Aggregate

Low Inflation Figures Bias Shadow Board’s Interest Rate Downwards

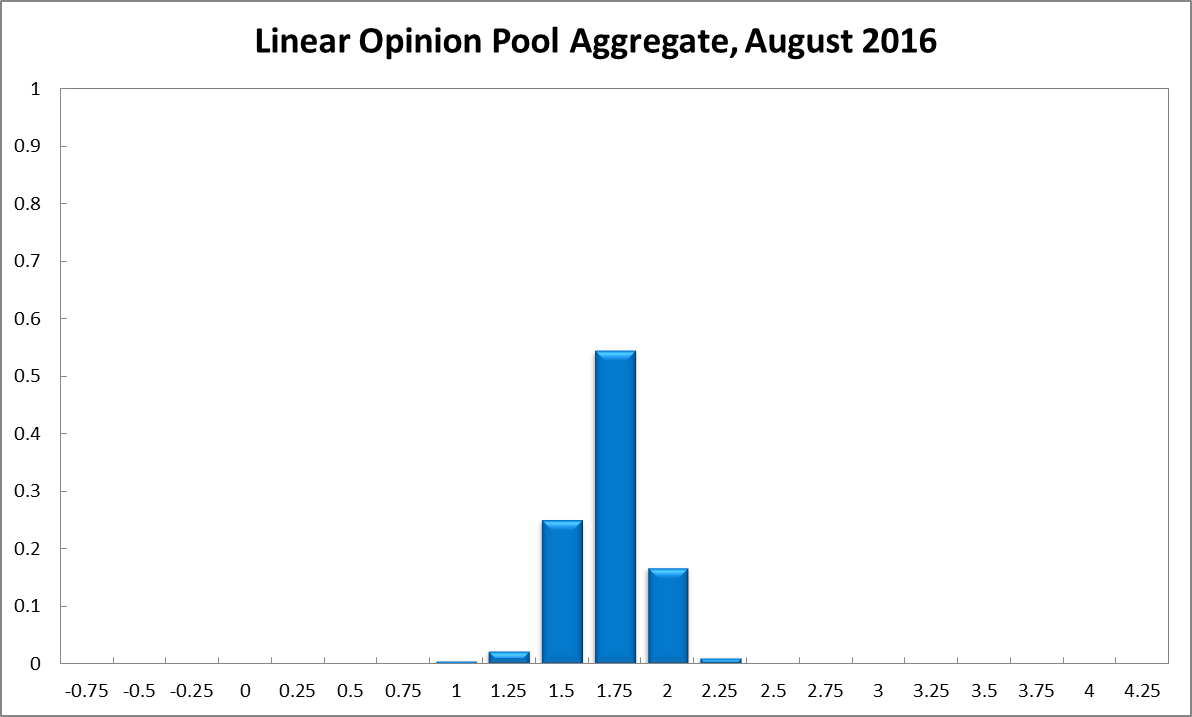

With the Brexit vote digested and the election decided, attention can turn again to economic indicators. In the June quarter consumer prices in Australia only rose 1.0% year-on-year, the lowest inflation rate since 1999, well below the RBA’s 2-3% target band. The RBA trimmed mean CPI rose 1.7% in the same period, slightly more than expected, but still below the RBA’s target. Relative to last month, the CAMA RBA Shadow Board’s policy preferences have become a little more dovish. The Shadow Board attaches a 54% probability to a rate hold being the appropriate policy setting. The confidence attached to a required rate cut equals 28%, while the confidence in a required rate hike equals 18%.

Australia’s unemployment rate edged up to 5.8%, according to the Australian Bureau of Statistics, as did the participation rate, which stands at 64.9%. Promisingly, full time employment increased by 38,400 in June, the third largest monthly increase in a year. Part time employment fell by 30,600 in the same month. Next month should offer new data on wage growth and thus provide a more detailed picture of the labour market.

Financial markets have settled down since the turmoil following the Brexit vote. The Aussie dollar has appreciated, relative to the US dollar; it is trading around 76 US¢. Yields on Australian 10-year government bonds remain at historic lows, well below 2%. Domestic share prices have followed the global lead up, posting significant gains during the past 3 weeks; the S&P/ASX200 last week closed just shy of 5,600. Worldwide, most stocks have fully recovered from last month’s Brexit vote fallout.

Globally, the storm created by the Brexit vote has been weathered but there remains significant uncertainty about the health of many of the world’s large economies. Cause for concern are the most recent numbers for the US. Second quarter GDP growth came in at 1.2%, well below the (admittedly optimistic) consensus expectation of 2.5%, while first quarter GDP growth was revised down to under 0.8%. These tepid figures can be largely attributed to weak US investment, suggesting that firms remain nervous about the economic outlook.

Consumer confidence, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, fell slightly while producer confidence, following the NAB survey of business confidence, edged up slightly. Both are consistent with long-run confidence levels. Capacity utilization fell to a little above 81%; the AIG Construction Performance Index posted a big gain, from 46.7 in May to 53.2 in June.

The Shadow Board’s confidence measures reflect greater concern about downside risks in the economy. The Board attaches a 54% probability (63% last month) that “no change” is the appropriate policy, a 28% probability (18% last month) that a rate cut is appropriate and an 18% probability (19% in the previous month) that a rate rise, to 2.00% or higher, is appropriate.

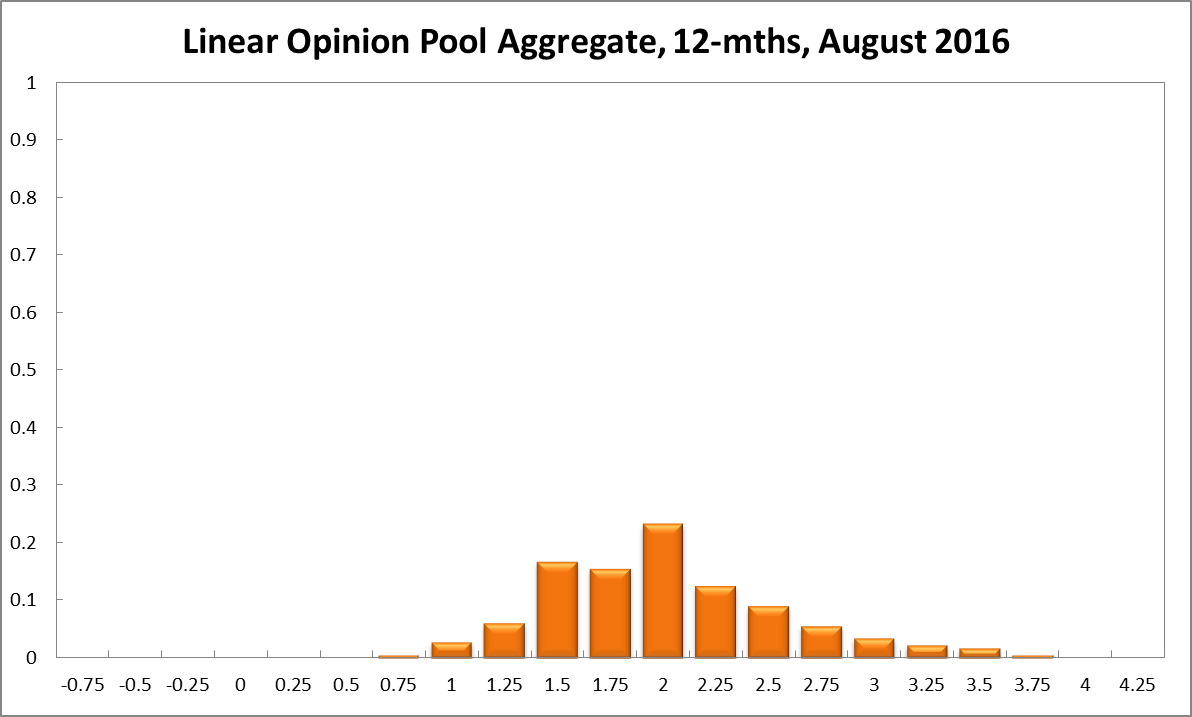

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 1.75% is unchanged at 23%. The estimated need for an interest rate decrease equals 29% (unchanged), while the need for a rate increase equals 48% (also unchanged). A year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 16% (18% in July), while the confidence in a required cash rate decrease equals 26% (unchanged) and in a required cash rate increase 58% (56% in July).

Updated: 21 November 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin