Aggregate

Australian Economy Consolidating Slowly

The Australian economy is continuing down its path of slow and steady consolidation. The labour market is holding up and GDP growth remains solid. Consumer confidence, depressed after the government’s May budget, has improved slightly, as have several indicators of business sentiment. The CAMA RBA Shadow Board’s conviction that the cash rate ought to remain steady at 2.5% remains unshaken; it continues to attach a 76% probability that this is the appropriate setting. The probability attached to a required rate cut has fallen two percentage points to 4%, while the probability of a required rate hike has risen slightly to 20%.

The unemployment rate again clocked in at 5.8%. Employment fell in May and fewer vacancies were posted, compared to the previous month. Labour costs have fallen slightly.

There is no new information about inflation until the release of second quarter inflation measures. The Australian dollar, now worth approximately 94 US cents, is strengthening slightly. Asset prices remain high, although there are possible signs that the housing market’s run is slowing, with new building approvals falling and price growth slowing. Some shadow board members, notably Prof. Warwick McKibbin, remain concerned about the distortionary effects on asset prices of prolonged low interest rates.

The global economy’s recovery remains shaky. US first quarter GDP growth was weak, with recent revisions to healthcare spending and a harsh winter indicating the world’s largest economy contracted by 2.9%. The Federal Reserve is continuing with its announced policy of phasing out monthly purchases but more weak economic data will presumably make the US central bank more doveish. European data is again mixed although tensions in the Ukraine appear to be waning which should reduce pressure on energy markets. Japan’s economy is improving, while China’s is steadying.

Promising signs for the Australian economy come from the rebound in the AIG’s manufacturing index, which in May climbed 4.5 points to 49.22, half a point shy of its 15-year average. With a slight improvement in consumer confidence as well as the AIG’s services index, we may just be seeing the fruits of sustained low interest rates. Should these indicators continue to improve over the next few months, the call for a tightening of monetary policy will likely grow louder.

The consensus to keep the cash rate at its current level of 2.5% remains unchanged at 76%. The probability attached to a required rate cut has edged down to 4% (6% in June) while the probability of a required rate hike has risen to 20% (18% in June).

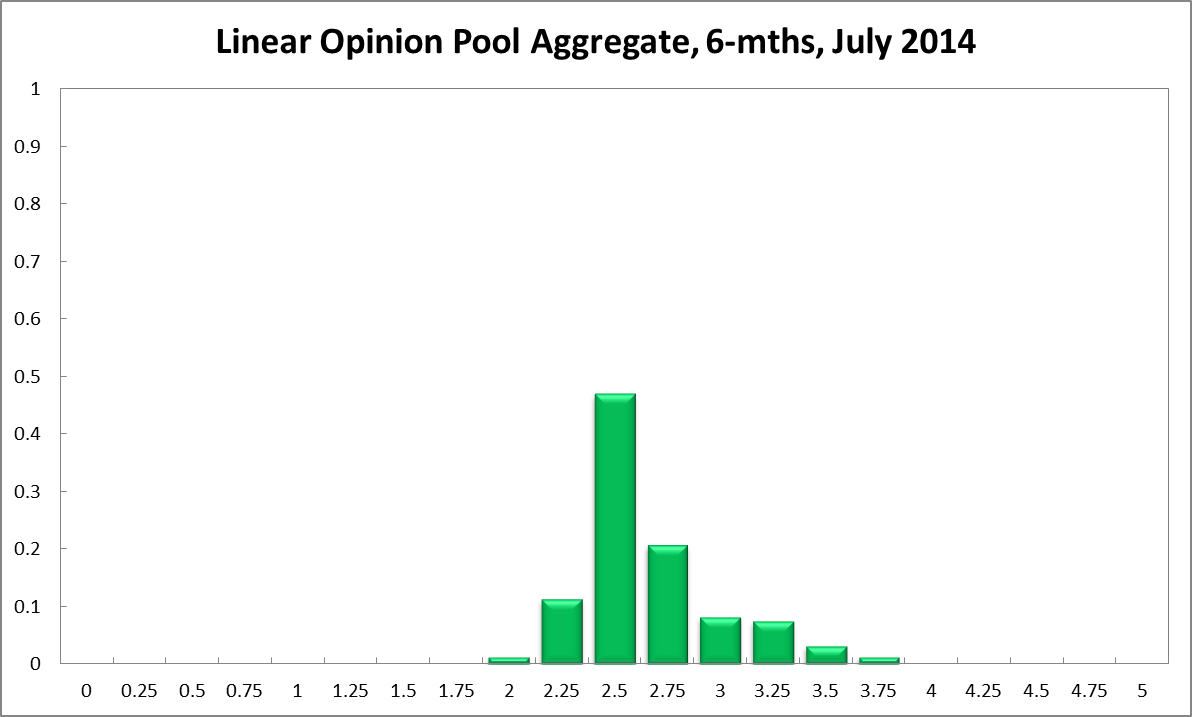

The probabilities at longer horizons are as follows: 6 months out, the probability that the cash rate should remain at 2.5% equals 47% (46% in June). The estimated need for an interest rate increase is 41% (40% in June), while the need for a decrease has fallen to 12%. A year out, the Shadow Board members’ confidence in a required cash rate increase has risen to 61% (59% in June), the need for a decrease fell to 11% (13% in June), while the probability for a rate hold has remains at 28%.

Note: Mark Crosby did not vote in this round.

Updated: 22 November 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin