leverage.

The Aussie dollar, relative to the US dollar, appreciated significantly, to above 80 US¢, largely reflecting the US dollar’s weakness as opposed to the Aussie dollar’s strength. Predicting forex markets is notoriously difficult but with increasing signs that domestic interest rates will likely rise this year, a range of 77-83 US¢ seems reasonable. Yields on Australian 10-year government bonds have passed their nadir of 2.5% in December and climbed to above 2.8% in the successive months, suggesting that the markets are beginning to expect interest rates to rise in the medium term. The local stock is being buoyed by the strength of global stock markets, the S&P/ASX 200 stock index’s settling well above 6100, its highest since the global financial crisis.

Global growth in 2017 unexpectedly turned out higher than anticipated, and the World Bank revised its growth forecast for 2018 upward, to 3.1%. The IMF is even more optimistic, expecting the world economy to grow 3.9% in 2018 and 2019. These numbers are bolstered by favourable readings of key global economic data such as investment growth, trade growth, financial conditions, improvements in fiscal sustainability, etc. However, there clearly remain downside risks in the form of over-indebtedness, both public and private, and a reduction in the potential growth rate. Geopolitical tensions have thankfully subsided, at least for the moment. There remains a real risk of an abrupt correction to inflated asset prices worldwide and the concomitant economic disruptions.

Business indicators have improved noticeably: the NAB business confidence index, “the results from the Survey indicate that the business sector in Australia is, the AIG Performance of Manufacturing Index and the Services PMI all rising. Demand indicators add to the brighter picture, with the Westpac-Melbourne Institute Consumer Sentiment index improving, along with retail sales.

Building permits fell by 20% in December, a precipitous decline, and, coupled with other weakening data for the housing sector (new home sales, the housing index, the construction PMI) points to a cooling of the real estate markets in Australia’s major cities. This is by and large welcome news, as the record increases in house prices were unsustainable; however, a sustained severe contraction in the real estate sector could spill over to the other sectors and pose a threat for the overall economy. Australia’s economic fortunes in 2018 will in no small part depend on whether the real estate market is able to land softly or whether the correction will be violent.

Since the last round in December 2017, the distribution of the Shadow Board’s policy preferences is virtually unchanged. The Shadow Board is 63% confident that keeping interest rates on hold is the appropriate policy, 3% higher than two months ago. It attaches zero probability that a rate cut is appropriate (1% in December) and a 37% probability (39% in December) that a rate rise, to 1.75% or higher, is appropriate.

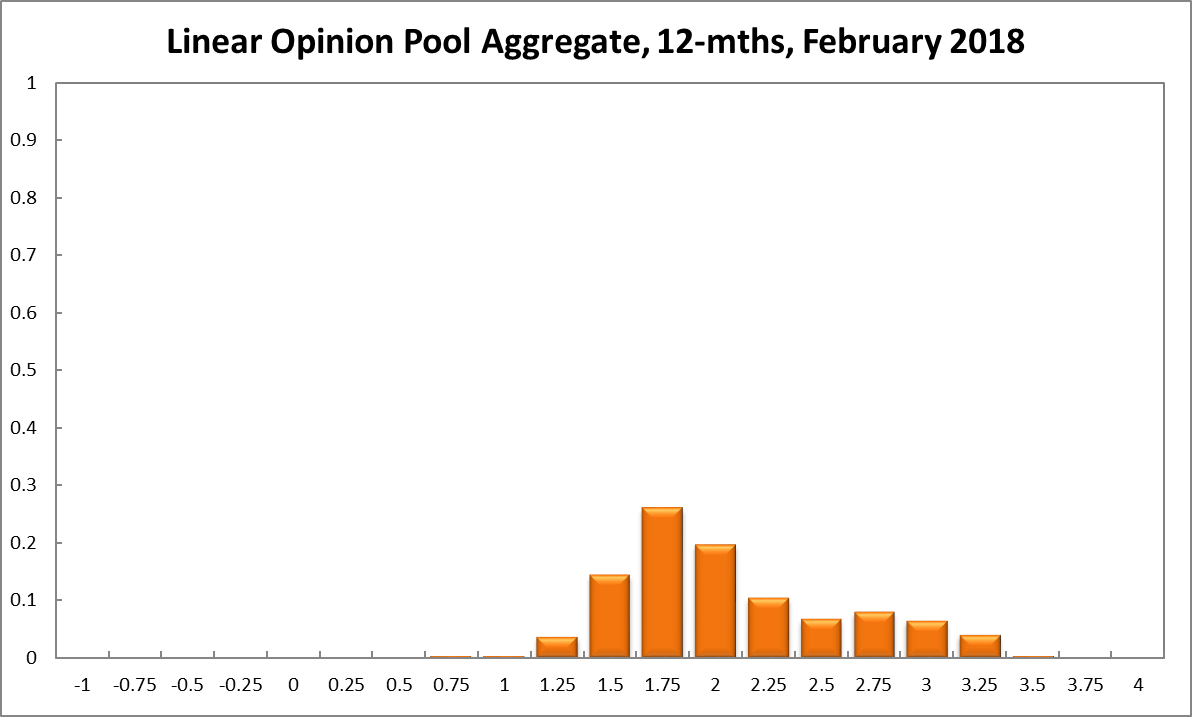

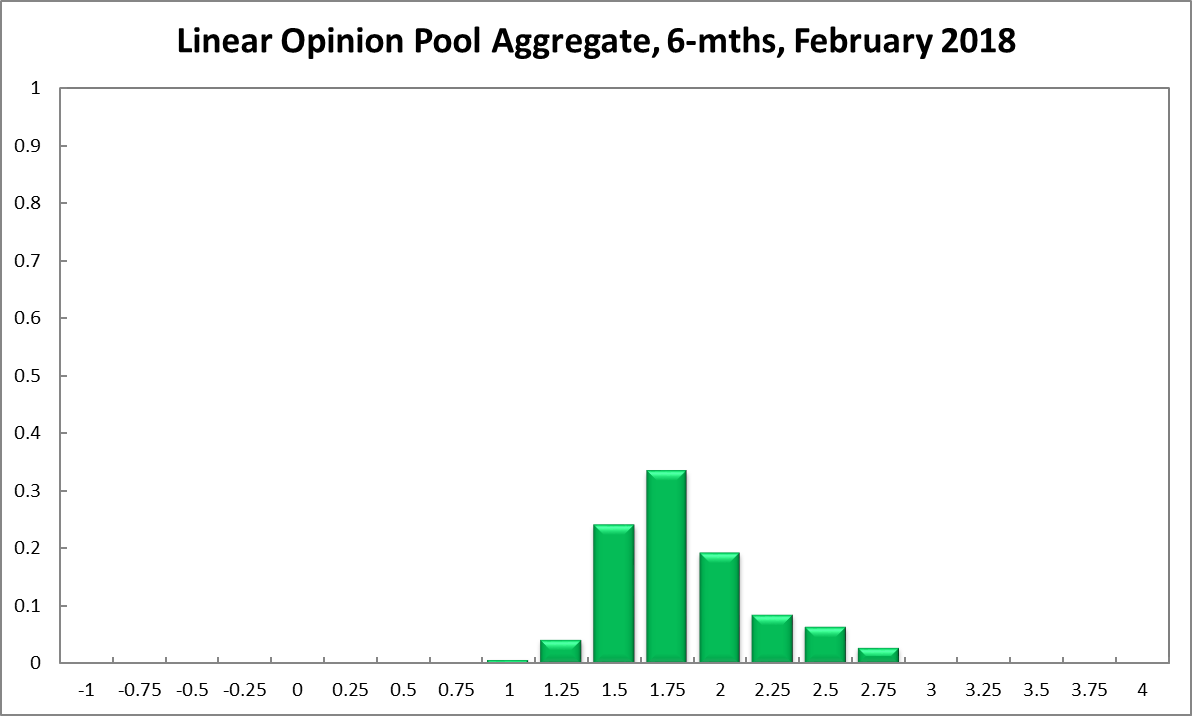

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 1.50% equals 24%, one percentage point lower than December. The estimated need for an interest rate decrease is 5% (6% in December), while the probability attached to a required increase equals 71% (69% in December). A year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 14% (17% in December), while the confidence in a required cash rate decrease equals 4% (8% in December), and in a required cash rate increase 81% (up 5% from December).

Updated: 18 July 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin