Aggregate

More of the Same: RBA Should Hold Rate

After last month’s rout, global stock markets bounced back but financial markets remain edgy. The unemployment rate rose to 6%, and inflation, at 1.7%, remains below the RBA’s target band of 2-3%. Overall, the outlook for the Australian economy is modest. The CAMA RBA Shadow Board continues to have a strong preference for keeping the cash rate on hold, attaching a 68% probability to this being the appropriate policy setting. The confidence attached to a required rate cut equals 22%, down five percentage points from the previous month, while the confidence in a required rate hike only equals 10%. Australia’s unemployment, according to the Australian Bureau of Statistics, climbed to 6%. Full-time employment shrank by over 40,000 in January, while the participation rate remain unchanged. At less than 0.5%, there is still no real wage growth to speak of, making it more difficult for households to stimulate the economy with higher consumption expenditure.

The Aussie dollar remains range-bound between 70 US¢ and 73 US¢. The benefits of a weak domestic currency are not yet obvious from the trade data. In December 2015 the trade deficit equalled $3.5 billion which is greater than the previous five months. Yields on Australian 10-year government bonds have fallen yet again, most recently to 2.39%, indicating that financial markets are expecting sustained weakness in the Australian economy.

Worldwide, particularly in the emerging markets, the economic outlook looks feeble. Global share markets have rebounded a little but volatility and uncertainty, as measured by the VIX, remain high. World trade fell 13.8% in dollar terms in 2015, making it the worst year for global trade since the global financial crisis, according to the Netherlands Bureau of Economic Policy World Trade Monitor. However, much of this decline can be attributed to falling commodity prices; in volume terms the picture looks much less grim. While the US economy continues to expand at a modest clip, Europe and the emerging markets are straining. High indebtedness, both private and public, limits the extent to which these economies can fuel demand, even at historically low interest rates. Thus, global growth will likely remain weak, and there may be further disruptions in financial markets.

The Shadow Board’s confidence that the cash rate should remain at its current level is virtually unchanged at 68% (69% in February). The confidence that a rate cut is appropriate has, after two consecutive drops, risen again and now equals 22% (17% in February); the confidence that a rate increase, to 2.25% or higher, is necessary has fallen to 10% (14% in February).

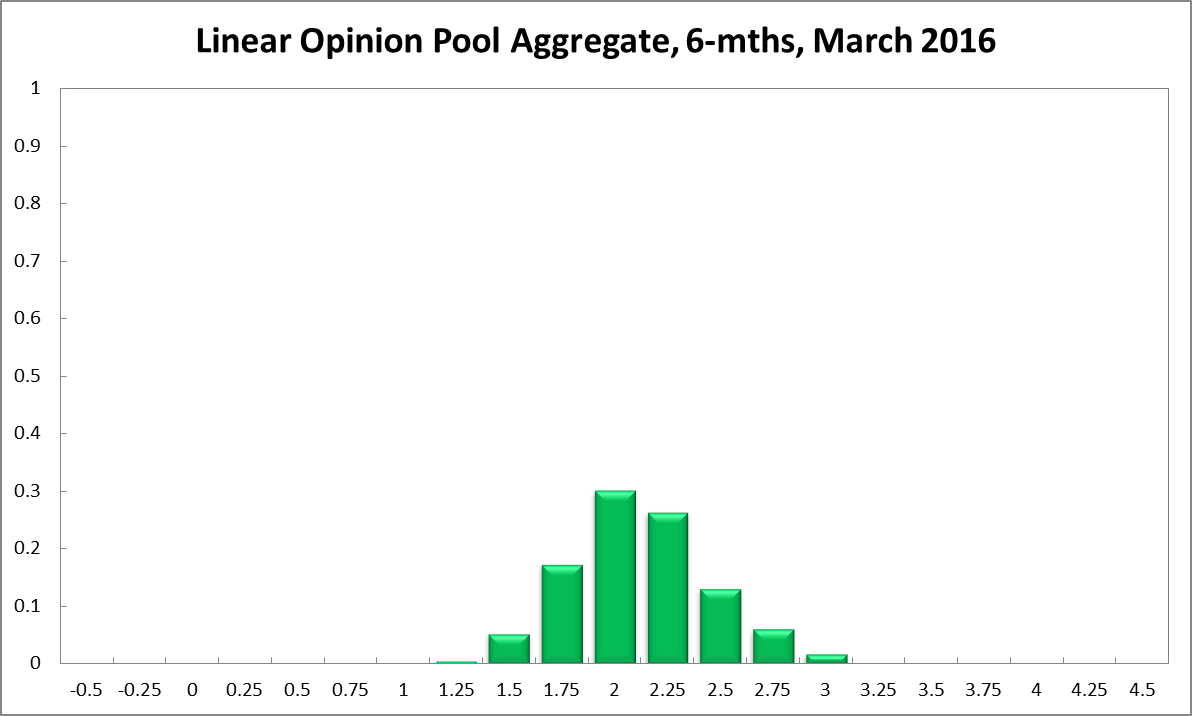

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 2% has jumped to 30% (24% in February). The estimated need for an interest rate increase has fallen 13 percentage point to 47%, while the need for a rate decrease has risen to 23% (16% in February). A year out, the Shadow Board members’ confidence that the cash rate should be held steady edged up three percentage points, from 19% to 22%, while the confidence in a required cash rate increase equals 63% (66% in February) and in a required cash rate decrease 16% (unchanged from February).

Updated: 22 November 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin