Aggregate

Overseas Weakness Dampens Economic Outlook: RBA Shadow Board Recommends Holding Cash Rate Steady

In Greece the economic tragedy appears to be in its final act, while dramatic falls in the Chinese stock market highlight the weaknesses of its economy. Domestic economic data is mixed: unemployment has fallen slightly but consumer and producer confidence have weakened. Inflation remains comfortably within the RBA’s target band. The CAMA RBA Shadow Board on balance prefers to hold firm. While it attaches only a small probability to the need for a rate cut, this probability has increased from the previous month. In particular, the Shadow Board recommends the cash rate be held at its current level of 2%; it attaches a 57% probability to this being the appropriate policy setting. The confidence attached to a required rate cut equals 8%, up from 2% in the previous month, while the confidence in a required rate hike stands at 35%.

Australia’s jobless rate, according to the Australian Bureau of Statistics, fell to 6% in May. Encouragingly, in the same month full-time employment and total employment have increased significantly while the participation rate is virtually unchanged. No new data has been released on wage growth, which recently has been at a record low of 2.3% per quarter.

The Aussie dollar keep hovering around the 76 US¢ mark. Yields on Australian 10-year government bonds have continued to rise, now equalling 3.02%, implying a further steepening of the yield curve, normally an indication that the economy is improving.

Regional housing markets, particularly Sydney and Melbourne. The S&P/ASX 200 stock market index has retreated from its all-time high in April, taking some of the froth out of the market. High real estate prices, which carry the risk of misallocated investment and a costly price correction, remain a concern for many Shadow Board members and are often cited for a reason not to cut the cash rate any further.

Overseas, the Greek debt crisis and the faltering Chinese economy give cause for concern. While Australia’s direct exposure to the Greek economy is minimal, a complete breakdown of negotiations between Greece and the European Union, followed by a Greek exit from the Euro, may have noticeable ramifications for global financial markets. Of greater concern is China, Australia’s largest trading partner, which grew by only 7% in the first quarter of this year, its weakest performance in six years. Some analysts, taking into account the recent tumble of the Chinese stock market and weak gauges of factory activity, entertain the possibility of a further slowing of the Chinese economy. Meanwhile, the US economy is looking more promising, but continued turmoil in the international economy will likely delay the long-awaited increase of the federal funds rate by the Federal Reserve Bank. Commodity prices are likely to remain soft and possibly fall further.

Consumer and producer confidence remain volatile and moderately weak. The AIG Manufacturing Index decreased from 52.29 in May 2015 to 44.20 in June, while the Westpac/Melbourne Institute Consumer Sentiment Index fell from 102.40 in May 2015 to 95.30 in June. The AIG Services Index increased slightly from 49.60 in May 2015 to 51.20 in June. These sentiment numbers are reflected in weak capital expenditure and weak consumer spending.

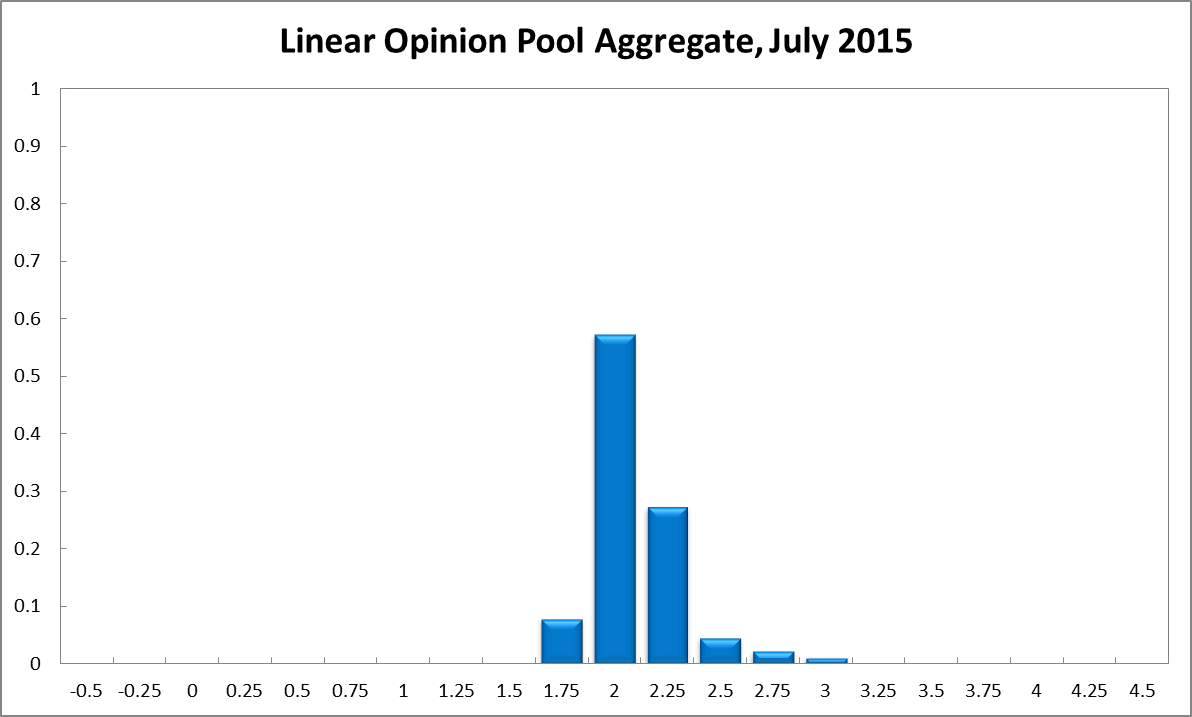

The Shadow Board’s confidence that the cash rate should remain at its current level of 2% equals 57% (down from 60% in June). The confidence that a rate cut is appropriate has increased from 2% in June to 8%; conversely, the confidence that a rate increase, to 2.25% or higher, is called for has decreased from 38% in June to 35%.

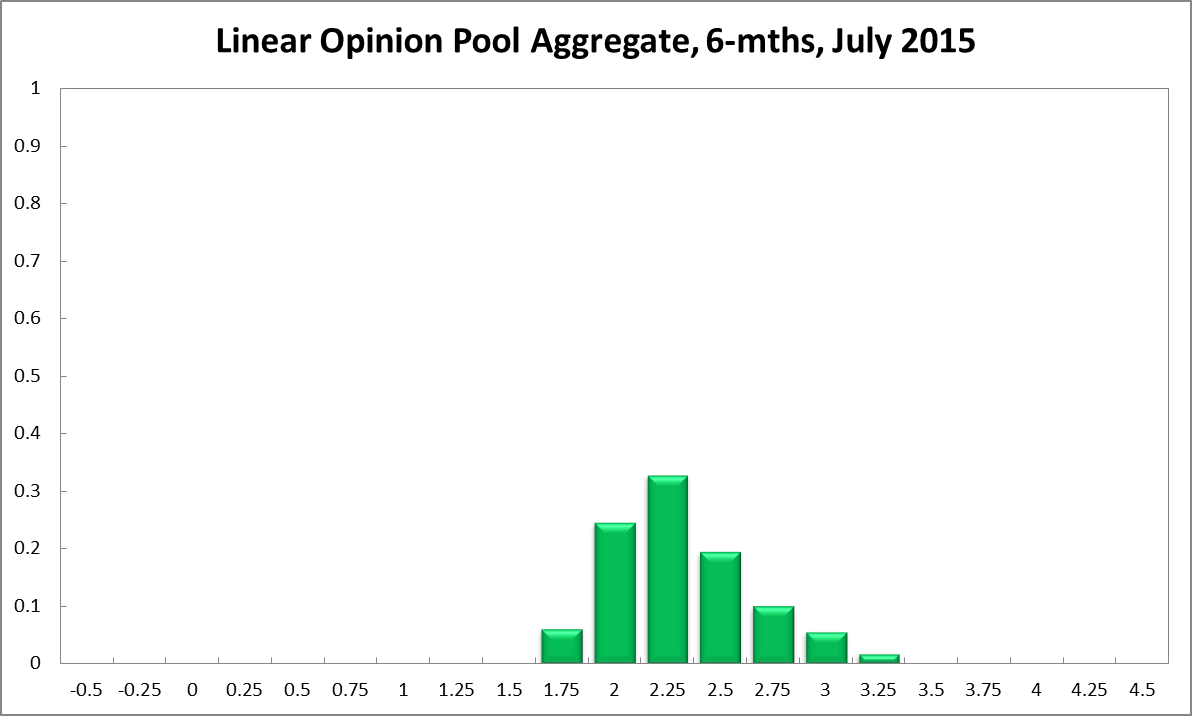

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 2% equals 24% (23% in June). The estimated need for an interest rate increase lies at 69% (76% in June), while the need for a rate decrease is estimated at 6% (3% in June). A year out, the Shadow Board members’ confidence in a required cash rate increase equals 77% (down from 81% in June), in a required cash rate decrease 4% (2% in June) and in a required hold of the cash rate 19% (up from 17% in June).

Updated: 18 July 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin