Aggregate

Australian Economy Looking Promising Despite International Risks

Despite uncertainties in the global economy, the Australian economy appears to be benefiting from the current expansionary stance in monetary policy. The Shadow Board is 71% confident that the cash rate should remain steady at 2.5%. The probability attached to a required rate cut equals 4% while the probability of a required rate hike has increased to 25%.

The Australian labour market is showing promising signs, with a surprisingly robust increase in employment in February 2014 (an increase of 47,000 for overall employment and 80,500 for full time employment). As the participation rate also rebounded from 64.49% to 64.85%, the unemployment rate remained unchanged at 6%.

Inflation remains within the 2-3% target range. The Australian dollar has appreciated considerably, this week making a 4-month high of over 92 US cents. Asset markets, in particular housing, remain buoyant. Overall, domestic consumption and production indicators point to a marginal improvement. Encouragingly, the AIG manufacturing index rose to 48.6 in February (compared to 46.7 in January 2014 and 45.6 a year ago) and the ACCI New Orders increased to 26 in the first quarter of 2014 from 13 in the fourth quarter of 2013.

At the moment, the greatest threat to the Australian economy comes from the international economy. US economic data is still mixed but improving. There is growing confidence in the likelihood that the Federal Reserve Board will tighten monetary policy by the end of this year. Of greatest concern is the fallout from a possible political crisis engulfing the Ukraine and Russia. This might include trade and investment sanctions, higher energy prices and volatile capital flows. China looks like cooling further, pointing to a softening of commodity prices, in particular of coal.

The consensus to keep the cash rate at its current level of 2.5% remains strong. The Shadow Board’s confidence in keeping the cash rate steady equals 71% (73% in March 2014). The probability attached to a required rate cut equals 4% (8% in March) while the probability of a required rate hike has increased to 25% (19% in March).

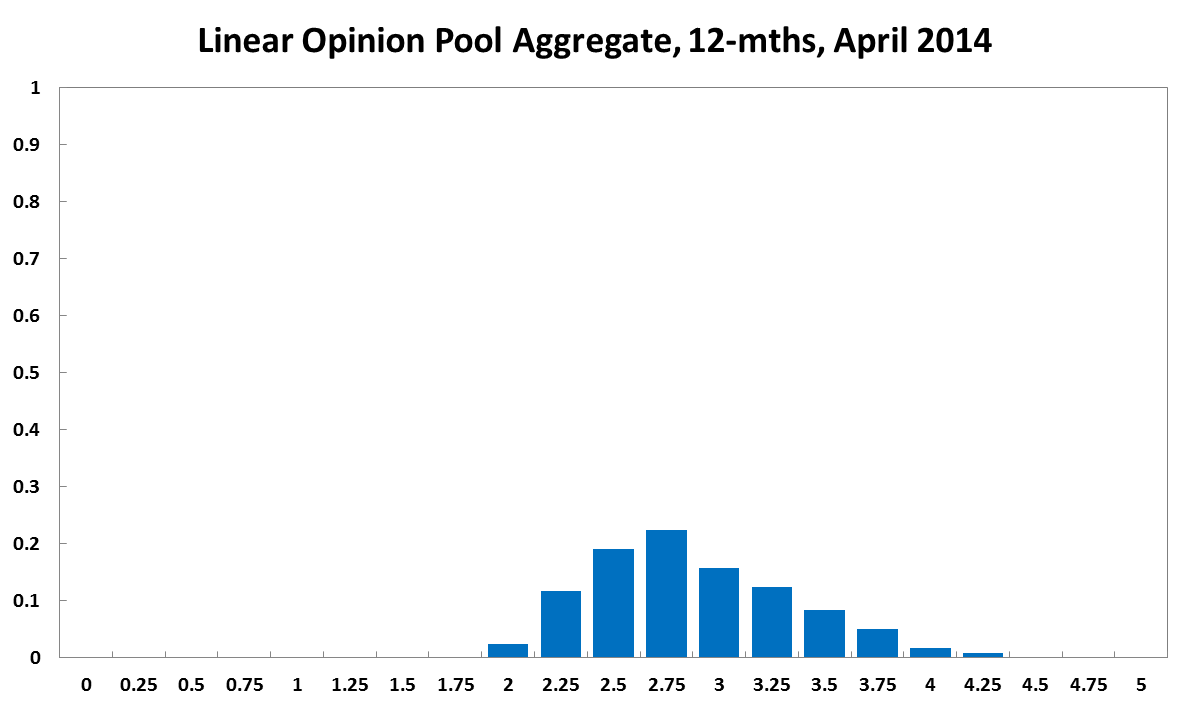

The probabilities at longer horizons are as follows: 6 months out, the probability that the cash rate should remain at 2.5% is unchanged at 39%. The estimated need for an interest rate increase has increased from 43% to 49%, while the need for a decrease has fallen to 12% (19% in March). A year out, the Shadow Board members’ confidence in a required cash rate increase has risen to 67% (54% in March), the need for a decrease dropped to 14% (down from 19% in March), while the probability for a rate hold has fallen to 19% (down from 26% in March).

Note: Mark Crosby, Mardi Dungey and Bob Gregory were unable to vote in this round, so the linear opinion pool aggregate is based on the remaining 6 members.

Updated: 19 October 2024/Responsible Officer: Crawford Engagement/Page Contact: CAMA admin