Aggregate

Drop in Inflation Temporarily Eases Pressure on RBA

Australian headline inflation eased from 3% p.a. in the second quarter to 2.3% p.a in the third quarter. The drop in inflation, along with the continued weakness in the global economy, takes some pressure off the RBA to lift the cash rate. On the other hand, the strong real estate market poses a worrying risk to financial stability. The CAMA RBA Shadow Board continues to recommend with confidence that the cash rate remain at its current level. The Board attaches a 71% probability that the cash rate ought to remain at 2.5% in November. The confidence attached to a required rate cut equals 6%, while the confidence in a required rate hike has decreased to 23%.

The drop in headline inflation to 2.3% reduces the pressure for the RBA to lift the cash rate. However, the lower inflation rate is largely driven by a fall in electricity prices, following the abolition of the carbon tax in July, and should be interpreted as a once off adjustment to prices as opposed to a sustained fall in inflation. Furthermore, continued weakness of the Aussie dollar will add inflationary pressures to the domestic economy in the medium run.

The continued weakness of the Australian dollar will be welcome news for many exporters, especially in the manufacturing, education and tourism sectors. However, it normally requires sustained weakness of a currency before export volumes pick up.

Wages growth has been weak recently and with the unemployment rate above 6% will probably remain weak in the medium term.

Business indicators have weakened further: the NAB Business Confidence, the Manufacturing PMI, and the Australian Performance of Services Index all posted lower numbers. The capacity utilization rate fell to 80.17%. On the upside, the Westpac consumer confidence index improved slightly. Estimates of GDP growth are largely unchanged. Residential construction has continued to strengthen, benefiting from low interest rates and rising house prices. The fiscal outlook remains unclear with the government still not managing to pass all components of its May budget in the Senate.

The global economy is worsening. Europe, including Germany, looks to slide into recession. China’s economy seems a long way from returning to double-digit growth. The US economy has been mixed but low and falling inflation expectations in the world’s largest economy do not bode well for the future. In spite of the Federal Reserve Bank’s assurance that it will not revive its policy of quantitative easing, US interest rates, and global interest rates, are likely to stay very low for some time. The deterioration of the armed conflicts in Iraq and Syria pose a serious threat to the world economy.

The consensus to keep the cash rate at its current level of 2.5% remains unchanged at 71%. The probability attached to a required rate cut equals 6% (4% in October) while the probability of a required rate hike has fallen to risen to 23% (25% in October).

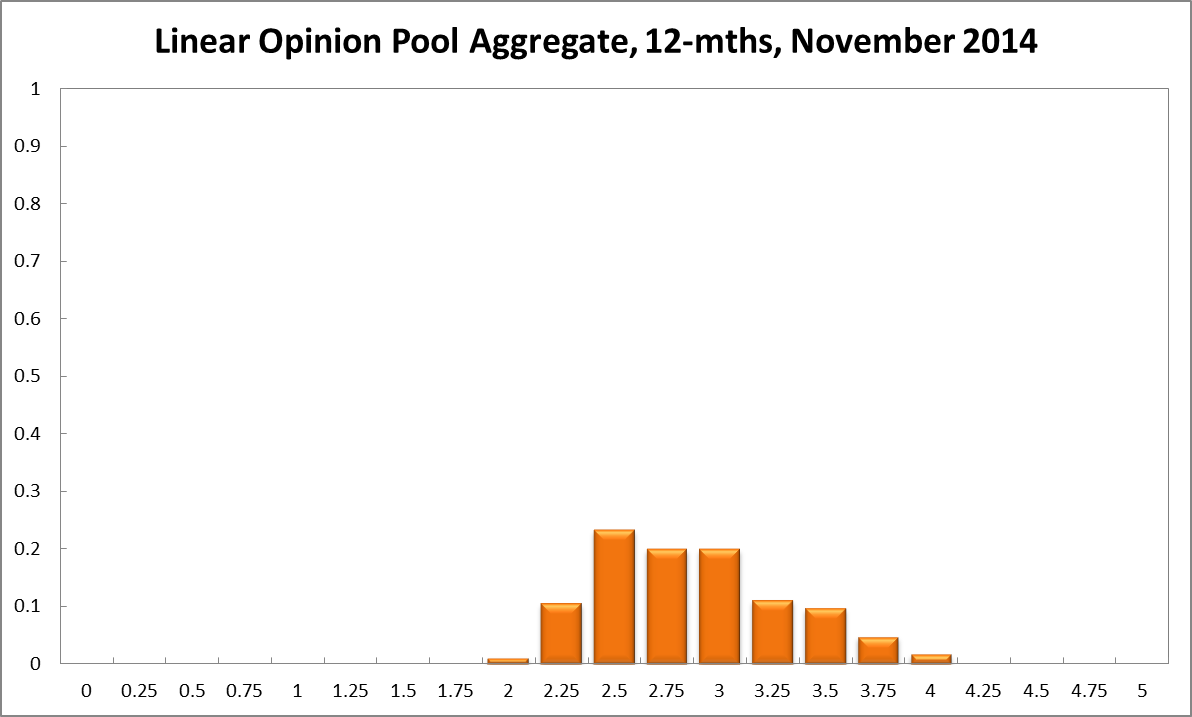

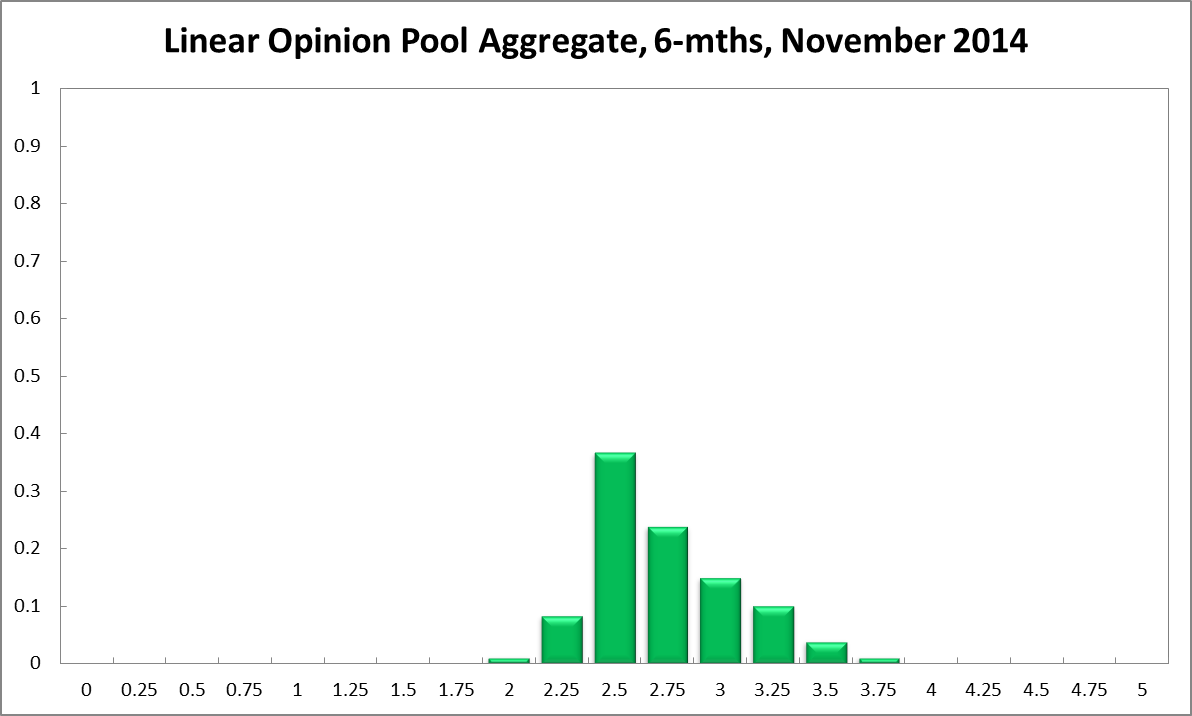

The probabilities at longer horizons are as follows: 6 months out, the probability that the cash rate should remain at 2.5% edged down one percentage point, to 37%. The estimated need for an interest rate increase fell to 54% (56% in October), while the need for a decrease equals 9% (7% in October). A year out, the Shadow Board members’ confidence in a required cash rate increase is down 4 percentage points to 67%, the need for a decrease edged up to 12% (9% in October), while the probability for a rate hold rose to 23% (20% in October).

Updated: 18 July 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin