Aggregate

Rates Should Stay On Hold Under Election, Brexit Uncertainty

The unexpected outcome of the Brexit vote injected a good dose of uncertainty and volatility into financial markets, especially in Europe and the UK. A flight to safety saw the US dollar appreciate relative to other currencies and, while currencies and stock markets have settled down, the Brexit vote will likely echo for a long time to come, durably changing the European political landscape. Domestically, the federal election has turned out much closer than many expected and it could be some time before the result is finalised. Without new economic data to go by, it is the political uncertainty that dominates the outlook. Relative to last month, the CAMA RBA Shadow Board’s policy preferences have become noticeably more dovish, reversing the more contractionary stance from the previous month. The Shadow Board attaches a 63% probability to a rate hold being the appropriate policy setting. The confidence attached to a required rate cut equals 18%, while the confidence in a required rate hike equals 19%.

Australia’s unemployment rate and participation rate remain unchanged at 5.7% and 64.8%. No new data on wage growth has been released since last month.

The turmoil in the financial markets following Brexit has left the Aussie dollar stronger relative to the US dollar; it is trading around 75 US¢. Yields on Australian 10-year government bonds have continued to fall to historic lows, below 2%.

Domestic share prices, though slightly more volatile, are largely moving sideways, with the S&P/ASX200 last week closing just under 5300, not far below the recent high of 5430. Global stocks, particularly in European and British markets have lost between 5% and 10% of their value, following the Brexit vote.

In the wake of the Brexit vote, the global economic outlook is currently dominated by politics, with elections looming in a number of countries and uncertainty in Europe and elsewhere working its way through the global economy. The direct effect of the Brexit outcome on the Australian economy should be minimal but through global capital markets and international trade this far-away event may eventually be felt after all.

Consumer and producer confidence have barely shifted since last month. Capacity utilisation has risen to above 82%, while construction output has declined slightly. Retail sales have been growing by a little over 3% year-on-year.

The Shadow Board’s confidence measures have reversed somewhat since last month. It attaches a 63% probability (52% last month) that “no change” is the appropriate policy, an 18% probability (11% last month) that a rate cut is appropriate and a 19% probability (37% in the previous month) that a rate rise, to 2.00% or higher, is appropriate.

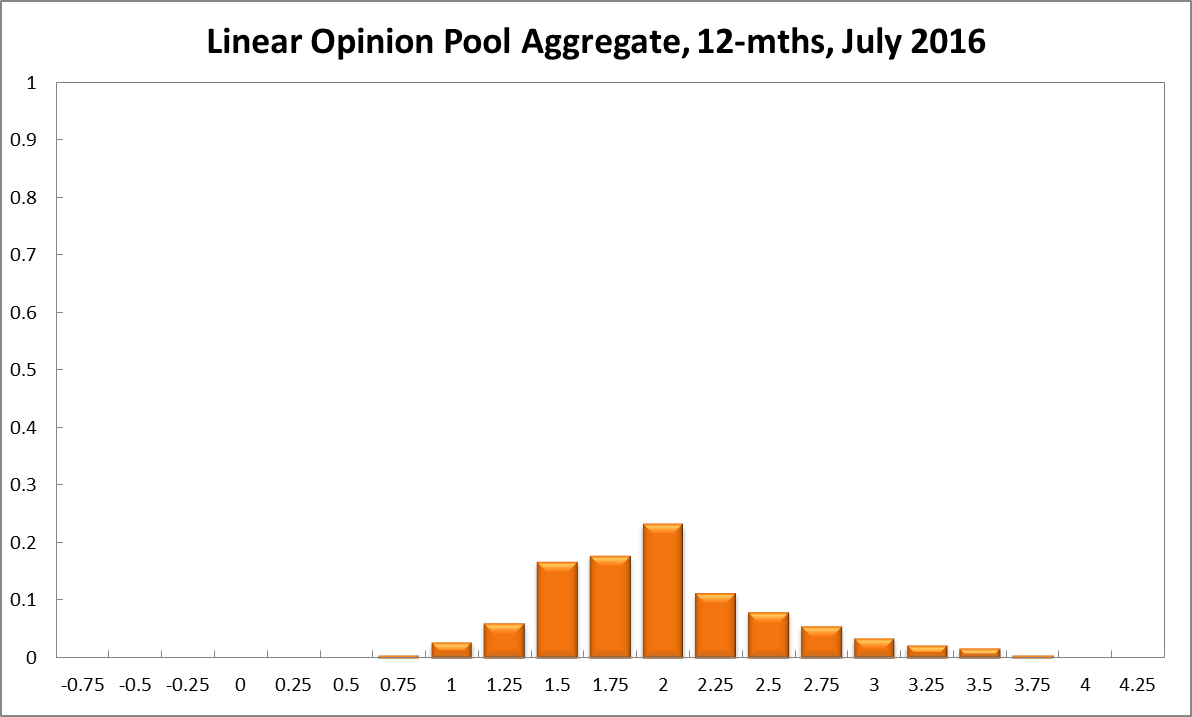

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 1.75% equals 23% (24% in June). The estimated need for an interest rate decrease has risen from 16% to 29%, while the need for a rate increase has fallen 12 percentage points to 48%. A year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 18% (14% in June), while the confidence in a required cash rate decrease equals 26% (16% in May) and in a required cash rate increase 56% (70% in June).

Updated: 19 September 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin